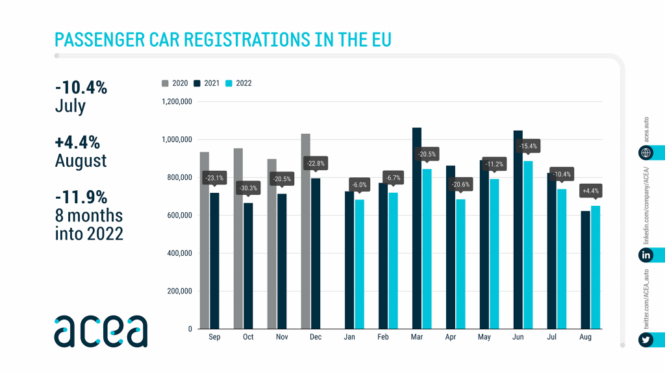

Brussels, 16 September 2022 – In July 2022, new automotive registrations within the European Union decreased once more (-10.4%), regardless of an already low base of comparability attributable to the continued semiconductor scarcity.

In July 2022, new automotive registrations within the European Union decreased once more (-10.4%), regardless of an already low base of comparability attributable to the continued semiconductor scarcity. All of the 4 main EU markets carried out worse than one 12 months in the past, with Germany (-12.9%) and Spain (-12.5%) posting the strongest declines.

In August, the European new automotive market lastly returned to development (+4.4%), bringing an finish to 13 months of consecutive decline. Nonetheless – with 650,305 items registered – this end result stays far under pre-pandemic ranges. All the important thing EU markets positively contributed to the area’s development, with strong positive factors seen in Italy (+9.9%), Spain (+9.1%), France (+3.8%) and Germany (+3.0%).

Eight months into 2022, total volumes contracted by 11.9% to achieve almost 6 million new passenger automobiles bought. Regardless of the latest enchancment, earlier declines weigh negatively on the cumulative efficiency. In consequence, the 4 key markets have all confronted losses to this point this 12 months: Italy (-18.4%), France (-13.8%), Germany (-9.8%) and Spain (-9.4%).

In August, the European new automotive market lastly returned to development (+4.4%), bringing an finish to 13 months of consecutive decline.

Downloads

About ACEA

- The European Vehicle Producers’ Affiliation (ACEA) represents the 16 main Europe-based automotive, van, truck and bus makers: BMW Group, DAF Vehicles, Daimler Truck, Ferrari, Ford of Europe, Honda Motor Europe, Hyundai Motor Europe, Iveco Group, Jaguar Land Rover, Mercedes-Benz, Renault Group, Stellantis, Toyota Motor Europe, Volkswagen Group, Volvo Automobiles, and Volvo Group.

- Go to www.acea.auto for extra details about ACEA, and comply with us on www.twitter.com/ACEA_auto or www.linkedin.com/firm/ACEA/.

- Contact: Francesca Piazza, Statistics Supervisor, [email protected].

In regards to the EU vehicle trade

- 12.7 million Europeans work within the auto trade (immediately and not directly), accounting for six.6% of all EU jobs.

- 11.5% of EU manufacturing jobs – some 3.5 million – are within the automotive sector.

- Motor autos are chargeable for €398.4 billion of tax income for governments throughout key European markets.

- The car trade generates a commerce surplus of €76.3 billion for the EU.

- The turnover generated by the auto trade represents greater than 8% of the EU’s GDP.

- Investing €58.8 billion in R&D yearly, the automotive sector is Europe’s largest personal contributor to innovation, accounting for 32% of complete EU spending.

Passenger automotive registrations