Medicare Tax Limit For 2022. For persons with higher income levels, the medicare part b premium may be higher than the standard monthly premium rate. Also, as of january 2013, individuals with earned income of more than $200,000 ($250,000 for married couples filing jointly) pay an additional 0.9 percent in medicare taxes.

Most people pay the standard part b monthly premium amount ($170.10 in 2022). Medicare tax in 2022, the medicare tax rate for employers and employees is 1.45% of all wages, unchanged from 2021. Also, as of january 2013, individuals with earned income of more than $200,000 ($250,000 for married couples filing jointly) pay an additional 0.9 percent in medicare taxes.

For 2022, The Standard Medicare Part B Premium Is $170.10 Per Month.

You enroll in part b for the first time in 2022. Refer to what's new in publication 15 for the current wage limit for social security wages; The standard monthly premium for medicare part b enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021.

For 2021, Social Security And Medicare Taxes Also Apply To Wages Paid To Household Employees If The.

$125,000 for married filing separately; $200,000 for all other taxpayers. (maximum social security tax withheld from wages is $9,114 in 2022).

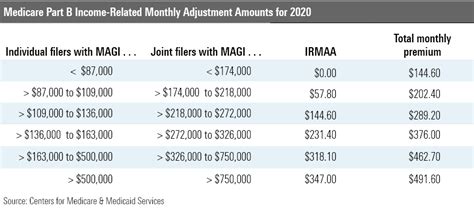

$91,000 Or Less ($182,000 Or Less For Joint Filers) Will Pay $170.10 For 2022.

You pay the standard premium amount if: Medicare contribution tax and additional medicare tax single $200,000 head of household $200,000 married filing jointly $250,000 child tax credit dependent under age 17 $2,000 other dependents $500 phaseout ($50 for every $1,000 over) This is up $21.60 per month or 14.5% from last year.

2022 Social Security And Medicare Tax Withholding Rates And Limits.

Your plan’s premium + $12.40 All covered wages are subject to medicare tax. Or publication 51 for agricultural employers.

The 2022 Medicare Tax Rate Is 2.9%.

Medicare part b (medical insurance) costs. While the employee is only subject to social security tax on the first $147,00, they will have to pay 1.45% medicare tax on the entire $165,000. Employees who reached the yearly ficamaximum tax for 2021 will see a change in their net pay beginning with the first check in calendar year 2022 on 1/14/2022.