Income Tax Guide 2022. Income tax rates and bands. Prepared by tax professionals from our washington national tax office, the guide provides valuable information and insights to.

Quick (& essential) guide to personal income tax in singapore [2022] abram lim last updated: Annual gift tax exclusion for 2021 is $15,000; Here is your quick and essential guide to filing personal income tax in.

This Amount Includes Payment For Pension Insurance, Health Insurance, And A Czk 100 Advance On Income Tax.

Do you need to file a tax return? The earned income tax credit is zero if earned income or agi exceeds the following amounts: Income tax for years of assessment ending during the following periods:

Finally, All Income Over $628,300 (Married Filing Jointly) Or $523,600 (Single Persons) Is Taxed At The 37% Rate.

But, here are the general requirements: This booklet also incorporates in coloured italics the 2022 malaysian budget proposals based on the budget 2022 announcement on 29 october 2021 and the finance bill 2021.these proposals will not become law until their enactment and may be. For both the 2022 and 2022 tax years, the corporate income tax is 28%.

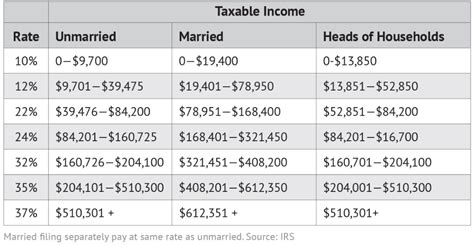

10 Percent, 12 Percent, 22 Percent, 24 Percent, 32 Percent, 35 Percent, And 37 Percent.

The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $539,900 for single filers and above $647,850 for married couples filing jointly. Your guide to filing taxes in 2022. Income over $418,850 for married filing jointly ($209,425 for single persons) but up to $628,300 ($523,600 for single persons) is taxed at the 35% rate.

This Publication Is A Quick Reference Guide Outlining Malaysian Tax Information Which Is Based On Taxation Laws And Current Practices.

Income between ₹ 1,00,001 and ₹ 12,50,000. Taxpayers who apply for a flat tax only must pay the tax office a total monthly amount of about czk 72,000 per year in total. Tax guide 2021|2022 3 individuals and special trusts tax rates for the year of assessment:

Income Between ₹ 12,50,001 And ₹ 15,00,000.

Quick (& essential) guide to personal income tax in singapore [2022] abram lim last updated: The latest edition has been revised to reflect numerous changes to the 2021 tax code and includes citations and guidance for accountants to help clients file their taxes. Filing taxes is plenty stressful, especially for those filers with complex tax filing needs.