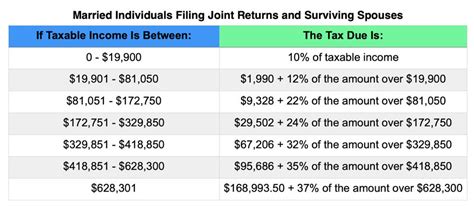

Irs Tax Brackets 2022 Married Jointly. The 2022 tax brackets affect taxes that will be filed in. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $539,900 for single filers and above $647,850 for married couples filing jointly.

Tax rate (%) 2022 tax brackets 2021 tax brackets; The maximum earned income tax credit (eitc) in 2022 for single and married filing jointly filers is $560 if the filer has no children. Tax brackets for income earned in 2022 37% for incomes over $539,900 ($647,850 for married couples filing jointly) 35% for incomes.

The Top Marginal Income Tax Rate Of 37 Percent Will Hit Taxpayers With Taxable Income Above $539,900 For Single Filers And Above $647,850 For Married Couples Filing Jointly.

T he new tax brackets for 2022 have been announced by the internal revenue service (irs).these tax brackets differ from taxpayer to taxpayer, depending on the amount of taxable income each person has. Capital gains tax will be raised to 28.8 percent, according to house democrats. Below are some of the most common deductions and exemptions americans can take.

2022 Federal Income Tax Brackets And Rates In 2022, The Income Limits For All Tax Brackets And All Filers Will Be Adjusted For Inflation And Will Be As Follows (Table 1).

Tax brackets for income earned in 2022 37% for incomes over $539,900 ($647,850 for married couples filing jointly) 35% for incomes. The other rates are as follows: 2022 federal income tax rates:

Single Or Married Filing Separately:

These brackets apply to your 2022 tax filing. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of $523,600 and higher for single filers and $628,300 and higher for married couples filing jointly. The irs 2021 tax tables married filing jointly can be used after you follow the method to determine the federal tax withholding.

35%, For Incomes Over $209,425 ($418,850 For Married Couples Filing Jointly);

For the tax year 2021, the maximum tax rate for individual single taxpayers with earnings over $523,600 ($628,300 for married couples filing jointly) remains 37 percent. 10 percent, 12 percent, 22 percent, 24. Married filing jointly or qualifying widow(er) married filing separately.

Federal Tax Brackets 2022 For Income Taxes Filed By April 15, 2023.

In calculating how much you owe in taxes for the gains, a lot depends on how long you had the item before. In addition to the tax rates, the irs upped many of the deductions and exemptions americans use to lower their taxable income calculation, and therefore their taxes. Irs unveils federal income tax brackets for 2022 syracuse.