The third stimulus bill included $1,400 payments for adults and dependents claimed on your tax returns, and a new baby is eligible for the. If you didn’t get the full economic impact payment, you may be eligible to claim the recovery rebate credit.

Irs Local Office Tampa Fl IRSYAQU

The irs issued three economic impact payments during the coronavirus pandemic for people who were eligible :

Stimulus check 3 eligibility irs. Who will qualify for stimulus check #3? $600 in december 2020/january 2021. Yes, inmates can receive stimulus money.

Children under age 17 will receive $600 each. Newborn babies are also eligible for the full $3,600 as long as they were born in the us. The maximum amount for the third round of stimulus checks will be $1,400 for any eligible individual or $2,800 per eligible couple filing taxes jointly.

Unlike prior stimulus payments, there are no age limits on eligible dependents. If you didn’t get any payments or got less than the full amounts, you may qualify for the recovery rebate credit and must file a. Check your final payment status in get my payment.

The last 2021 stimulus payment has been issued, the internal revenue service said wednesday, but if you did not get yours, you are not out of luck yet. All first and second economic impact payments have been sent. In that third round of economic impact payments (eip.

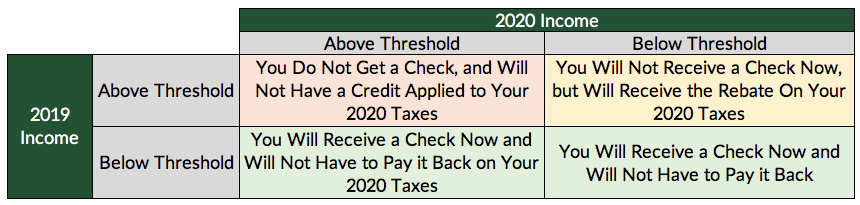

>> read more trending news according to the irs, if you did not get a stimulus check but are eligible for one, you must use the recovery rebate credit on your 2021 income tax return to claim the. $1,200 per eligible adult and $500 per eligible dependent child: You may be eligible to claim a recovery rebate credit on your 2020 or 2021 federal tax return if you didn't get an economic impact payment or got less than the full amount.

Can americans expect stimulus checks in 2022? Payments are being made in $300 or $250 installments and households will receive another five checks before the end of the year. The third stimulus checks were mailed by the federal government between march and december 2021, following passage of the american rescue plan.

Most eligible people will get the third economic impact payment automatically and won't need to take additional action. Any third stimulus check you received will reduce the amount of the credit youre eligible for. How to claim a missing payment.

Determining eligibility for the third economic impact payment. Coronavirus aid relief and economic security act: Until the end of january, they’ll be here.

After months of back and forth, the irs was ordered by a federal judge to send the first stimulus checks to people who are incarcerated. Eligibility for the payments include du.s. You can use the get my payment application to check the status of your third payment only.

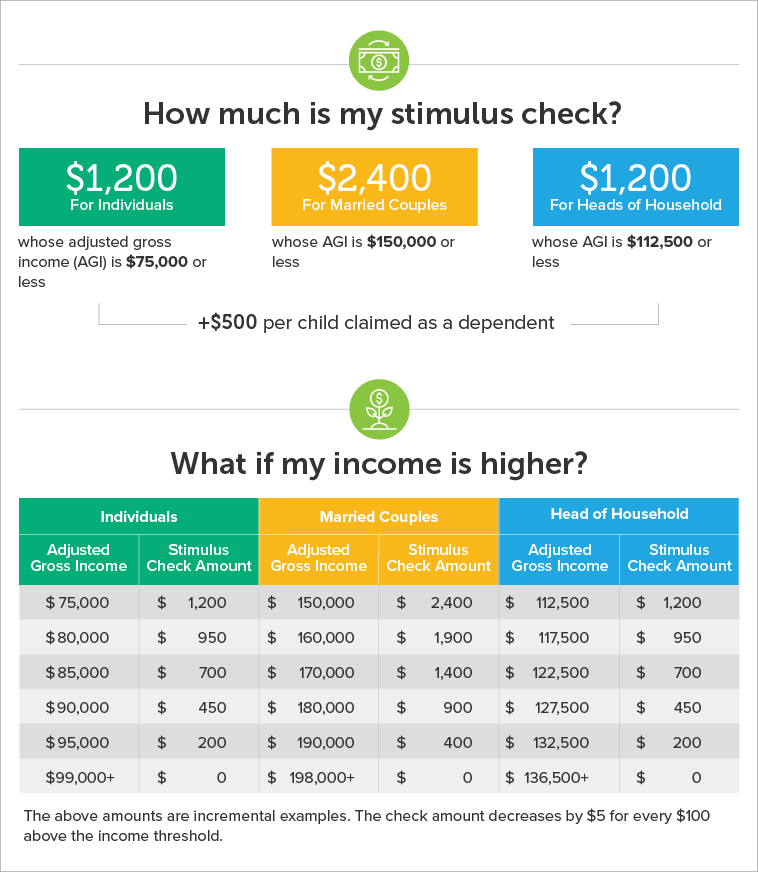

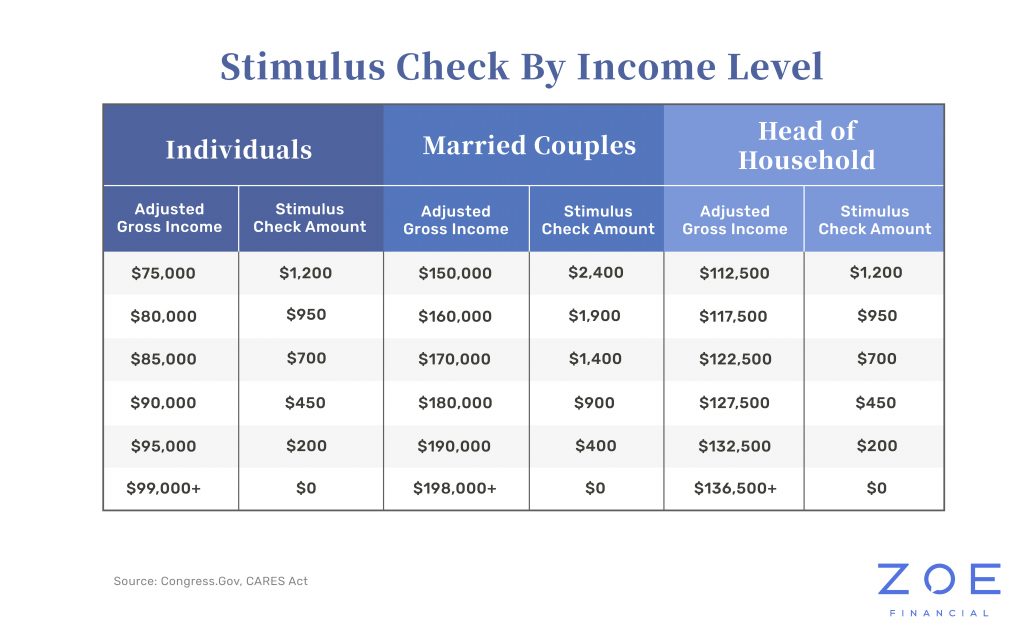

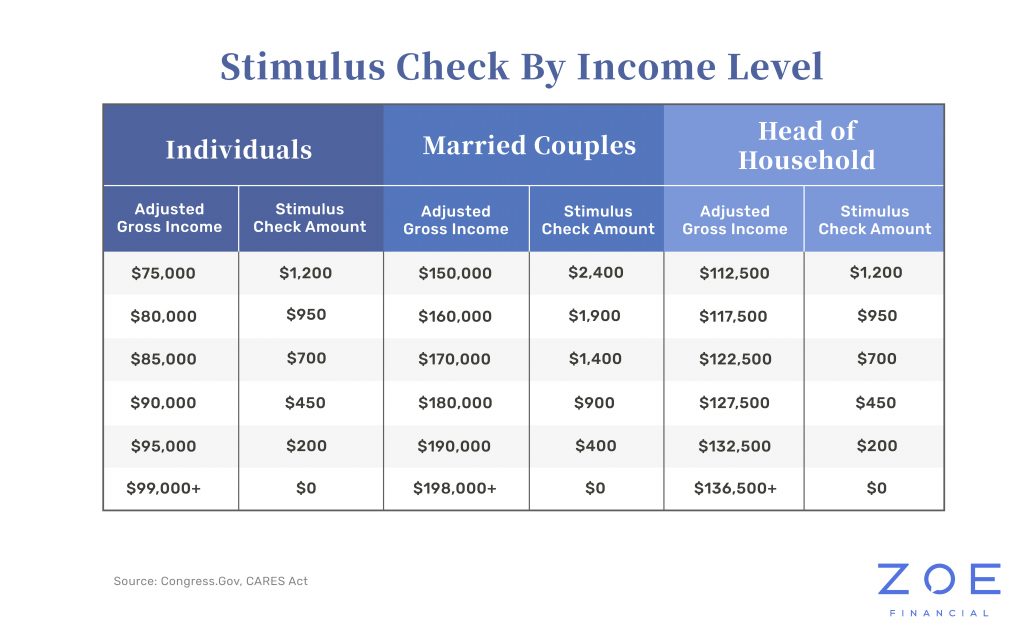

American rescue plan approved in march 2020 permitted most citizens to receive up to $1400 each plus an additional $1400 for dependents as a direct. The amount your will receive from a 3rd stimulus check begins to gradually decrease for individuals and married couples who earn more than $75,000, $112,500, or $150,000 until being phased out entirely at $80,000 for individuals, $120,000 for heads of household, and $1600,000 for married couples filing jointly. All eligible adults with adjusted gross incomes less than the following will qualify for the full payment:

This new law provides a third round of stimulus payments of $1,400 for each qualifying tax filer and each qualifying. Act now to sign up for the third economic impact payment if your income was less than $12,400 in 2020, or less than $24,800 if you are married. Millions of americans who were eligible for the $600 second stimulus checks could qualify for the third round of stimulus payments up to $1,400.

President biden signed the american rescue act plan into law on march 11. The irs will send two letters to taxpayers in 2022 who were qualified for either the third stimulus check or the monthly advance child tax credit in 2020. Married couples with an annual income of less than $150,000 will receive $1,200.

Singles with an annual income of less than $75000 will receive $600. Families can claim up to $3,600 per child under six and $3,000 for dependents aged six to 17. The irs will use available information to determine eligibility and issue the third payment to eligible people who:

Filed a 2020 tax return. However, new parents and other recipients who added dependents in 2021 may still qualify for. $112,500 for head of households;

Citizens or residents with incomes of $150,000 if married and filing a joint. These payments were sent by direct deposit to a bank account or by mail as a paper check or a debit card. That means a family of four could receive as much as $5,600 in total.

Each eligible dependent — including adult dependents — also will qualify for a payment of $1,400.

Your Third Stimulus Check Could Be Much Bigger If You File

IRS On Stimulus Checks Sent To Dead Relatives

Stimulus Check Info Your PlusUp Payments Timeline

Where's My Stimulus Check 2020 Irs Gov Refund IRSAUS

Another 2.2 Million 1,400 Stimulus Checks Have Gone Out

Only Hours Left to Claim Late IRS Stimulus Check

Stimulus check update IRS sending out MORE 'plusup

Irs Stimulus Verification Pennsylvania Stimulus Checks

Third Stimulus Check Track Your COVID19 Relief Fund With

Third stimulus check, federal unemployment boost and other

IRS to reach out to 9million Americans who are eligible

How Does the Coronavirus Stimulus Package Affect Me? Zoe

New Stimulus Checks & PPP 2.0! Everything You Need to Know

Eligibility For Stimulus Check 2022 Irs E Jurnal

![]()

Stimulus Check Tracker IRS to Release More Payments, Find

Pennsylvania stimulus checks IRS sends letters on