Tax Refund 2022 Low. The letter will help economic impact payment recipients determine if you are entitled to and should claim the recovery rebate credit on your tax year 2021 tax returns which you will file in 2022. If you’re surprised by a tax refund that is less than expected in 2020 or 2021, not sure why your tax refund was reduced, or the complexity around taxes has got you stressed, h&r block is here to help.

A refund is typically issued based on your taxable income in cases where you’ve paid or withheld more than you owe. People who live in the lower council tax bands will get the £150 refund. And only 42% of americans with the lowest household incomes (under $50,000) anticipate getting a refund, despite the fact that 77% of.

If You Are At Risk Of Receiving A Lower Tax Refund In 2022, Consider Taking Out A Personal Loan To Help Pay Down Debt.

As a result, withholding for the applicable tax year may not have been adjusted. We can help you file your taxes, check your withholding and understand your lower tax refund. Feb 5, 2022 / 10:54 pm est.

Feb 3, 2022 / 07:42 Am Est / Updated:

The american rescue plan, signed by president joe biden in march, boosted the 2021 child tax credit to $3,000 from $2,000 per child age 17 and under, with an extra $600 for children under age 6. Make an appointment to speak with a tax pro today. I made 21,689 this year social security tax withheld 1,334 federal income tax withheld 1,034 medicare withheld 314 i’m getting 122$ this doesn’t make sense to me my girl worked the same job as me for less time and made 13k but is getting 930 we both filed single with no dependents someone help this make sense pls.

People Who Live In The Lower Council Tax Bands Will Get The £150 Refund.

After spouting all of that misery, we will now provide you guys with steps to take to lower the likelihood of facing large tax refund delays this year. Families with babies or children born, adopted or fostered in 2021 will be able to claim the full enhanced ctc credit on their 2021 tax returns, giving them a credit of $3,600 per child. (wroc) — many parents will be getting a much lower refund than expected this tax season.

And Only 42% Of Americans With The Lowest Household Incomes (Under $50,000) Anticipate Getting A Refund, Despite The Fact That 77% Of.

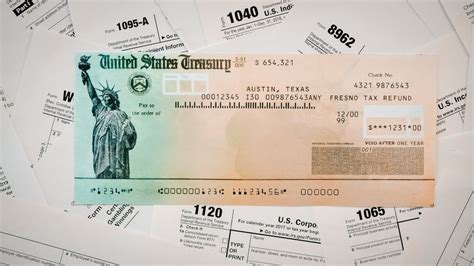

If you received a tax refund that was smaller than you expected this year, chances are it’s not a random mistake. If your income exceeds these thresholds for your filing status, you may need to pay it back. The internal revenue service (irs) issued 122 million refunds for fiscal year 2020, totaling more than $736.2 billion in 2021 refunds, according to irs data, but in 2022, some americans could receive checks that are smaller than they’re used to, according to william neilson.

Why Am I Getting So Little.

Low incomes tax reform group calls for urgent action on diversion of tax refunds in light of reports of problems from taxpayers that are increasing in both number and seriousness, the low incomes tax reform group (litrg) is calling on hmrc to stop accepting deeds of assignment at face value with immediate effect and also to revisit historic deeds in certain. Currently, the average 2020 tax refund is about equal to last year's — roughly $2,800 — but every. Unlike in prior years, the credit is fully refundable for 2021.