I received a reduced stimulus in april for 783, and my wife got the full 1200, in january she got 600 and i received nothing i am wondering if my children's credit for 500 per and 600 per are income based since they are dependents on mine? If filing separately, peter’s taxable income will be $20k higher than if filed jointly.

California Stimulus Check 2022 For Married Couples Filing

Married joint filer whose agi is.

Stimulus check 3 married filing separately. What effect will be had on us being married but filing separately and after receiving a stimulus check most of the year? $160,000 for married couples filing jointly; (we have a specific circumstance where mfs makes sense this year.)

The covid relief bill included stimulus payments worth up to $1,400 for americans who filed their taxes individually, and made up to $75,000. The third stimulus payment amounts are as follows: Married couples who file taxes jointly and have incomes between $150,000 and $160,000.

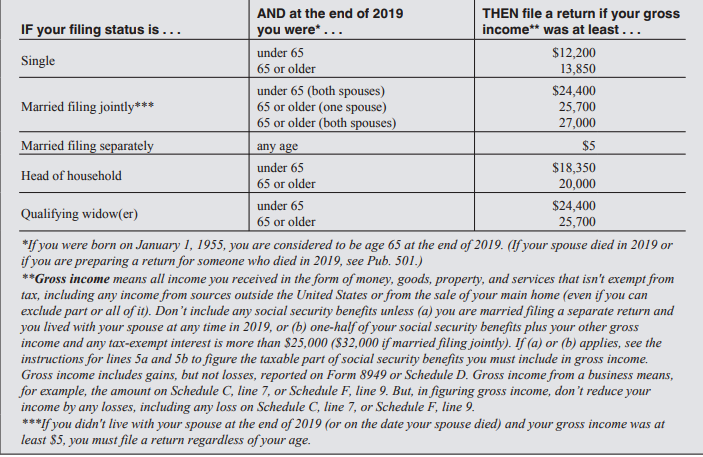

You can file your federal return as married filing separately even if you reside in a community property state, which is a state where you are required to split equally all assets acquired during a marriage. They choose to file separate tax returns, each using the married filing separately filing status. Your spouse would not claim you as a dependent.

He cannot pick and choose. Married filing jointly you are eligible to receive the full payment if your adjusted gross income is below $75,000 and a reduced payment amount if it is more than $75,000 the adjusted gross income limit for a reduced payment is $99,000 if you don’t have children and increases by $10,000 for each qualifying child under 17. What effect will be had on us being married but filing separately and after receiving a stimulus check most of the year?

Your 2019 or 2020 income is under $80,000 (single, or married filing separately) or $160,000 (married filing jointly). 3) married, no children, filing separately; My wife and i have received two (reduced due to our agi) stimulus payments based on our 2019 tax return where our filing status was 'married filing jointly'.

Taxpayer b has agi of $26,000. The only difference is that you choose to file separately, or you and your spouse cannot agree to file jointly, so you have to file separately. Married couples filing jointly can receive $2,400, while two single people or a married couple filing separately can receive $1,200 each.

$1,400 for single filers, head of household, married filing separate, and widower. Someone filing as head of household with an agi at or above $120,000 would not receive a stimulus check. My husband hasn't filed for 2018 or 2019.

I have 3 kids and have been married filing separately for years. I've heard that there are issues with getting stimulus check if you used these. But you can get it by filing a 2021 return in 2022.

A couple filing jointly would not receive a stimulus check once agi is at or above $160,000. Taxpayer a has agi of $25,000; Posted by 2 days ago.

Your eligibility for a stimulus check of any amount ends totally if you're a: A married couple with two dependents and an agi of $155,000 will generally get a payment of $2,800 (again, half the full amount). An individual (either single filer or married filing separately) with an agi at or above $80,000 would not receive a stimulus check.

You must file according to your 2021 legal status. You get no stimulus check if you're a: You also qualify if you have no income.

I also filed through turbo tax in 2019 and h and r block in 2018. He will receive a stimulus check of $1,200, far below the tax of $3,829 he would owe if. Unfortunately, if you are not divorced you.

Couples who made up to $150,000 would receive 2,800. It is too late to get the 3rd stimulus now in 2021. This math is complicated, but our third stimulus check calculator can do it all for you—sliding scale and all.

Note — if this couple files jointly, their economic stimulus payment would be $600. In 2020, we will each file a separate 2020 return with the filing status 'married filing separately'. Is the stimulus check 1200 for married couples?

The irs announced on march 12 that the third installment of $1,400 checks was on its way credit: Rental loss is not allowed for the status ‘married filing separately’. So i have usaa and no sign of check yet, however, my wife received an email today at 11:51am est from navy fed saying she has a refund or stimulus check in the amount of.

Eligible married couples filing a joint return with adjusted gross income up to $150,000 will automatically receive the full $2,400 payment. Eligible individuals with adjusted gross income up to $75,000 will automatically receive the full $1,200 payment. Filers with incomes of at least $80,000 (single and married filing separately), $120,000 (head of household) and $160,000 (married filing joint and surviving spouse) will get no payment based on the law.

For married couples who filed separately, only the spouse with the social security number qualified. See information about your irs filing status here. For married filing joint taxpayers where one is active duty military, only one spouse needs to have a ssn and they will both receive the payment.

If you earn more than these upper limits, you won’t get any stimulus money this time. Will i get my stimulus check, i filed married filing separately?

How Your Second Stimulus Check Will Differ from the First

Tax Planning with the American Rescue Plan Griffin Black

Third Stimulus Check For Senior Citizens Takeaway For

California Stimulus Check Eligibility Who Qualifies For

thedesigningcircle When Do File Tax Return

Stimulus Check For Spouse With Itin STIMUQ

Newlywed? Whether To File Separately Or Jointly CBS Seattle

How Much Was The First Stimulus Check For Individual WHMUC

How Does Stimulus Check Work For Married Filing Jointly

Direct Express 3 Stimulus Check Deposit Date 2021

Practical Ways to Spend Your Stimulus Check After Bills

Wow! Married, Filing Separately, May Be the Tax Year 2020

3 Things You Should Not Do With Your Stimulus Check The

Stimulus Check For Married Couples Who File Separately

American Rescue Plan Act What You Need to Know — Davis

who is not eligible for a stimulus check