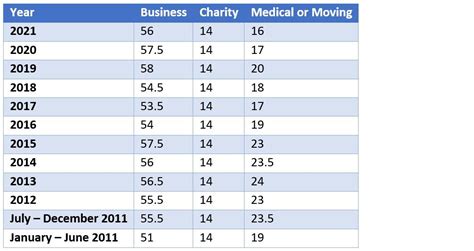

Irs Reimbursable Mileage Rate 2022. Irs mileage rate 2021 & 2022 for different purposes. The irs mileage rate is typically updated each year, and the new rate for 2022 has just been announced.

The irs federal mileage rate 2021 & 2022. Engaging congregations easter season services care of congregations grants/scholarships grants scholarships For 2022, the business standard mileage rate is 58.5 cents per mile (a 2.5 cent increase from the 56 cents rate for 2021), and.

Beginning On January 1, 2022, The Standard Mileage Rates For The Use Of A Car (Also Vans, Pickups Or Panel Trucks) Are As Follows:

You may expect to see a slight increase in the 2021 irs mileage rate that currently stands at $0.14/mile for charity purposes, $0.16/mile for moving and medical purposes. Here are the 2022 irs mileage reimbursement rates for businesses, individuals, and other organizations: 15 rows rates in cents per mile source;

It Is Vital That Churches And Ministries Keep Up To Date With The Current Rates, As They Can Change From Year To Year.

58.5 cents per mile driven for business use, up 2.5 cents from the rate for 2021. The irs has announced the 2022 standard mileage rates for business, medical, and other uses of an automobile, and the 2022 vehicle values that limit the application of certain rules for valuing an automobile’s use. If you’re planning on doing a lot of driving in the next year, be sure to keep this in mind and factor it into your budget.

The Irs Mileage Rate Is Typically Updated Each Year, And The New Rate For 2022 Has Just Been Announced.

For anyone expecting to claim mileage on their taxes in 2022, it’s an exciting time. The 2022 irs mileage rate of $.585/mile was derived from a blend of vehicle cost factors averaged out from across the u.s from 2021, including average gas prices, insurance costs, and depreciation for a vehicle driven an average number of miles. Businesses could anticipate the increase of 2022 mileage reimbursement rate calculator from the current rate of$0.56/mile to approximately $0.57 to $0.58/mile.

The Rates Of Reimbursement For Mileage Set By The Irs To Be Used In 2021 Are:

1, 2022, the irs announced the standard mileage rate is 58.5 cents per mile. 16 cents/mile is the rate for moving and medical miles (reduced to 17 cents/mile over the last three years). The irs has announced the 2022 standard mileage rates for business, medical, and other uses of an automobile.

It’s Almost Certain That There Will Be An Adjustment Of The Mileage Reimbursement Calculator 2022 As It Does With The Prior Years.

The irs has increased the reimbursable mileage rates for 2022 to 58.5 cents per mile ($.585) from the 56 cent rate set in 2021. Friday, january 7, 2022 new mileage reimbursement rate for 2022 e ffective jan. The irs mileage rate is an amount per mile ($/mile) that the irs allows businesses to reimburse their employees for trips made using a personal vehicle.