Tax Rate Calculator 2022

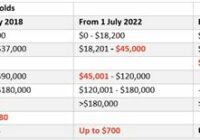

Tax Rate Calculator 2022. Us income tax calculator 2022. $5,092 plus 32.5c for each $1 over $45,000. IRS Releases 2021 Tax Rates, Standard Deduction Amounts from www.forbes.com There are seven federal income tax rates in 2022: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Click to select a tax section.