Income Tax Filing For Ay 2022-23. 31.may.2021 recommendations of 43rd gst council meeting; 19.may.2021 income tax return deadlines:

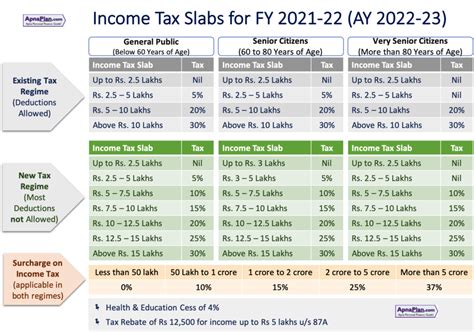

15% of income tax, where the total income exceeds rs.1 crore. Tick if 80u is claimed. There will be two types of tax slabs.

There Were No Changes Proposed In This Budget 2022 With Respect To Income Tax Slab Rates.

Long term capital gains (covered u/s 112a ) 10%. After that, the same needs to be deposited, and the return of tds is required to be filed before the due date. No major changes were made in income tax rules.

There Will Be Two Types Of Tax Slabs.

They can claim a certain amount of deduction by default. Only change which is made in budget is senior citizen above 75 years of age is exempted for filing income tax return if they have income only from pension and interest. Income tax is paid in assessment year (ay) for income earned during previous year (py).

However, The Surcharge Shall Be Subject To Marginal Relief (Where Income Exceeds One Crore Rupees, The.

Therefore your total income or taxable income will always be less than the gross total income. Local authority is taxable at 30%. 19.may.2021 income tax return deadlines:

Always Use A New Copy For Preparation Of It Bill.

Income tax slab for individual aged more than 80 years Tick if 80u is claimed. Extended due date(if any) individual & huf.

The Tax Deducted From The Total Payment Amount Goes To The Government.

10% of income tax, where total income exceeds rs.50 lakh up to rs.1 crore. Interest on deposits in saving account (u/s 80tta ) interest on deposits (u/s 80ttb ) any other deductions. Tds is applicable on salary, interest, commission, fee and others.