What to know about child tax credit, third stimulus check news. The amount of credit you receive is based on your income and the number of qualifying children you are claiming.

How To Know If I Qualify For Stimulus Check 2021

Recipients of the third round of the economic impact payments will begin receiving information.

Stimulus check 3 child tax credit. A petition for $2,000 monthly stimulus checks failed to reach its goal. Best vpn service of 2022. If you received monthly advance child tax credit payments in 2021, you may get a smaller refund or owe money this filing season.

To check whether they qualify, americans should click on where it states: Stimulus checks worth $1,400 for each taxpayer and $1,400 for each qualifying dependent can be claimed during the 2022 tax filing season, along with child tax credits up to $3,600 per child. As usa takes a look back at each of the trio of stimulus checks.

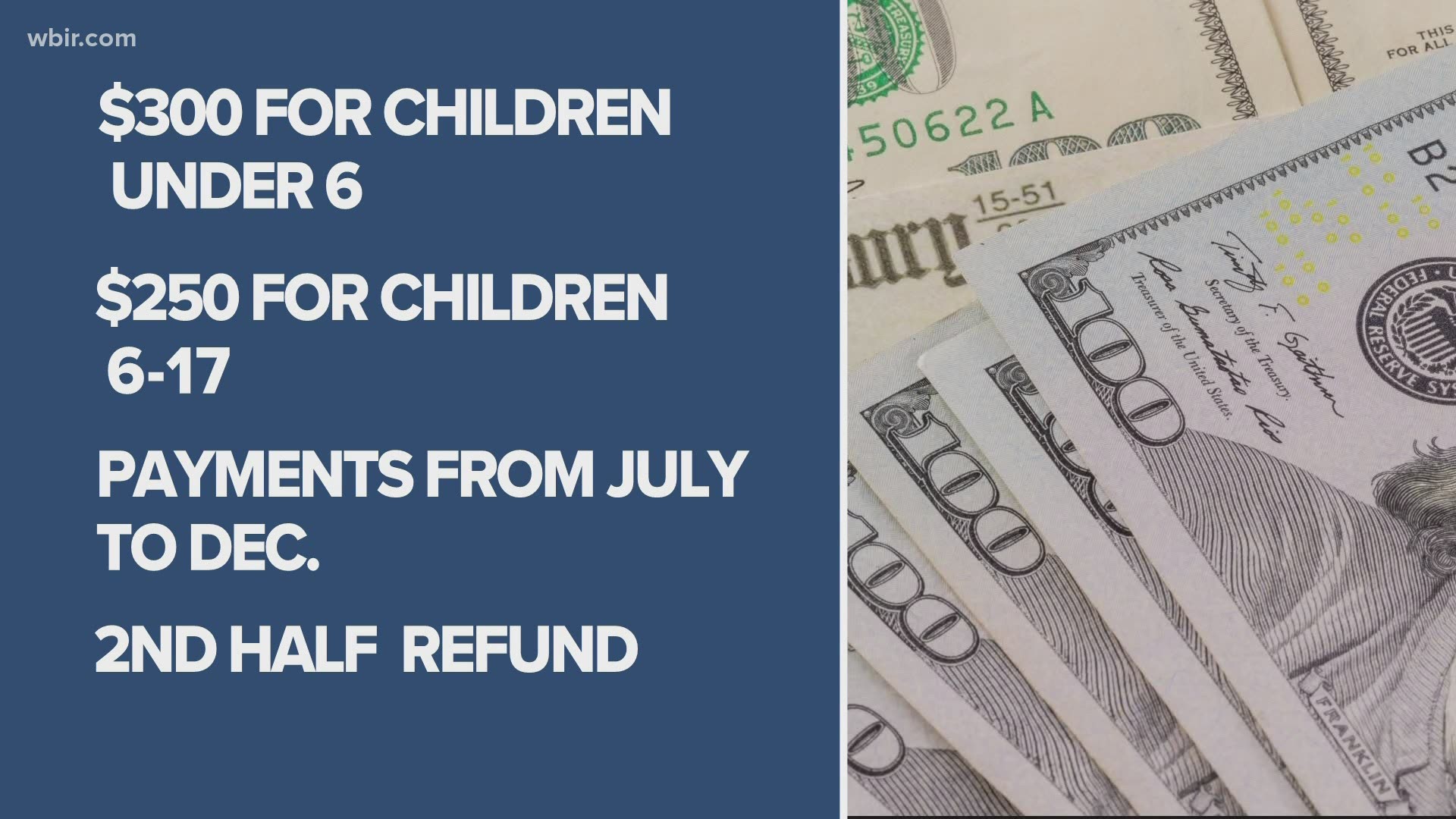

Jan 11, 2022 / 10:32 am cst / updated: Individuals eligible for payments could receive. Most eligible families will be able to receive half of their 2021 child tax credit money in advance due to changes in 2021 to the us child tax credit system.

Until the end of january, they’ll be here. The final monthly child tax credit payment of 2021 went out on december 15, but there may still be more money coming to americans in the new year. Most eligible families will be able to receive half of their 2021 child tax credit money in advance due to changes in 2021 to the us child tax credit system.

Stimulus checks, boosted unemployment benefits and the expanded child tax credit were all designed to provide economic relief for those hit hardest by the pandemic, and numerous studies have shown. Child tax credit payments have been extended from $2,000 to $3,600 as part of the american rescue plan. Americans might get three child tax credit stimulus checks worth $900 in march if congress passes this bill.

The irs started issuing information letters to advance child tax credit recipients in december. The american rescue plan increased the credit to as much as $3,600 per child. For the first time ever, half of the full credit was delivered in advance as monthly payments throughout 2021, but.

The irs will send two letters to taxpayers in 2022 who were qualified for either the third stimulus check or the monthly advance child tax credit in 2020. The next round of child tax credit payments will be sent to families from august 13 credit: By claiming the child tax credit (ctc), you can reduce the amount of money you owe on your federal taxes.

The letter verifies how much you got in advance payments in 2021, and the number of qualifying children used to determine the payouts. Child tax credit checks don't count as income,. Parents making up to $75,000 a year ($150,000 for couples)

$2,000 monthly payment petition adds 1m signatures in 2021. To help out americans looking to claim their third stimulus check when they file their 2021 tax return this year, the irs has produced this video explainer on what the recovery rebate credit is. The extra cash is part of biden's american rescue plan credit:

Americans who were eligible for the third stimulus check or the monthly advance child tax credit in 2021 need to be on the lookout for. Most eligible families will be able to receive half of their 2021 child tax credit money in advance due to changes in 2021 to the us child tax credit system. 2021 advance child tax credit (ctc).

There are some new stimulus checks, and another child tax credit payment of up to $1,800 to come in april, while we outline below the other benefits, as well as the changes to cola and medicare. Around 40million american families will be sent a stimulus check worth up to $300 per child credit: The third stimulus check, formally known as an economic impact payment, was a product of the american rescue plan, which was enacted in march 2021.

Irs sending information letters to recipients of advance child tax credit payments and third economic impact payments. American rescue plan approved in march 2020 permitted most citizens to receive up to $1400 each plus an additional $1400 for dependents as a direct payout.

Stimulus update Here's what to do if your child tax

FOURTH Stimulus CHECK Update! Child Tax Credit + Student

Coronavirus stimulus check IRS has 2 portals to claim

December Child Tax Credit Date Here's When To Expect

Irs Child Tax Credit Stimulus Trending US

Irs Child Tax Credit 2021 Portal Access

Calls for 2,000 surprise stimulus check after

Fourth Stimulus Check Starts to Roll Out in Some States

Timeline stimulus checks 3, unemployment, child tax credits

Fourth stimulus check 3 ways to see if you're eligible

Stimulus update Three ways to find out if you're due an

Coronavirus Stimulus Child Tax Credit NACOROS

Didn’t Get the Last Stimulus Payment? Don’t Expect the

Child Tax Credit Update Democrats Trying to Bring Back

Will there be a 4th stimulus check? Not likely, but

You might get THREE child tax credit stimulus checks worth