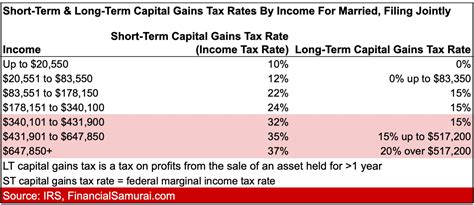

Tax Calculator 2022 Married Filing Jointly. Capital gains tax will be raised to 28.8 percent, according to house democrats. Use the rateucator below to get your personal tax bracket results for tax years 2021 and 2022.

Review the current 2021 tax brackets and tax rate table breakdown. The irs isn't changing the percentages people will pay 10% for incomes of $10,275 or less ($20,550 for married couples filing jointly , $14,650 for heads of household). This calculator includes the 3.8% medicare contribution tax on the lesser of (a) net investment income, or (b) modified adjusted gross income exceeding a threshold based on your.

2022 Wisconsin Tax Tables With 2022 Federal Income Tax Rates, Medicare Rate, Fica And Supporting Tax And Withholdings Calculator.

This site does not currently calculate state income tax, which is levied differently by each state. The calculator will calculate tax on your taxable income only. Multiply the number of qualifying children under age 17 by $2,000

For Example, A Single Taxpayer Will Pay 10 Percent On Taxable Income Up To $10,275 Earned In 2022.

The 2022 tax brackets for married couples filing jointly. 10% tax rate for incomes less than $20,550; Using a tax refund calculator is the easiest way to get an estimate on your tax refund, but you can also do an estimate by hand.

2022 Married Filing Jointly Tax Brackets.

Estimate your us federal income tax for 2021, 2020, 2019, 2018, 2017, 2016, 2015 or 2014 using irs formulas. The calculator below can help estimate the financial impact of filing a joint tax return as a married couple (as opposed to filing separately as singles) based on 2022 federal income tax brackets and data specific to the united states. Taxact’s free tax bracket calculator is a simple, easy way to estimate your federal income tax bracket and total tax.

Just Answer A Few Simple Questions About Your Life, Income, And Expenses, And Our Free Tax Calculator Will Give You An Idea If You Should Expect A Refund And How Much, Or If You’ll Owe The Irs When You File Taxes In 2021.

2021 tax brackets and rates for single filers, married couples filing jointly, and heads of households; Married filing jointly tax filing status. 2022 tax brackets (for taxes due in april 2023) announced by the irs on november 10, 2021, for individuals, married filing jointly, married filing separately and head of household are given below.

Calculate Your Income Tax Bracket 2021

Use the rateucator below to get your personal tax bracket results for tax years 2021 and 2022. Review the current 2021 tax brackets and tax rate table breakdown. 2021 federal income tax brackets ( (for taxes due in april 2022 )) for individuals, married filing jointly, married filing separately and head of household are given below.you can see also tax rates for the year 2020 and tax bracket for the year….