There’s a new protective shield over the round 3 stimulus checks, but if you’re heavily in debt, you still might not see the $1,400, depending on who you owe. + $200 social security raise update.enter the stimulus check giveaway here:

Gov. Pritzker suspends law to protect stimulus checks from

Under the bill governing the second stimulus check, your funds could not be garnished to pay debts like child support, banks.

Stimulus check 3 garnishment. The governor also ordered that any money collected be returned. If you have unpaid private debts that are subject to a court order, your $1,400 stimulus check could be garnished. Can your stimulus check be garnished to pay child support?

A third round of stimulus checks are on the way, but did you know the $1,400 checks can be garnished to pay off debts? The governor suspended the permits that allow garnishment on april 14. While the $1,400 payments can’t be garnished for back taxes or child support, for example, according to the tax foundation, the.

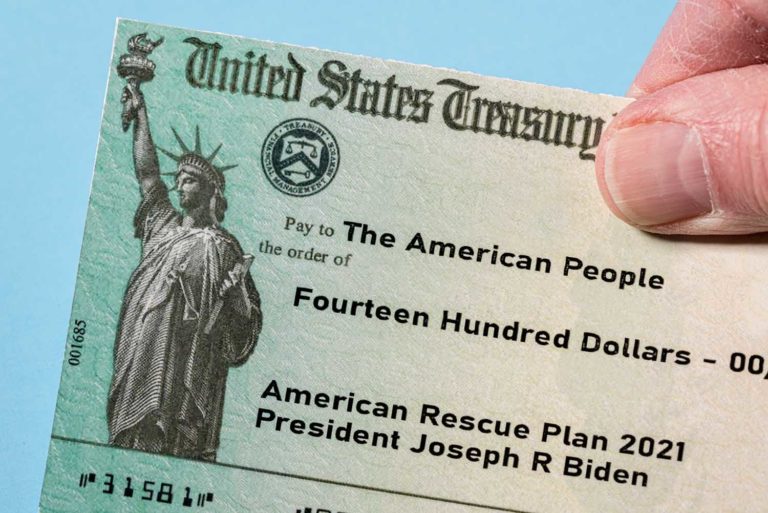

President joe biden’s american rescue plan pays individual taxpayers earning less than $80,000 a maximum of $1,400 and couples making under $160,000 up to $2,800. Federal law exempts some federal benefits from garnishments. Can the $1400 stimulus check be garnished?

Henry grzes is from the american. The irs has already sent out more than 156 million third stimulus checks, worth approximately $372 billion. That means collectors that have received a court judgment in their favor could potentially garnish your stimulus check.

Individuals earning $75,000 or less are eligible to receive $1,400, and couples earning. Today, i read an interesting article regarding the third round of stimulus checks that are on the verge of being approved by congress. Who gets a 3rd stimulus check?

1 the probable reason arpa payments are not protected is that arpa passed the senate via the budget reconciliation process, which allowed the act to survive the senate with fifty votes (evading the filibuster) but. This is a relief for parents who lost their last stimulus payment to the child support collection office, the da’s office, or directly to their ex. Garnishments require a court proceeding to which you must be given notice.

Yes, your third check might be seized to pay certain debts. Of course, because the stimulus checks are going to be delivered right to americans, it is not possible for the government to garnish a person’s wages and receive any of the stimulus money. Your coronavirus stimulus checks could be garnished.

The internal revenue service has. Your third stimulus payment cannot be garnished to pay overdue child support. Just like in the past, these stimulus checks can't be garnished by the federal government or the irs, including matters like federally collected child support.

Stimulus checks cannot be garnished. Las vegas (ksnv) — according to lawmakers, technicalities in the way the american rescue plan was enacted have made the $1,400 stimulus checks vulnerable to garnishment by private debt collectors. Individuals who have an adjusted gross income (agi) of up to $75,000, heads of household with an agi of up to $112,500, and married couples with an agi of up to $150,000 per year qualify for the entire stimulus check amount, which is $1,400 for individuals and $2,800 for heads of household and married couples filing.

These checks are part of a budget reconciliation act, and because a budget reconciliation act only requires a simple majority vote, it can be used only for limited purposes. The third stimulus bill does not similarly protect debtors. Some are calling for that to change published wed, mar 10 2021 10:00 am.

Banks, financial institutions, judgments creditors, and other parties can collect on funds received under the most recent round of stimulus checks. Posted at 5:00 am, mar 17, 2021. The irs has already started sending out the third stimulus checks of up to $1,400.

The latest stimulus bill will feature the largest cash payments to citizens yet. However, the third round of coronavirus stimulus checks don’t have the same. This latest round of stimulus checks is the highest amount so far (earlier checks amounts being up to $1,200 and $600).

However, a government entity still could seize a person’s bank account, giving them access to the stimulus money. New $1,400 stimulus checks could be garnished for unpaid debts. Private debt collectors can garnish stimulus payments.

I do not know whether this applies to stimulus payments. The previous checks were fully protected, but this one is not. Stimulus checks can be garnished by debt collectors.

According to the irs website, the stimulus payment is protected from garnishment for all debts, including specifically child support arrears.

/cloudfront-us-east-1.images.arcpublishing.com/gray/BUHOMBJSGZF4BGWH2V7P3MLZA4.jpg)

Can your stimulus check be withdrawn by debt collectors

Your third stimulus check can be garnished. Here’s what to

Can They Garnish Your Stimulus Check? Scioto County

What! Creditors Can Take My Michigan Stimulus Check

Garnishing stimulus checks Can my stimulus check be

Why Americans May Have Stimulus Check Garnished By Debt

/arc-anglerfish-arc2-prod-gray.s3.amazonaws.com/public/JJOTW6TD7RI4JA6EA5KAIKRU6Y.jpg)

Debt collectors could seize stimulus checks

What Can I Do to Make the Most of My Tennessee Stimulus

Will I get a stimulus check if I defaulted on my student

Stimulus check 3 shielded from garnishment for some debt

Can They Garnish Your Stimulus Check? Scioto County

Consumers Could Face Garnishment on Stimulus

Beware Your Coronavirus Stimulus Check Could Be Garnished

When Will I Get My Stimulus Check 3

Stimulus checks Debt collectors can garnish your 1,400

Stimulus Check Info Your PlusUp Payments Timeline