Property Tax Deadline 2022. The original deadline was today, november 30th, where property owners would have had to submit their valuation return forms or face a $5000 fine. To pay the third 2022 personal income tax installment:

City treasurer mare vae reyes said that taxpayers have until january 15, 2022 to pay their real property tax. Here are the quarterly tax payment due dates in 2022: Deadlines for 2022 real property tax payments remember, there are two options for paying real property tax:

Q1 2022 Estimated Tax Payments Due;

Your property is liable for local property tax (lpt) for 2022 if it is a residential property on the valuation date of 1 november 2021. The filing deadline to submit 2021 tax returns or an extension to file and pay tax owed is monday, april 18, 2022, for most taxpayers. Q2 2022 estimated tax payments due;

Johnson, Pcc Galveston County Assessor And Collector Of Taxes.

Deadlines for 2022 real property tax payments remember, there are two options for paying real property tax: What is the sole proprietorship tax deadline? The original deadline was today, november 30th, where property owners would have had to submit their valuation return forms or face a $5000 fine.

2022 Property Tax Calendar Christopher B.

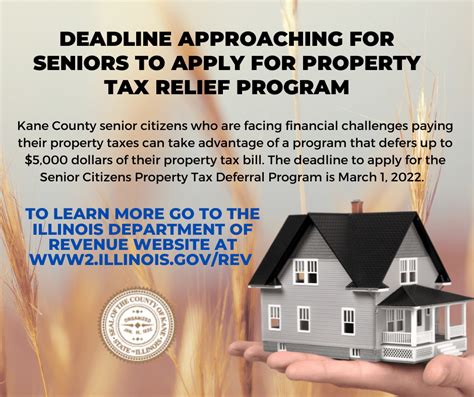

City treasurer mare vae reyes said that taxpayers have until january 15, 2022 to pay their real property tax. For the former, you must settle your obligation on or before january 31, 2022. Deadline to appeal property taxes for new york city is march 1, 2022.

The New York State Department Of Taxation And Finance Is Reminding Seniors That, For Most Localities, The Deadline To Apply For Greater.

On the other hand, if you prefer to pay your obligations every quarter, you have the following deadlines to meet: The deadline for timely payment of 2021 property taxes is january 31 st and the galveston county tax office hopes to make it easy for you to check that chore off the “to do” list. Currently receive the basic star property tax exemption;

Q4 2021 Estimated Tax Payments Due;

And have had 2020 income equal to or below $92,000. Property owners are being urged to pay their local property tax ahead of today's 5pm deadline and to ensure they have submitted an updated valuation for their property. Commercial property (class 4) total market value increase was 11.72% citywide.