Tax Return Period 2022. Angela lang/cnet this story is part of taxes 2022, cnet's coverage of the best tax software and everything else you. For your 2nd period provisional tax return, we need to declare all income, including (but not limited to) business and rental income, interest earned on accounts or investments and capital gain transactions, in addition to salaries earned.

2020 income tax return due for clients of tax agents (with a valid extension of time) 31 march 2022. The irs has warned there could be delays in issuing refunds in. Deadline for amending ated returns for 2021/22.

How Much You Get Back On Your Tax Return Depends On.

Gst return and payment due. Do not forget to file your sars tax return 2021, penalties for late tax return. Midnight 31 january 2022 (you can submit up to 28 february 2022 without getting a late filing penalty) pay the tax you owe

Taxpayers Can Begin Filing 2021 Tax Returns Monday, Jan.

Angela lang/cnet this story is part of taxes 2022, cnet's coverage of the best tax software and everything else you. The self assessment tax return deadline is on 31 january each year. Prior years individuals tax return forms and schedules;

This Tax Calculator Will Be Updated During 2022 As New 2022 Irs Tax Return Data Becomes Available.

In 2021, americans received on average $2,775 in tax refunds, an 11% increase from the previous year, according to the internal revenue service. The 2022/23 tax year begins on 6 april 2022 and ends on 5 april 2023. Tax return for individuals (supplementary section) 2021;

24, 2022, 21 Days Earlier Than Last Year.

Form 550 series (for employee benefit plan) 1st august 2022 To pay the fourth 2022 personal income tax installment A sars media release 2021 list is available.

Sars Tax Year 2022 Starts 1 July 2022, Are You Ready?

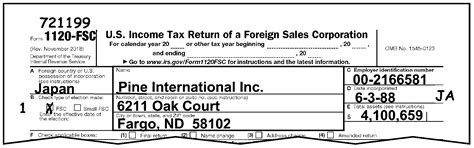

Corporation income tax returns (irs form 1120): Tax return deadlines in 2021 and 2022. We need your information by 11 february 2022 to ensure submission by the deadline date!