How Do You Qualify For Child Care Tax Credit. You can claim the credit when you file your 2021 return. For your 2021 tax return, the cap on expenses eligible for the child and dependent care tax credit is $8,000 for one child (up from $3,000) or.

You will generally qualify for the child and dependent care tax credit if you meet all of the following conditions: To qualify for the child care credit, a tax filer must have earned income, such as wages from a job or unemployment. For example, let’s assume you have a dependent in college, but you may.

If You Are Married And Filing A Joint Tax Return, Your Spouse Must Also Have Earned Income.

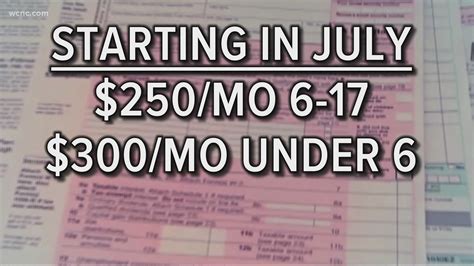

Find out how to claim the eitc without a qualifying child. If you pay childcare costs for a child under the age of 13, you can claim this credit for a daycare facility or a babysitter. As a result of the american rescue plan act or arpa, the child tax credit for tax year 2021 can be worth from $3,000 to $3,600 per qualified child, depending on the age of the child (ren) and your total income.

To Qualify For The Child Care Credit, A Tax Filer Must Have Earned Income, Such As Wages From A Job Or Unemployment.

To qualify for the child tax credit, you must have a child or dependent who meets all of the following requirements: Meet all 4 tests for a qualifying child; You can claim the credit when you file your 2021 return.

Going Back To The Child Care Tax Credit—In Order To Claim The Credit, You Must Provide Care For The Child You Are Claiming A Cdctc For.

You must have earned income, such as wages from a job. To claim the credit, you will need to complete form 2441, child and dependent care expenses, and include the form when you file your federal income tax return. By care, we mean that the child is a dependent, not that you are the one providing the childcare of a preschool or daycare facility.

Tax Credit For Dependent, Child Care.

To qualify for the eitc, a qualifying child must: You can apply for working tax credit. For your 2021 tax return, the cap on expenses eligible for the child and dependent care tax credit is $8,000 for one child (up from $3,000) or.

You Need Irs Letter 6419 For The Rest Of Your Money.

Have a valid social security number; You also must be working. (see qualified expenses section below) qualifying persons include: