Tax Refund 2022 Child Tax Credit. Claim $8,000 per child on your 2021 taxes. $3,600 per child younger than age 6 and $3,000 per child between ages 6 and 17.

For the 2022 tax year, the credit goes back to $2,000 per eligible child. When should i expect my tax refund in 2022? There might not be planned advance child tax credit payments for 2022, but there’s still more money coming.

Child Tax Credit Eligibility In 2021, You May Have Received Up To $1,800 In Monthly Payments Per Child Age 5 And Younger, And Up To $1,500 For Kids Between Ages 6.

Advanced child tax credits would not be offset if you or your spouse owe child support. You will no longer receive monthly payments. For the 2022 tax year, the credit goes back to $2,000 per eligible child.

Kid Tax Credit Payments 2022 Kid Tax Reduction Settlements Early Were Done In December 2021, And The Additional Juvenile Obligation Decline Subsidizes Will Be Conveyed Off Qualified Watchmen Close By Their 2021 Government Structures In The 2022 Expense Season.

You file your return online; They can be garnished for tax debt and federal or state debts owed. How advance child tax credit payments might impact your tax refund in 2022 child tax credits are typically claimed when taxpayers file their income tax returns.

That Would Mean They Can Claim The Full Credit When They File Their 2021 Taxes:

When filing taxes in 2022, claim your newborn as a dependent. How child tax credits could lead to costly surprise. The enhaced ctc are not permanent parents of newborns in 2021 are eligible for the child tax credit.

Outsiders Who Received A Monthly Child Tax Credit Payment In 2021 May Be In For A Big Surprise Come Tax Refund Time.

You might be entitled to more child tax credit support last year the irs sent out advanced monthly payments of the 2022 child tax credit, entitling parents to up to $300 per child in monthly. How to factor in your child tax credit and covid costs taxpayers who file early and electronically should be able to avoid. You choose to get your refund by direct deposit;

Under President Joe Biden's American Rescue Plan, The Child Tax Credit (Ctc) Was Expanded From $2,000 Per Child To $3,600 For Each Kid Under Age 6 And $3,000 For Those Between 6 To 17.

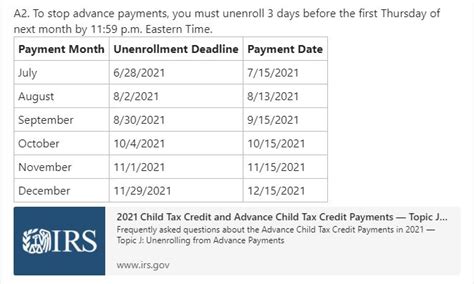

However, as part of the american rescue plan package, millions of parents received monthly advances of their child tax credits from july through december of 2021. The advance child tax credit received from july through december last year amounted to up to $1,500 or up to $1,800 for each child, depending on the child's age. Parents can claim the other half of the tax credit on their 2021 tax returns, per business insider.