Short Capital Gains Tax Rate 2022. The plan proposed by house democrats would also apply a surtax of 3 percent for people with adjusted gross incomes of more than $5 million beginning in 2022 along with raising the capital gain tax rate to 15%. Capital gains tax will be raised to 28.8 per cent by house democrats.

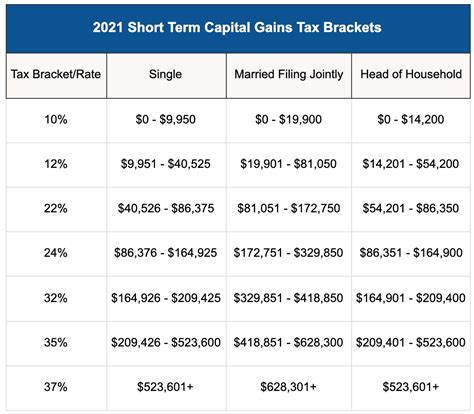

This is shown in the table below. Capital gains tax rate 2022. This will make you pay taxes as if the capital gain were ordinary income from a job or business.

Additionally, There Is An Amendment That Will Increase The Marginal Rate Of Income Tax From 37% To 39.6 Percent.

Federal capital gains tax rates for crypto. According to a house ways and means committee staffer, taxpayers who earn more than $400,000 (single), $425,000 (head of household), or $450,000 (married joint) will be subject to the highest federal tax rate beginning in 2022. 2022 capital gains tax rate thresholds tax on net investment income there's an additional 3.8% surtax on net investment income (nii) that you might have to pay on top of the capital gains tax.

Capital Gains Tax Rates On Most Assets Held For Less Than A Year Correspond To Ordinary Income Tax Brackets (10%, 12%, 22%, 24%, 32%, 35% Or 37%).

Capital gains tax rate 2022. According to a house ways and means committee staffer, taxpayers who earn more than $400,000 (single), $425,000 (head of household), or $450,000 (married joint) will be subject to the highest federal tax rate beginning in 2022. This is shown in the table below.

Capital Gains Tax Rates On Most Assets Held For Less Than A Year Correspond To Ordinary Income Tax Brackets (10%, 12%, 22%, 24%, 32%, 35% Or 37%).

2022 capital gains tax rate thresholds tax on net investment income there's an additional 3.8% surtax on net investment income (nii) that you might have to pay on top of the capital gains tax. Capital gains tax will be raised to 28.8 percent, according to house democrats. For single tax filers, you can benefit from the zero percent capital gains rate if you have an income below $41,675 in 2022.

Capital gains tax will be raised to 28.8 per cent by house democrats. Here's what those brackets will look like in 2022. Capital gains tax will be increased to 28.8 per cent by house democrats.

The Plan Proposed By House Democrats Would Also Apply A Surtax Of 3 Percent For People With Adjusted Gross Incomes Of More Than $5 Million Beginning In 2022 Along With Raising The Capital Gain Tax Rate To 15%.

4 rows you’ll owe either 0%, 15% or 20% on gains from the sale of most assets or investments held for. 2022 0% capital gains tax. Your rate will depend on your total taxable income and filing status.