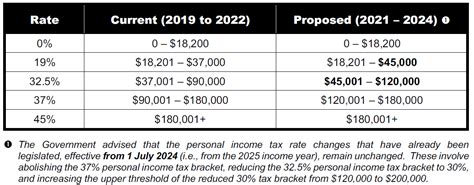

Income Tax In 2022. In 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). Following amendments have been proposed under income tax laws in the finance bill, 2022 vide clause 2 to 84 which shall be effective from april 01, 2022 as per clause 1 (2) (a) of the finance bill, 2022:

Income tax rates and thresholds (annual) tax rate taxable income threshold; Top 5 things to remember when filing income tax returns in 2022. Finance minister nirmala sitharaman announced that any income from transfer of any virtual digital asset will be taxed at a rate of 30 percent.

The Measure Will Bring 319,000 Individuals Into Income Tax In 2022 To 2023, And 186,000 Individuals Into The Higher Rate Of Income Tax Compared To If These Thresholds Were Indexed With Inflation.

Income tax rates and thresholds (annual) tax rate taxable income threshold; The buyer of the property is required to deduct tax at the time of making payment to the seller of the property. [38] this is the first of six incremental reductions that will ultimately reduce the rate to 3.99 percent by tax year 2027.

For Heads Of Households, The Standard Deduction Will Be $19,400 For Tax Year 2022, Up $600.

Tax on the sale amount is required to be deducted at the rate of 1%. This dashes the high hopes of the hardworking salaried taxpayers. What should you opt for in 2022?

10 Percent, 12 Percent, 22 Percent, 24.

Under provisions of north carolina’s biennial budget bill signed by governor roy cooper (d) on november 18, 2021, the state’s flat income tax rate was reduced to 4.99 percent on january 1, 2022. However, for 2022 if you make the same salary, your income now falls in the 12 percent tax bracket. 30% tax on transfer of virtual digital assets.

No Change In Income Tax Slabs.

There are seven federal income tax rates in 2022: 2022 tax brackets and rates. New income tax regime vs old income tax regime:

There Are No Budget 2022 Tax Changes In The Personal Income.

Set up or log in securely at irs.gov/account to access personal tax account information including balance, payments, and tax records including adjusted gross income. Finance minister nirmala sitharaman announced that any income from transfer of any virtual digital asset will be taxed at a rate of 30 percent. Levy of surcharge @ 12% in cases where tax has to be charged and paid.