This is where the new irs letter — officially known as letter 6475 — comes in. If you confirm you didn't receive a third stimulus check and you are eligible, you can get that money by claiming the recovery rebate tax credit on your 2021 tax return.

Third Stimulus Checks Should You File Your Taxes to the

The irs is expected to start sending the letter out sometime in late january, and is asking people to keep this letter safe.

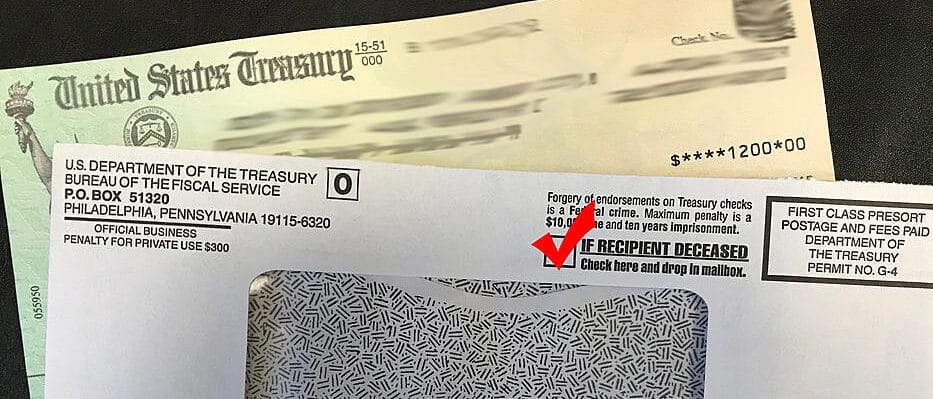

Third stimulus checks tax return irs. The irs is sending out important stimulus check envelopes. The 6475 letter is for those who received a third stimulus check last year. For this reason, the irs news release recommends not throwing letter 6475 away.

Your stimulus check will not impact your tax refund because that’s money that is owed to you by the irs. Question about irs form 6475 (3rd stimulus) and 2021 tax return: The stimulus checks are not an advanced payment on your tax refund like the child tax credit payments.

Which tax return is used for my third stimulus check? They will be marked as important tax document or third economic payment, according to reports. Those whose third stimulus check was based on outdated 2019 information may actually qualify.

Those who received the third stimulus check of up to $1,400 last year should soon be getting a letter from the irs. You should note that if your income fell in the 2020 tax year, filing your tax return earlier could help you qualify for a bigger third stimulus check. Individuals eligible for payments could receive.

It will also help those who may not have yet received money they are owed. The irs uses 2019 or 2020 tax returns to determine eligibility for your third stimulus check. In addition to the third stimulus payment, parents of children born in 2021 can likely claim the enhanced child tax credit on their return.

“these letters can help taxpayers, or their tax professional, prepare their 2021 federal tax return,” the agency said in a press release. Here’s everything you need to know about the third stimulus check and your 2021 tax return. I also don’t think i reported it on my 2021 return in my credits section.

The consequence of not reporting the correct amount on your tax return could result in your tax owed (or tax refund) being miscalculated, which in turn will trigger the irs to make an adjustment to your tax owed/tax refund. How can i find my stimulus payment history? Those without current direct deposit information on file will receive the payment as a check or debit card in the mail.

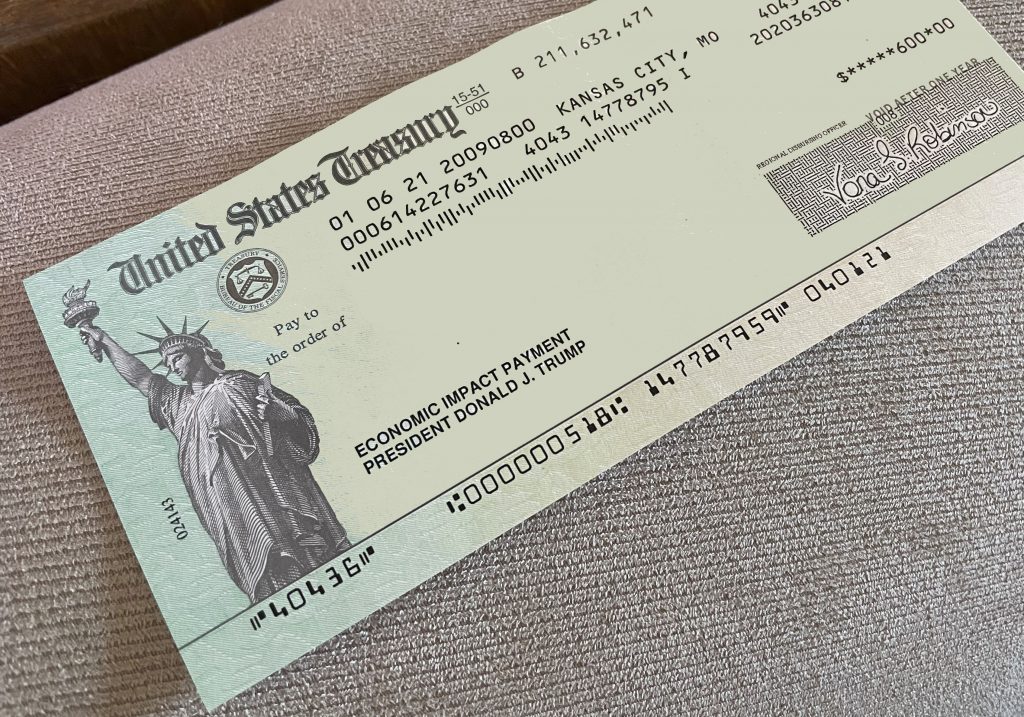

The irs states on its website that you are not required to report the third stimulus check on your 2021 tax return. The latest news live on irs tax return filing, california state stimulus check, federal stimulus checks and child tax credits saturday 20 february 2021. The third stimulus check, formally known as an economic impact payment, was a product of the american rescue plan, which was enacted in march 2021.

The full amount of the third stimulus payment is $1,400 per person ($2,800 for married couples filing a joint tax return) and an additional $1,400 for. Even if someone already received their third stimulus check, they may have qualified to receive an additional check from the irs. The income cutoff to receive a third stimulus check is $80,000 for an individual taxpayer, $120,000 for a head of household and $160,000 for a married couple that files jointly.

The stimulus check was a separate payment. Taxpayers with direct deposit information on file will receive the payment that way. The base amount of the third round of stimulus checks is expected to be $1,400 for individuals — more than the $1,200 delivered under the cares act and the $600 that rolled out to bank.

The irs will use data already in its systems to send the third stimulus payments. However, the information may be helpful to determine if you're eligible to claim a 2021 recovery rebate credit on your tax return. I received that last year with my 2020 tax return & stimulus checks.

I filed my 2021 tax return with h&r block online not realizing i was getting a notice from the irs (6475) about my 3rd stimulus check. Americans who were eligible for the third stimulus check or the monthly advance child tax credit in 2021 need to be on the lookout for two letters from the irs before they file their taxes in 2022.

IRS Wednesday is the 'official payment date' for 1,400

More stimulus checks are coming in the mail. 2 ways you

Stimulus Checks Tax Return Irs H&r Block TAXW

Third Stimulus Check Track Your COVID19 Relief Fund With

Second stimulus check update If you received notice that

IRS Requires Return of Stimulus Checks Sent to Decedents GYF

Any News On Our Second Stimulus Check NEWCROD

3rd stimulus checks Social Security recipients could see

Third stimulus check update Tax season is here. Should I

Third stimulus check Will the IRS tax returns affect my

When will I get my third stimulus check? IRS tracking tool

Where’s My Third Stimulus Check? IRS Confirms New Batch Of

Third Stimulus Checks Delayed? 1400 Payments Still Coming

How To Get Third Stimulus Check Without Filing Taxes

A bonus stimulus check may be on the way, thanks to your

Third Stimulus Check Why Some People Should File Their

Your Third Stimulus Check Could Be Much Bigger If You File