Tax Brackets 2022 Single Head Of Household. The money individuals pay in tax to the government each year is then sent to the neighborhood social development canada office for processing. There are seven federal income tax rates in 2022:

The tax filing for the head of household and single differ in terms of the standard deduction and the initial tax brackets. 2022 tax brackets (taxes due april 2023 or october 2023 with an extension) tax rate In tax year 2020, for example, a single person with taxable income up to $9,875 paid 10 percent, while in 2022, that income bracket rose to.

10% Tax Rate For Incomes Less Than $10,275.

After the tax is processed. In tax year 2020, for example, a single person with taxable income up to $9,875 paid 10 percent, while in 2022, that income bracket rose to. The tax brackets up to 22% are more relaxed for the head of household than single.

There Are Seven Tax Brackets For Most Ordinary Income For The 2022 Tax Year:

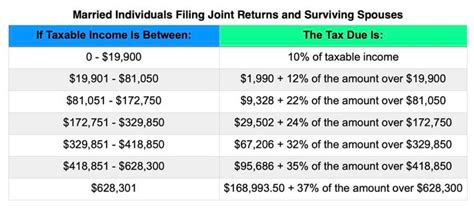

The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $539,900 for single filers and above $647,850 for married couples filing jointly. 10%, 12%, 22%, 24%, 32%, 35% and 37%. Use the rateucator below to get your personal tax bracket results for tax years 2021 and 2022.

22% Tax Rate For Incomes Over $41,775 But Not Over.

The additional standard deduction for people who have reached age 65 (or who are blind) is $1,400 for each married taxpayer or $1,750 for unmarried taxpayers. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. The tax filing for the head of household and single differ in terms of the standard deduction and the initial tax brackets.

Tax Bracket Tax Rate ;

Tax rate for single filers for married individuals filing joint returns for heads of households; $200,000 for single filers or head of households, $250,000 for married couples filing 2021 tax brackets and rates for single filers, married couples filing jointly, and heads of households;

The Standard Deduction For Head Of Household Is $18,800, While That For The Single Is $12,550 As Per The Irs For The Year 2021.

$12,950 for single filers (up $400) $12,950 for married taxpayers who file their taxes separately (up $400) $19,400 for heads of households (up $600) $25,900 for married taxpayers who file jointly (up $800) 2022 tax brackets (for taxes due in april 2023) announced by the irs on november 10, 2021, for individuals, married filing jointly, married filing separately and head of household are given below. Single or married filing separately: