Tax Return 2022 Ctc. Still, based on statements from the irs and trends over past years, the estimates in the following chart should be accurate for the vast majority of taxpayers (see exceptions below). Your tax preparer will need these 2 letters to help reconcile the tax credits on your 2021 form 1040.

12, 2022, the irs updated the faq page for the advance ctc to give taxpayers and tax preparers additional guidance. The irs will begin accepting tax returns on january 24, 2022. As of the 2022 tax season, the ctc is not taxable.

The Child Tax Credit And Your 2022 Tax Return.

See below for the standard/base. However, parents must reconcile the amount they received with the amount they were supposed to receive based on their 2021 adjusted gross income. 12, 2022, the irs updated the faq page for the advance ctc to give taxpayers and tax preparers additional guidance.

Last Year President Joe Biden Signed The American Rescue Plan Which Increased The Child Tax Credit (Ctc) Amount And Offered Half Of The Credit Through A Series Of Monthly Payments.

Last year, the agency was forced to push back the start of the tax. See all of the requirements for the child tax credit. Your tax preparer will need these 2 letters to help reconcile the tax credits on your 2021 form 1040.

You Are Able To Get A Refund By March 1, 2022, If You Filed Your Return Online, You Chose To Receive Your Refund By Direct Deposit And There.

If families get a letter from the irs saying how much they received from the advance ctc, they should keep the letter because it will have. It's possible you could be looking at another $1,500 or $1,800 for each qualifying child now for the child tax credit after you file a 2021 federal income tax return. Up to $2,000 per eligible child under 17, in the form of an annual tax credit

It Wasn’t A Normal Year, With Joe Biden ‘S Presidency Bringing About Various Stimulus Packages And Financial Aid In The Usa.

Washington — the internal revenue service today kicked off the 2022 tax filing season with an urgent reminder to taxpayers to take extra precautions this year to file an accurate tax return electronically to help speed refunds. 2022 tax filing season begins jan. How will ctc affect your 2022 tax returns?

The Qualifying Dependent Must Be A U.s.

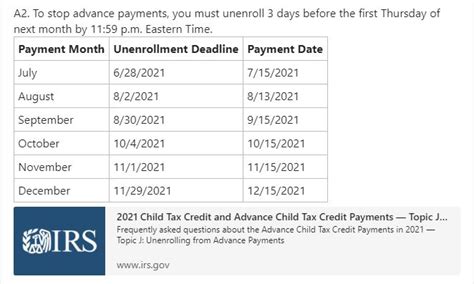

The rest is claimed in 2022 via your tax return. If you received too much, you may need to repay it; W ith 2021 becoming 2022, it’s time to start thinking about filing your tax returns for the year of 2021.