Tax Brackets 2022 Married Filing Separately. Tax rates 2022 married filing separately. In tax year 2020, for example, a single person with taxable income up to $9,875 paid 10 percent, while in 2022, that income bracket rose to.

15% tax rate up to $517,200 Taxable income (married filing separately) taxable income (head of household) 10%: 2021 tax brackets (taxes due april 2022 or october…

Once Of All That Is Calculated And Subtracted.

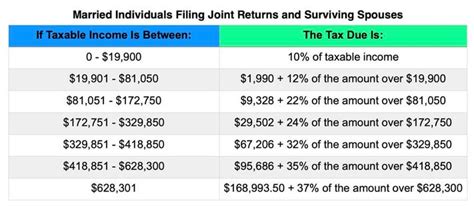

35% for incomes over $215,950; Generally, as you move up the pay scale, you also move up the tax scale. Without further ado, here are the 2022 tax brackets according to your filing status and income from the irs.

Without Further Ado, Here Are The 2022 Tax Brackets According To Your Filing Status And Income From The Irs.

32% for incomes over $170,050 Meanwhile, filing your taxes under the single status involves being either unmarried or legally separated or divorced on the tax year’s last day, which is december 31. Another significant change is the exclusion for gifts, which has been raised from $15,000 in 2021 to $16,000 in 2022.

10 Percent, 12 Percent, 22 Percent, 24 Percent, 32 Percent, 35 Percent, And 37 Percent.

37% for incomes over $539,900; 37% for incomes over $539,900 ($647,850 for married couples filing jointly) 35% for incomes over $215,950 ($431,900 for married couples filing jointly) 32% for incomes over $170,050 ($340,100 for married couples filing jointly) 24% for incomes over $89,075 ($178,150 for married couples filing jointly) 32% for incomes over $170,050;

The Irs Also Announced That The Standard Deduction For 2022 Was Increased To The Following:

24% for incomes over $89,075 To file your taxes as married, you will have to get married legally either on the last day of the tax year or before that. Married filing separately is the filing type used by taxpayers who are legally married, but decide not to file jointly using the married filing jointly filing type.

Single Taxpayers And Married Individuals Filing Separately:

The top tax rate for individuals is 37 percent for taxable income above $539,901 for tax year 2022. Single, married filing jointly or qualifying widow(er), married filing separately and head of household. $12,950 for single taxpayers and married couples filing separately.