Tax Calculator 2022 Quebec. Actual 2022 cwb rates may not be known until dec 2022 or jan 2023. The quebec salary calculator uses personal income tax rates from the following tax years (2022 is simply the default year for the quebec salary calculator), please note these income tax tables only include taxable elements, allowances and thresholds used in the canada quebec income tax calculator, if you identify an error in the tax tables, or a tax credit / threshold that you would like.

It was named after jean bienvenue, who was the minister of municipal affairs responsible for instituting this tax. The 2022 tax year in quebec runs from january 2022 to december 2022 with individual tax returns due no later than the following april 30 th 2023. Sales tax breakdown for quebec, canada

Income Tax Calculations And Rrsp Factoring For 2022/23 With Historical Pay Figures On Average Earnings In Canada For Each Market Sector And Location.

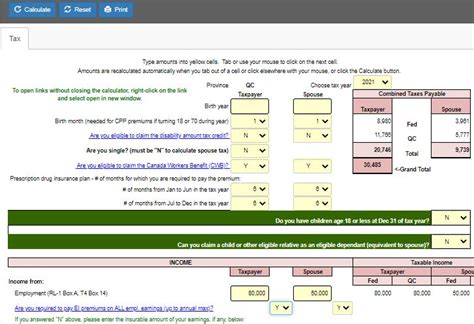

Use the simple annual canada tax calculator or switch to the advanced canada annual tax calculator to review nis payments and income tax. The detailed quebec income tax calculator for 2021/2022 (click link to open the calculator in a new window) is a great tax planning and financial planning tool, but will not actually file your tax return for you. Qpp contributions the table below provides.

In 2022, Quebec Is Increasing The Provincial Tax Brackets By 2.64%.

Calculate your 2021 estimated personal income taxes in quebec with the turbotax® income tax calculator. This calculator is intended to be used for planning purposes. However, in some provinces, harmonized sales tax (hst) must be used.

The Quebec Salary Calculator Uses Personal Income Tax Rates From The Following Tax Years (2022 Is Simply The Default Year For The Quebec Salary Calculator), Please Note These Income Tax Tables Only Include Taxable Elements, Allowances And Thresholds Used In The Canada Quebec Income Tax Calculator, If You Identify An Error In The Tax Tables, Or A Tax Credit / Threshold That You Would Like.

Cwb 2022 rates are using 2021 rates indexed for inflation. Your average tax rate is 1.7% and your marginal tax rate is 1.7%.this marginal tax rate means that your immediate additional income will be taxed at this rate. This means the basic personal allowance will increase to $16,143 from $15,728.

The Canada Annual Tax Calculator Is Updated For The 2022/23 Tax Year.

The first step is to work out whethe. In 2022, quebec is increasing the provincial tax brackets by 2.64%. The 2022 tax year in quebec runs from january 2022 to december 2022 with individual tax returns due no later than the following april 30 th 2023.

This Marginal Tax Rate Means That Your Immediate Additional Income Will Be Taxed At This Rate.

Qc prescription premium factors for 2022 are estimated based on indexation. Hst tax calculation or the harmonized sales tax calculator of 2022, including gst, canadian government and provincial sales tax (pst) for the entire canada, ontario, british columbia, nova scotia, newfoundland and labrador The cumulative sales tax rate for 2022 in quebec, canada is 14.975%.