In recent days biden has made clear that he is not willing to alter. Your third stimulus payment cannot be garnished to pay overdue child support.

/cloudfront-us-east-1.images.arcpublishing.com/gray/BUHOMBJSGZF4BGWH2V7P3MLZA4.jpg)

Can your stimulus check be withdrawn by debt collectors

Your third stimulus payment can't be seized to pay child support.

Stimulus check 3 and child support. Unlike the second and third economic stimulus payments, the recovery rebate credit can be intercepted by the federal program to pay for overdue north carolina child support. While many people know that past due child support will not take their third stimulus check, what they may not know. Can your stimulus check be garnished to pay child support?

This will not be the case for the second. These funds will not be subject to child support garnishment. His new wife stays home with their twin babies and has a child from a previous relationship;

Intercepting federal stimulus checks to offset overdue child support by: He owes a large amount of back child support, but has been making regular payments for years. Question about stimulus check and child support, va.

Unlike the cares act, which made it legal for states to garnish the first stimulus check for people who owed more than $150 in arrears, a rule for the second check indicates that parents can keep the entirety of their payment even if they. It said it was for past child support. So as someone who pays child support bc of a vile disgusting (male) ex who lied about his role in my child’s life and on and on, got not only my stimulus but our child’s and his while i have been close to starving (he kept hiking up child support every time i would move or get a new job, which was 3 times in 3 months because i was waiting for closing and had to couch surf once.

Key amongst the inclusions in the package was a third round of stimulus check payments, this time worth up to $1,400 per person. The latest proposal shows that congress is intending on keeping the language that would prevent state agencies from grabbing the upcoming stimulus check. Applying that to the stimulus checks means that when a deduction for child support owed to the state is taken out of the parent’s check, not only does the state keep that money, but the state’s child support agency can count it in the incentive structure as collection on past due child support.

She was mailed a check from the state of illinois for $1200.00. The irs has already sent out more than 156 million third stimulus checks, worth approximately $372 billion. While he received a stimulus check in 2021, he says a portion of the check he received in 2020 was.

I have moved on and started a new family, why is it except able to inconvenience children and a wife. Under the act, if a person is behind in child. Will my 3rd stimulus check be intercepted?

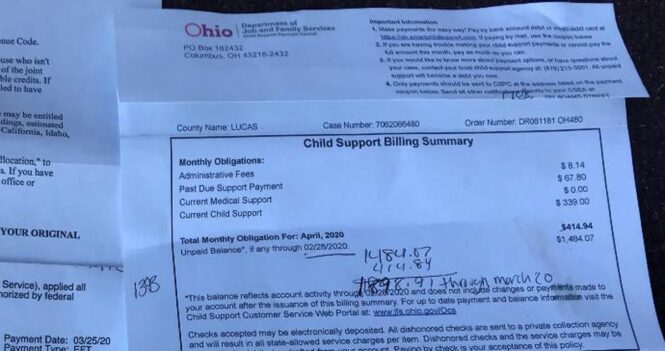

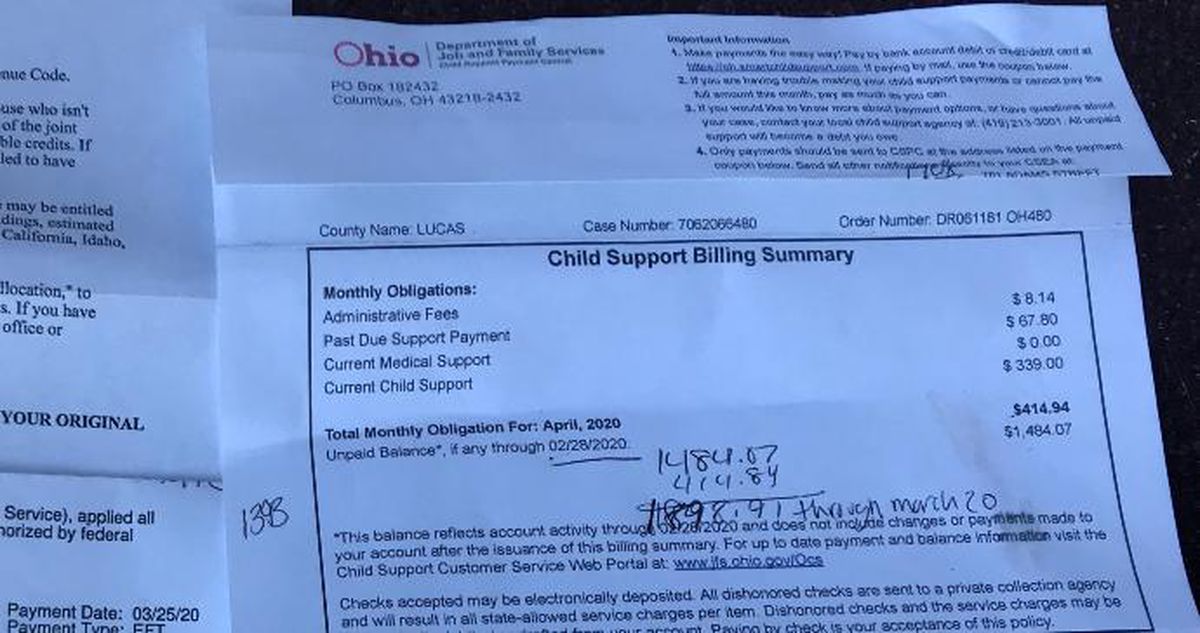

Stimulus check and child support by terry savage on april 07, 2020 | wild card & pandemic related so, i am paying hold support from a previous relationship and when she files they when back 3 years because i could prove my financial support. With the first stimulus check if you owed child support payments by as much as 150 the government gave states the right to garnish the amount you needed to pay. The rule changed for the second stimulus payment and.

It won't be redirected to cover late support payments. President joe biden’s american rescue plan pays individual taxpayers earning less than $80,000 a maximum of $1,400 and couples making under $160,000 up to $2,800. The second stimulus check blocks garnishment of overdue child support, but the irs may still be able to redirect your payment.

With the second stimulus check each eligible adult will get up to 600 decreasing as income raises. Charles cory tells the fox31 problem solvers he is current on his child support payments. Can i deposit this check into her estate?

Luckily, those debts do not include late child support payments, meaning your third check cannot be garnished to pay child support. With the third check, if you're past due on child support, you can still receive your full stimulus payment. In other words, if you or your spouse owe child support, the stimulus check cannot be.

Unlike the second stimulus check, the third stimulus check could be garnished to pay off certain debts. Can tax refunds be intercepted to pay child support? The cares act allows the treasury department to reduce the $1,200 stimulus check most adults would be receiving for delinquent child support payments.

Asking for a friend who is an essential worker and very stressed, worried and scared. 9 responses to “2021 stimulus check will not be garnished for child support according to irs” zarea january 12, 2021 at 9:16 am permalink i feel that if the absent parent owes more than $4,000 in back support, he/she should. The 3 rd round of stimulus covid relief has just started to formulate but there has been some talk regarding child support payments.

This money will eventually be dispersed to her 3 grown children. The funds in the third round of stimulus checks are intended to stimulate the economy and are not subject to child support garnishment.

How To Stop Child Support From Taking Tax Refund 2020

How To Request Stimulus Check For Newborn Have Children

4th Stimulus Check Update States providing financial

VERIFY Does one person's child support payments affect

Stimulus check and Child Tax Credit live updates Thursday

How To Stop Child Support From Taking Tax Refund In

How To Apply Stimulus Check For Child / 3 600 Per Child

Child support and third stimulus checks We'll clear up

Fourth Stimulus Check Economic Nonprofit Calls for More

Over 3 million Americans delinquent on child support could

Stimulus checks and child support Who may get an extra

Can the Government Take My Stimulus Check for Back Child

Have unpaid child support? Your stimulus check will likely

Stimulus Check Warning IRS Can Take Your Recovery Rebate

Can They Garnish Your Stimulus Check? Scioto County

Stimulus Checks (Round 3) and Garnishment What to Know

Over 3 million Americans delinquent on child support could