Tax Calculator 2022 England. This is known as your personal allowance, which works out to £12,570 for the 2021/2022 tax year. Gross net calculator 2022 of the german wage tax system.

This is known as your personal allowance, which works out to £12,570 for the 2021/2022 tax year. There is no stamp duty tax applied to the first £125,000. China income tax calculator 2022/23.

Sars Income Tax Calculator For 2022 Work Out Salary Tax (Paye), Uif, Taxable Income And What Tax Rates You Will Pay

Only 3 easy steps for vat calculation: This is known as your personal allowance, which works out to £12,570 for the 2021/2022 tax year. Simply enter your annual salary and click calculate or switch to the advanced tax calculator to review employers national insurance payments, income tax deductions and paye tax commitments for scotland.

How To Calculate The New Stamp Duty Rate.

£10,000 £20,000 £30,000 £40,000 £50,000 £60,000 £70,000. Anything you earn above £150,000 is taxed at 45%. $61,200 plus 45c for each $1 over $180,000.

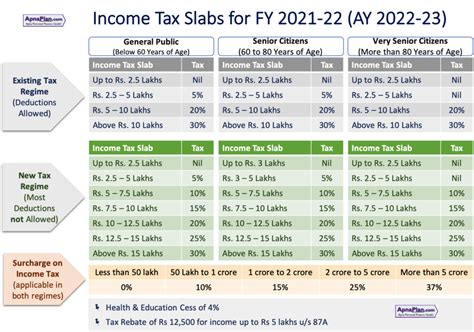

Short Term Capital Gains (Covered U/S 111A ) 15%.

More information about the calculations performed is available on the about page. Interest on deposits in saving account (u/s 80tta ) interest on deposits (u/s 80ttb ) any other deductions. The tax calculator helps you to calculate your taxes.

Long Term Capital Gains (Covered U/S 112A ) 10%.

Just enter your salary into our uk tax calculator. Earnings in this tax band: After this, you will pay 20% on any of your earnings between £12,571 and £50,270, and 40% on your income between £50,271 and £150,000.

$39,000 Plus 37C For Each $1 Over $120,000.

You can calculate your take home pay based on your gross income, paye, ni and tax for 2022/23. This uk tax calculator will make light work of calculating the amount of take home pay you should have after all income tax deductions have been considered. Select first time buyer, moving home or additional property.