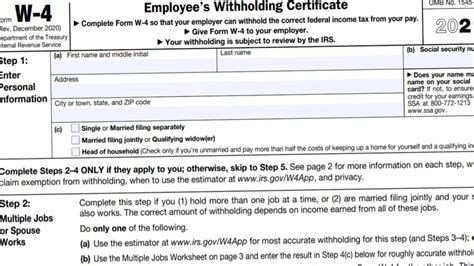

Irs Tax Forms 2022. The document is formatted with a name of ‘employee’s withholding certificate which explains the tax amount you have to withhold from the employees’ each paycheck. Instructions and help about irs 8962 2022 form.

The january 24 start date for individual tax return filers allows the irs time to perform programming and testing that is critical to ensuring irs. We make this a simple process for you, our customer, by eliminating common mistakes known to halt the process. Form 1040, us individual income tax return, is the federal income tax return most adults will file in 2022 to report their income earned in 2021.

Simplified Forms & Accurate Filing.

If you are a citizen of the united states, you should have known that there are about a thousand forms present to report the income and the expenses with the internal revenue service. Irs forms 2441 form 2022 kelvin richards last updated: By federal law, employers are required to withhold federal income taxes from.

We Make This A Simple Process For You, Our Customer, By Eliminating Common Mistakes Known To Halt The Process.

Form 1040, us individual income tax return, is the federal income tax return most adults will file in 2022 to report their income earned in 2021. The form 1040ez is a simplified version of the tax return, and the form 1040a allows for. The january 24 start date for individual tax return filers allows the irs time to perform programming and testing that is critical to ensuring irs.

2022 Irs Federal Tax Id Application.

Common irs forms you should know for 2022 (form 1040, schedule a, b, c and d, form 1098, form 1099, and form 4868) february 16, 2022. Order status check order status contact. It will essentially be an electronic return, but you’ll be completing a pdf file rather than doing it through tax preparation software.

Irs Forms 8863 Form 2022 Kelvin Richards Last Updated:

Tax filing for your 2021 return begins soon, and the irs will be sending a list of what you need to do to ensure your taxes are in order. Use this tax form to claim the american opportunity. Although it isn’t mandatory to file for those that are due for a refund, you won’t get it unless you submit your tax return to the internal revenue service.

Irs Begins 2022 Tax Season;

We assure your ein will be obtained promptly and accurately. Leave the irs procedures and guidlines to us! Otherwise late filing penalties might apply if you wait until october 15, 2022.