Even you may file a tax return for the year 2020, then the irs will get information on your 2020 tax return. For the new stimulus checks specifically, the $1,400 per person maximum remains (including for dependents), but an effort to target the payments would result in stricter rules around an income.

Stimulus check 3 update Money amounts, limits, adult

With the third check, any dependent you claim is eligible to count toward $1,400 going to the family total.

Stimulus check 3 qualifications dependents. Unlike the first and second round of checks, payments for dependents in the third round are. Individuals earning $75,000 head of households earning. The third round of stimulus checks, worth up to $1,400, includes all dependents.

A married couple with two dependents and an agi of $155,000 will generally get a payment of $2,800 (again, half the full amount). Who qualifies for the third stimulus check? Which dependents qualify for a stimulus check?

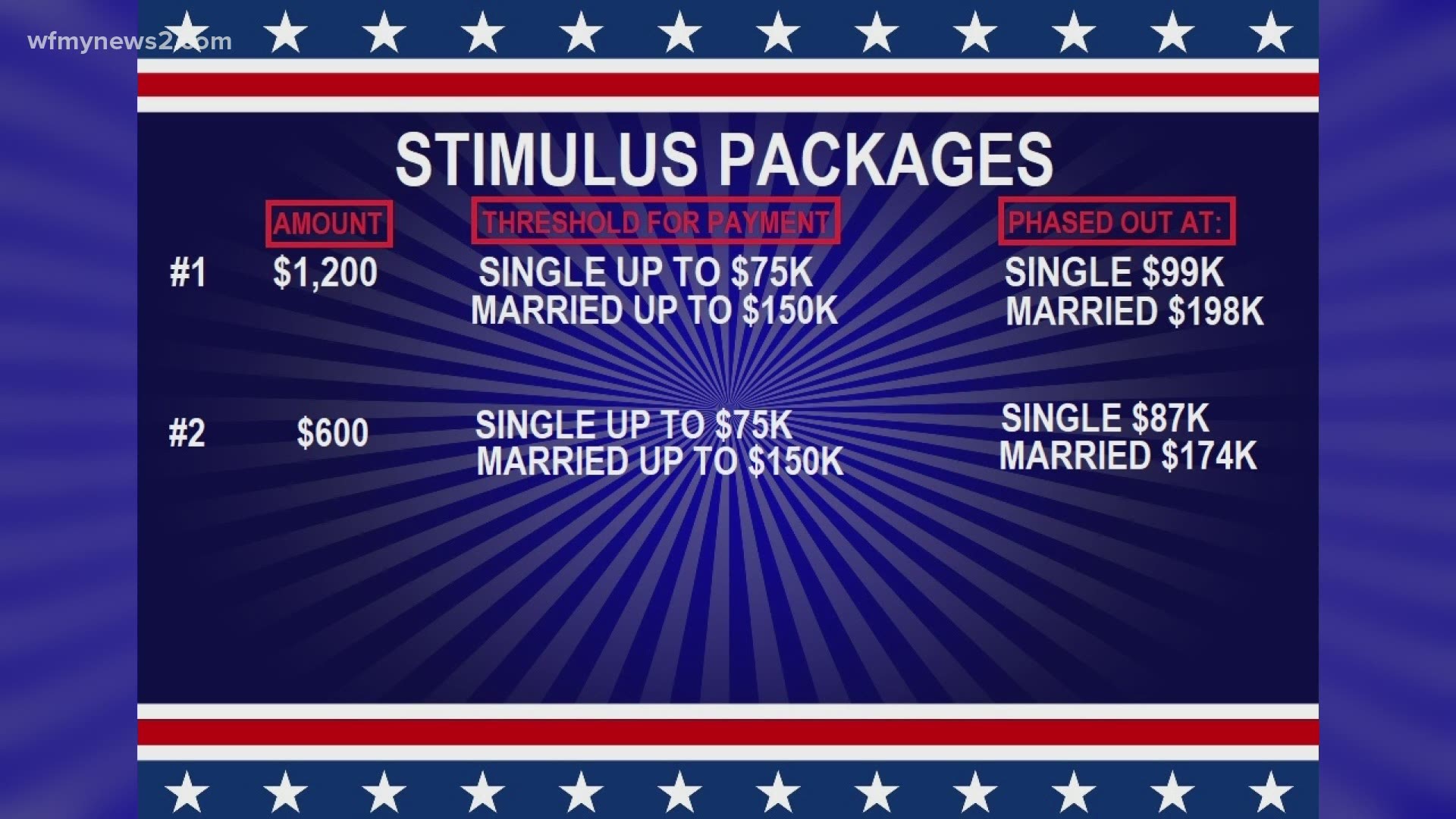

3 stimulus check income limits; Based on adjusted gross income (agi), the following people qualify for the full $1,400 stimulus (and the same applies for their dependents): Dependents over age 16 didn’t qualify for the first and second checks, but a change here would make college students, older adult relatives and people of any age with certain disabilities entitled to receive money on.

The next stimulus check could qualify more dependents biden’s proposal would open up eligibility requirements to both child and adult dependents. 1 your dependents qualify toward a third check, with no age restrictions; The american rescue plan expands the definition of a dependent to anyone who meets the irs definition of a dependent on your taxes.

But you get a third stimulus check and then your 2020 tax return is being filed and processed now. The third check makes dependents of all ages, including young adults and older adults, eligible to add up to $1,400 each to your household's total. The qualifications for another stimulus payment and how much it would be worth remain in flux as negotiations to fund an economic relief package continue in washington.

4 nonfilers may need to file a tax return to register dependents; 6 an expansion to the child. That means a family of four could receive as much as $5,600 in total.

Filers with incomes of at least $80,000 (single and married filing separately), $120,000 (head of household) and $160,000 (married filing joint and surviving spouse) will get no payment based on the law. Those who receive va benefits should look for a stimulus check soon. So it is still possible to get a stimulus check if you were claimed as a dependent in 2019.

Dependents and the first two stimulus checks. Dependents do not receive their own stimulus checks. Stephen shankland/cnet who is a qualified dependent?

A change to qualifications could bring families more money. The maximum amount for the third round of stimulus checks will be $1,400 for any eligible individual or $2,800 per eligible couple filing taxes jointly. The american rescue plan provides households with $1,400 for each adult, child and adult dependent, such as.

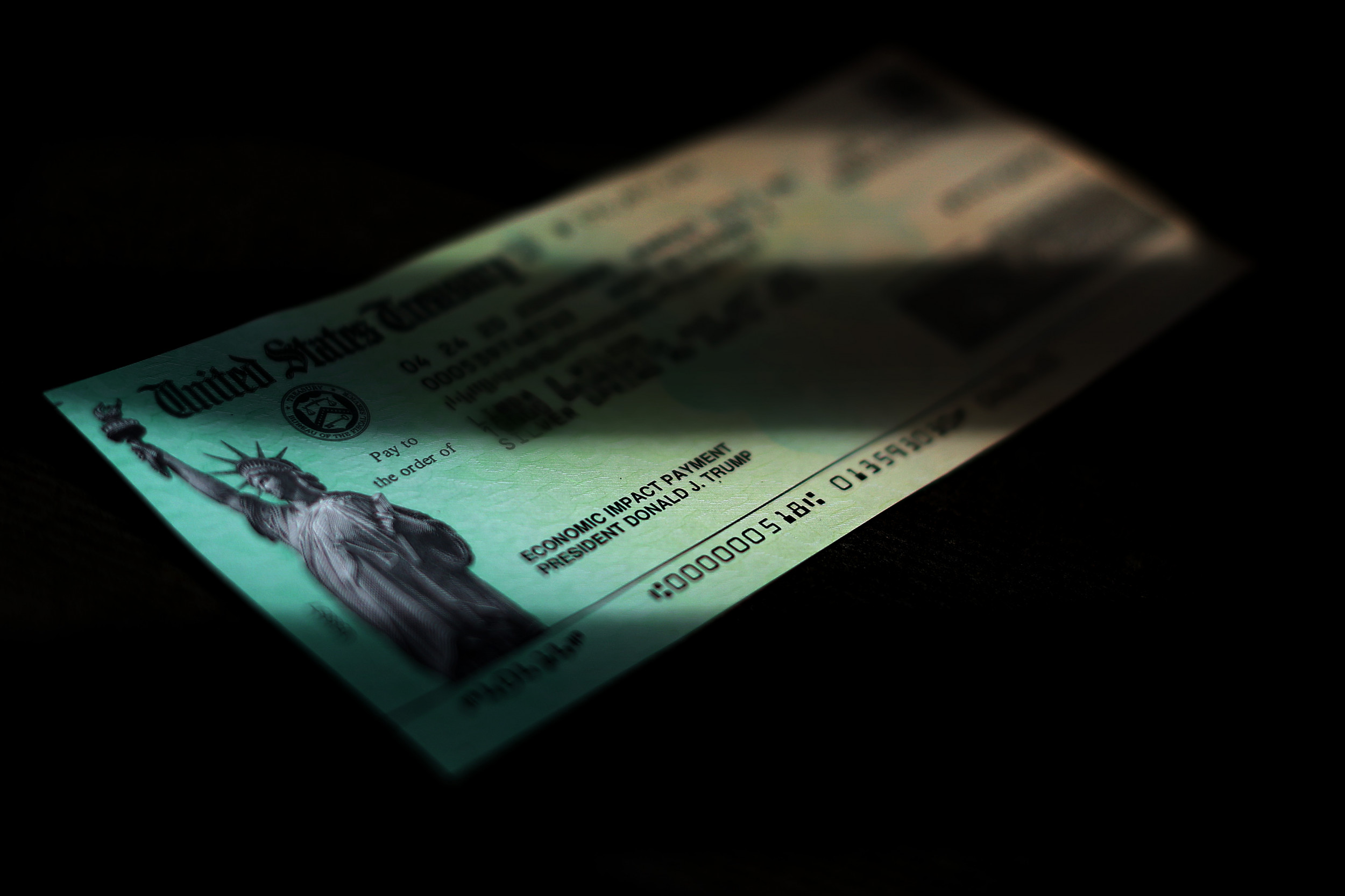

This payment is composed of a $1,400 stimulus check to qualifying individuals and $1,400 per their dependents as part of the american rescue plan act, or president biden's early 2021 tax plan. Additionally, there are changes to the 2021 child tax credit, the 2021 earned income tax credit, 2021 child and dependent care credit, and. Two currently competing proposals each offer a change from the first stimulus check, each of which could.

In the third stimulus check, dependents of every age count toward $1,400. Who gets a third stimulus check? Which dependents qualify for a stimulus check?

The first two rounds of stimulus checks left out many people claimed by others as dependents. Each eligible dependent — including adult dependents — also will qualify for a payment of $1,400. Important information you’ll want to know;

Millions of americans who were eligible for the $600 second stimulus checks could qualify for the third round of stimulus payments up to $1,400. Individuals who have an adjusted gross income (agi) of up to $75,000, heads of household with an agi of up to $112,500, and married couples with an agi of up to $150,000 per year qualify for the entire stimulus check amount, which is $1,400 for individuals and $2,800 for heads of household and married couples filing. What dependents qualify for the third stimulus check?

2 how strict income limits disqualify families, even if they have dependents; If you're a parent of a baby born in 2020, you could be entitled to $1,100 if you never received the first two payments. In this case, the irs will make sure to send.

According to the irs website: Unlike the first and second round of checks, payments for dependents in the third round are not restricted to only children under 17. Eligible families will get a payment based on all of their qualifying dependents claimed on their return, including older relatives like college students,.

Who gets a 3rd stimulus check?

Stimulus Check Eligibility with H4 ITIN but child SSN

Here’s who doesn't get the 600 stimulus check

You ask, we answer Questions about COVID19 stimulus

Stimulus Check 3 Older Dependents 1,400 Or More? This

Stimulus Checks 3 Would You Get 1,400 For Each Dependent

302021cashmoneystimulusbill600dollarscheck

Stimulus Check Eligibility For Dependents STIMUQ

Who's a dependent for stimulus checks New qualifications

Stimulus checks and veterans Payment schedule

Stimulus Check 3 Older Dependents 1,400 Or More? This

Where Is My PlusUp Stimulus Payment?

What Dependents Should Know About Timing, Eligibility of

Details Of The Different Qualification Requirements For

Stimulus Check The Timeline, Amount, And Potential Delays

012021cashmoneystimulusbill600dollarscheck

New stimulus check rule 1,400 for dependents of any age

Second stimulus check qualifications Here are the details