Californians could receive another stimulus check next year thanks to a 1970s tax ruling. The 2021 credit is only stimulus three.

Third Stimulus Checks IRS Tax Return, Amount and More

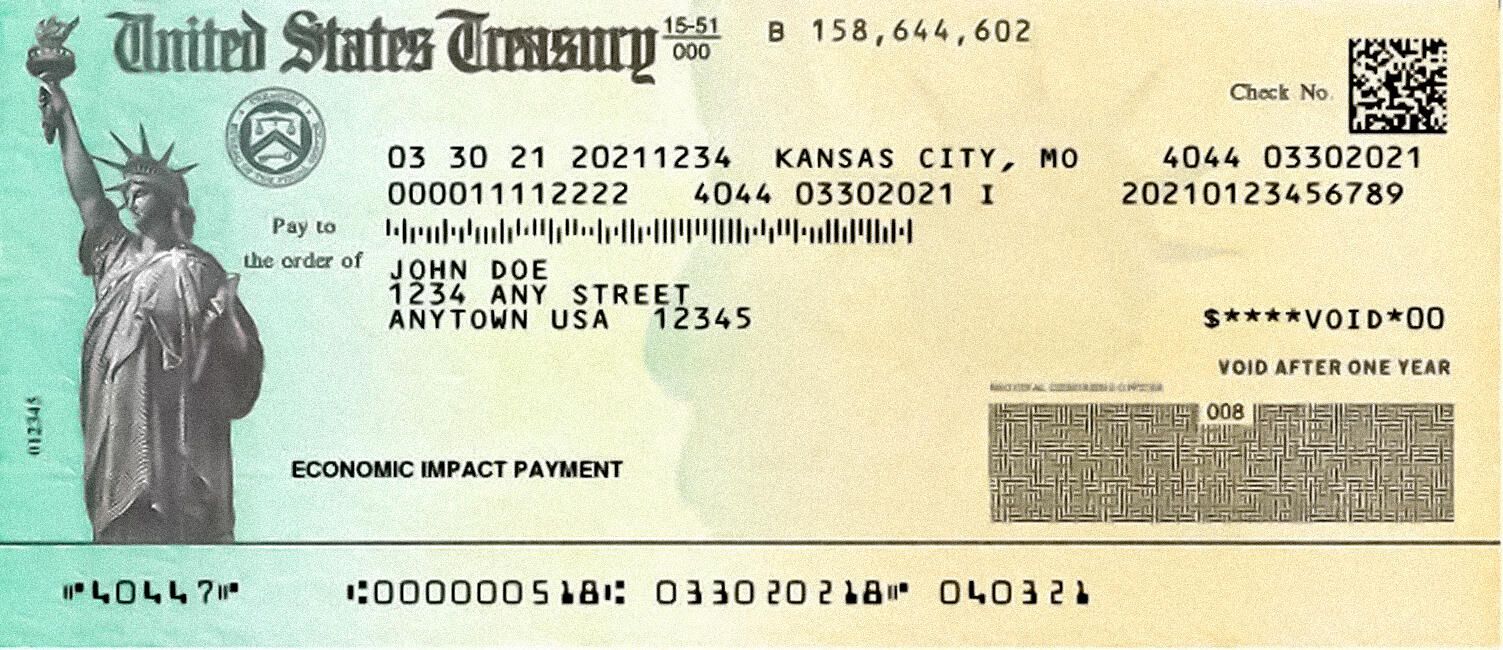

The amount of your third stimulus check is based on your 2019 or 2020 taxes, whichever the irs has on file at the time it determines your payment.

Stimulus check 3 of what tax year. Who is eligible to still get the 3rd stimulus check or child tax credit in 2022. Until the end of january, they’ll be here. Individuals eligible for payments could receive up to $1,400 , and married couples.

Claim your 2021 recovery rebate credit when you prepare. 9:46 am cst january 3, 2022. Stimulus checks are not taxable, but they still need to be reported on 2021 tax returns, which need to be filed this spring.

The third stimulus check, formally known as an economic impact payment, was a product of the american rescue plan, which was enacted in march 2021. 3:58 et, dec 7 2021. Millions of americans have already pocketed payments between $600 and $1100 as part of governor gavin newsom’s golden state stimulus ii program.

The simple 3rd stimulator tax tool can help you decide. Targeted income limits, however, exclude individuals earning. Sometimes referred to as a stimulus check, the irs states it.

The payments will be based on 2020 agi if a taxpayer has already filed tax returns for last year. The irs will start accepting federal income tax returns for the 2021 tax year on monday, jan. If your situation changed dramatically between.

When will i get my 3rd stimulus check? The earned income tax credit can be applied using 2019 income data while families can also apply to receive any stimulus check. The american rescue plan was signed into law on march 11, authorizing a third round of stimulus checks that pay a maximum of $1,400 for millions of americans.

Do you qualify for stimulus check three? If you did not receive your third stimulus check, this is to be claimed on your 2021 tax return as the recovery rebate credit or rrc.this refundable tax credit was introduced in 2020 and was composed of stimulus one and two; What tax year are the payments based on?

The second $600 stimulus checks authorized by congress in december included $600 per individual, or $1,200 per married couple filing jointly, plus $600 per child under 17. There are some new stimulus checks, and another child tax credit payment of up to $1,800 to come in april, while we outline below the other benefits, as well as the changes to cola and medicare. The third round of stimulus checks are based on your most recent tax filing with the irs but are an advanced payment on a refundable tax credit for 2021.

Latest on push for one group to get 4th stimulus check if you’re getting ready to file your 2021 tax return, click here for steps you can take to make filing easier. American families can qualify for up to $6,700 in tax credits when filing their 2021 return with the irs this year. Americans who were eligible for the third stimulus check or the monthly advance child tax credit in 2021 need to be on the lookout for two letters from the.

The american rescue plan or stimulus check payment three was launched in march of 2021. Under the current proposal, the amount for the third stimulus check would be phased out, reaching zero at $100,000. The irs will send two letters to taxpayers in 2022 who were qualified for either the third stimulus check or the monthly advance child tax credit in 2020.

Couples filing jointly would get a total of $2,800 if they made up to $150,000. All these were advance payments of the credit; 4:09 et, dec 7 2021.

Incarcerated individuals and expatriates who have not filed taxes for the years between 2018 and 2020 are ineligible to receive a stimulus check, but will be eligible once they update their tax returns.

Stimulus Check Update Hope The ‘Plusup’ Payment Is Up To

At Least 8.7 Million Americans At Risk Of Losing 1,200

1040 Us Individual Tax Return Form With Stimulus Check

State leaders say new scam is targeting your stimulus check

Stimulus check, IRS tax refund questions How to check the

Still Didn’t Get Your Stimulus Checks? File A 2020 Tax

Third Stimulus Check Track Your COVID19 Relief Fund With

Third stimulus check, federal unemployment boost and other

Will Your Stimulus Check Increase Your Tax on Social

Stimulus check update President Joe Biden pushes 1.9

The 600 stimulus could affect your tax refund

Stimulus checks Rev and Tax finalizing plan for distribution

More stimulus checks are coming in the mail. 2 ways you

Your Third Stimulus Check Could Be Much Bigger If You File

NonFilers Stimulus Check Federal Tax

Third stimulus check update Get more stimulus money by

Four Stimulus Check Scams To Look Out for As Government

Stimulus check 2021 What to do if you must file a tax return