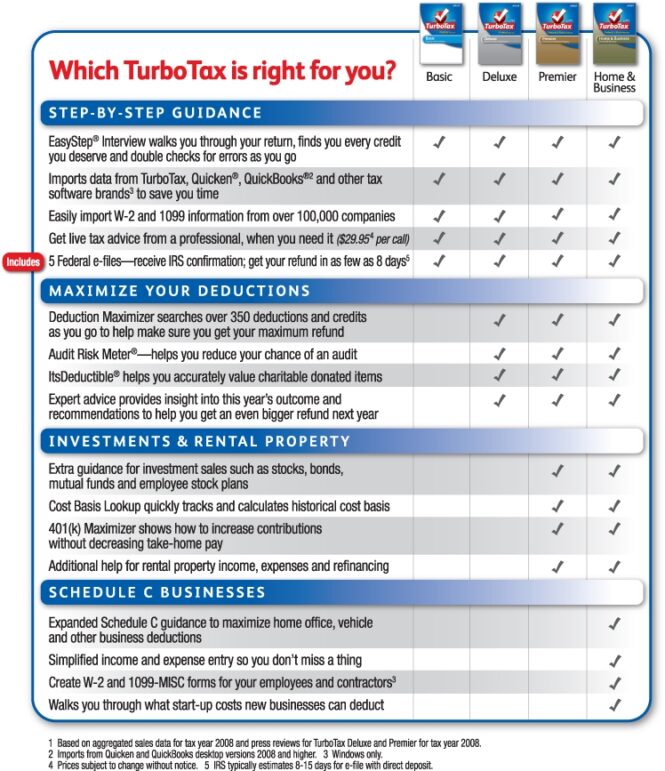

Covers stocks, bonds, espps, and other investments however, the turbotax deluxe return does prepare a schedule d form for both federal and state taxes, so i am not sure what i am getting out of a premier upgrade if it also allows me to roll over losses from prior years? My entire working life (currently in my mid 30s) i've used turbotax deluxe.

Turbotax Deluxe Vs Premier 2jo Ei68xykt3m Is paying

Looking for advice which version to buy.

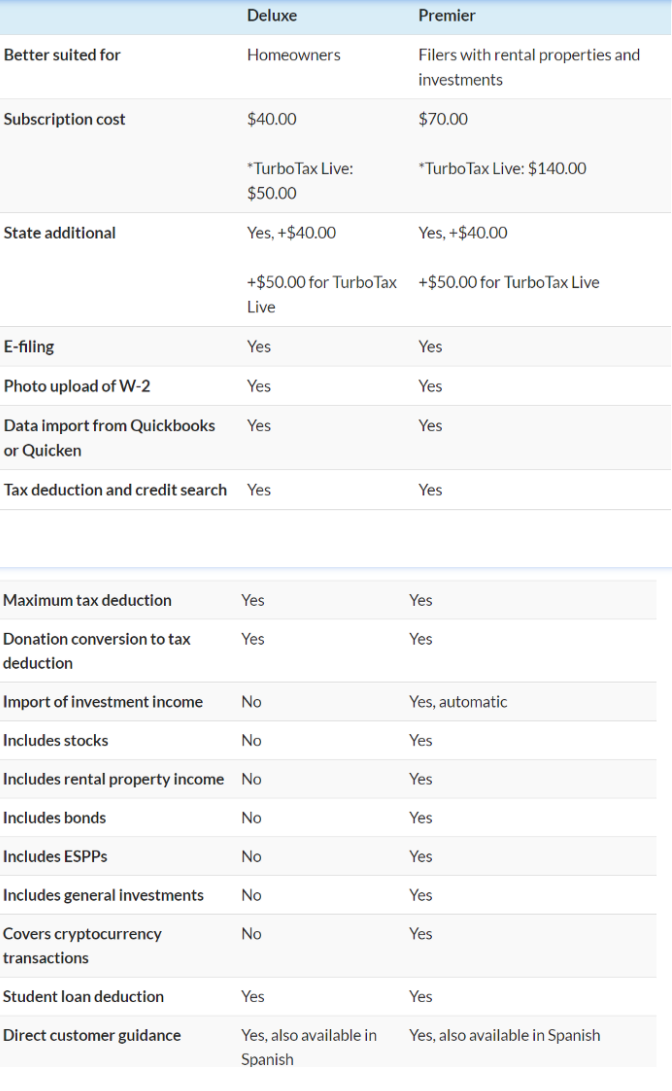

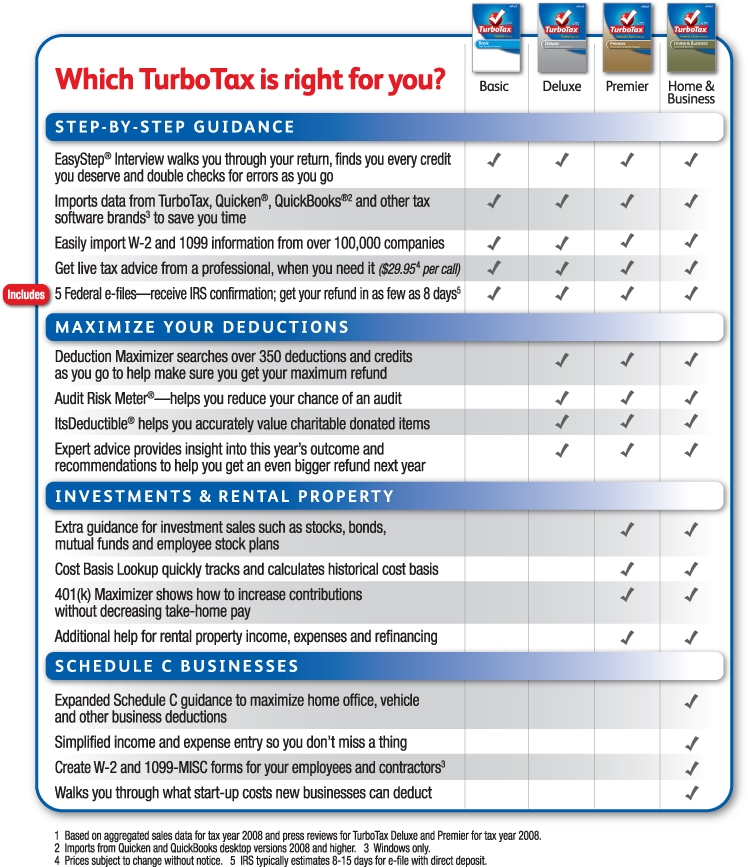

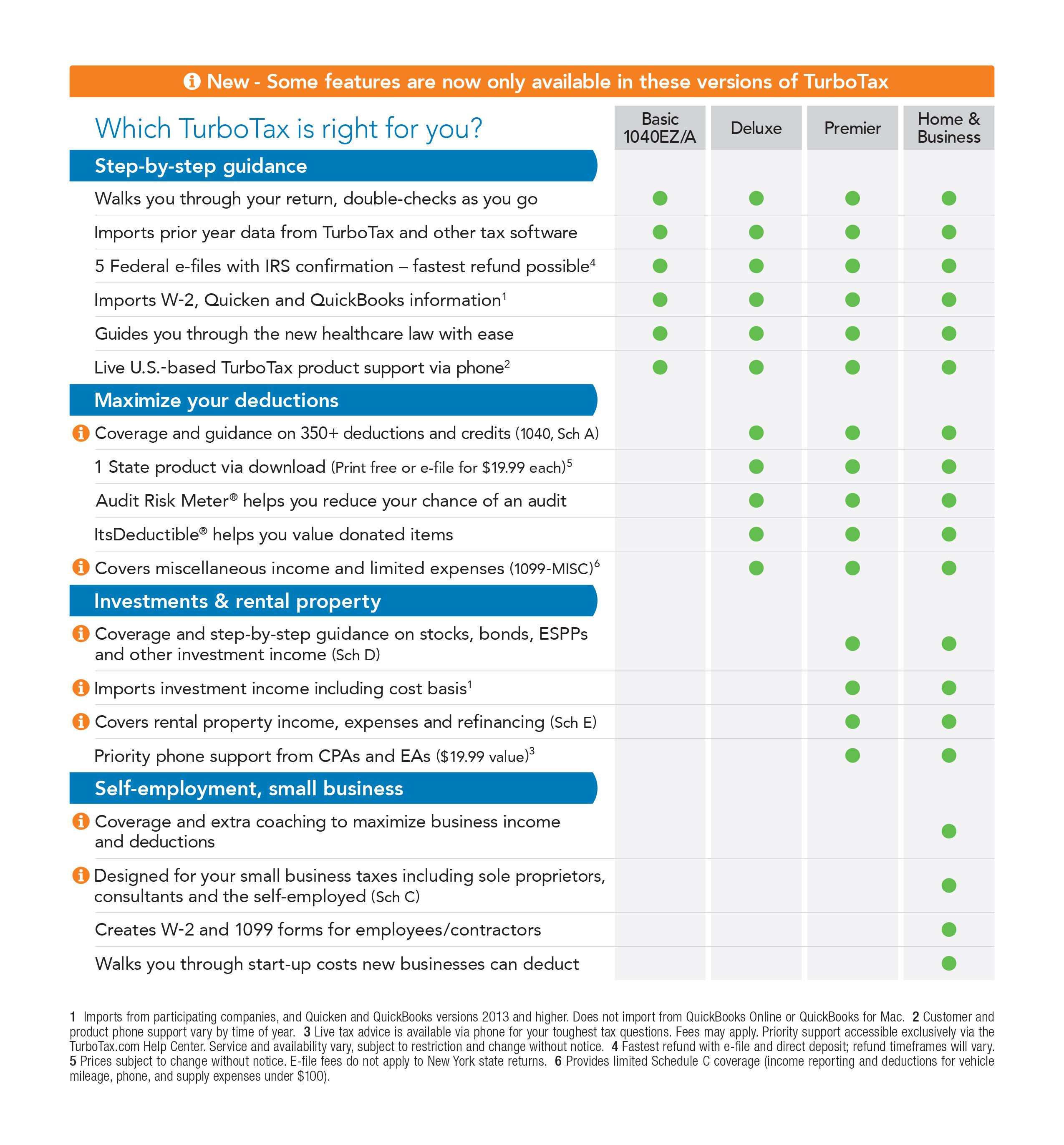

Turbotax premier vs deluxe. Don't forget the commissions the broker charges. In 2010, premier retails for $89.95 from most outlets, and is $49.95 as a download. What you need to do and what turbotax and brokers conspire to make needlessly complex, is to determine your capital gain or capital loss from the sale vested rsu or espp.

This feature, which is a paid feature, is an added step of support as you file your tax returns. Beginning with tax year 2015, turbotax has reversed their disastrous decision and put the functionality back into deluxe, making it once again an acceptable choice. On turbotax’s deluxe plan, you can’t report capital gains or rental income (schedules d and e).

The cd version includes options for federal and state filing. Basic online assist $39.99 + $0 per state. If you live in a state with no income tax, save yourself about ten bucks by choosing the federal version only.

The download versions are only include federal tax software. Your employer's statements probably will. If you are familiar with the income and deductions you have to enter on your return, you should do well with the deluxe version.

I know all the ins and outs of making it work for me, even in cases where perhaps premier would be slightly easier. Yes, if $1,500 or less: Premier version plus business income, expenses on a schedule c, home office deductions and features for freelancers.

The additional help comes from expanded interviews and/or blue links with specific information. It includes many tax forms, but not schedule d. Turbotax premier is required if you need to use schedule d.

Earned income credit (eic) yes: Need to report stocks, rsu, espp. Skip basic and for most users turbotax deluxe has all you need.

If you're under 65, your taxable income is less than $100,000 and consists of salary, tips, interest, scholarships, grants or unemployment, and you have no dependents, don't employ household staff, aren't in chapter 11 bankruptcy and don't have any. Turbotax specialists are available to provide general customer help and support using the turbotax product. The comparison says that premier additional help for investment sales such as stocks, bonds, royalties, mutual funds.

Turbotax specialists are available to provide general customer help and support using the turbotax product. The cd version includes options for both federal and state filing. Turbotax premier costs $90 plus $50 per state return and it includes everything offered in the deluxe package with a few more bells and whistles.

Turbotax recommends the premier edition, which has all the features of deluxe plus more tools to deal with investments and rental property, to people who have stocks and bonds or rental income. With turbotax live, you have access to live support as you’re working on your taxes. Form 1040ez is the simplest federal income tax form, and you can file it using turbotax free edition.

Yes, even if more than $1,500: The only thing different this year is that i bought and sold cryptocurrency via robinhood in 2021, which i've. Turbotax live is a feature that turbotax introduced a few years ago.

I don’t need any help, just a way to report it. Their free version includes much of what is included in turbotax premier (investments, rental income) and home & business (1099 income and expenses). Deluxe is sold for $59.95, and is $29.95 as a download.

Yes, even if more than $1,500: The deluxe version is only about support. Not included with free edition (but is available as an upgrade).

While turbotax deluxe does include schedule d, we do suggest premier to get the guided interview questions to ensure information is being accurately entered. For more complex financial situations, you will need to upgrade to one of the paid versions of turbotax. The transaction entering is extremely tedious.

Turbotax deluxe for desktop includes all tax forms and schedules. Alternatively, h&r block tax software deluxe will handle schedule d at a fraction of the cost of turbotax premier. I've been reading conflicting information concerning turbotax deluxe and turbotax premier when it comes to which download can be used if you have security sales.

Yes, even if more than $1,500: Turbotax premier premier adds a little piece of mind with videos that you will not need after the first year or two of using turbotax. Not included with free edition (but is available as an upgrade).

Premier is listed with advanced help for stocks. Turbotax deluxe vs premier for rh crypto. They make money on the state return, which costs $12.95, and on the deluxe version, if you need extra customer support, which only costs $6.99.

The description for turbotax premier states: This is the down side of vesting monthly: Free version plus access to a tax.

TurboTax Deluxe VS Premier. Tax filing does not have to be

Which TurboTax Do I Need TurboTax Deluxe vs. Premier vs

Turbotax Deluxe vs Turbotaxlive Deluxe

Which TurboTax Do I Need TurboTax Deluxe vs. Premier vs

Crack turbotax deluxe versus premier

Turbotax Deluxe Vs Premier 2jo Ei68xykt3m Is paying

Taxact Vs Turbotax Must Read Comparison Before Buy!

TurboTax Deluxe vs. Premier vs. Home & Business TurboTax

TurboTax Costco Price + Coupon (Cheaper To Buy Online

How Can I Downgrade From Turbotax Deluxe To The Free

Difference Between Turbotax Home And Business And Premier

TaxAct vs TurboTax Review Best Features and Options for

Drivers & Soft Compare turbotax versions online versus

TurboTax vs H&R Block Which Is Better? Careful Cents

Turbo Tax 2012 Review and Premier/Deluxe Giveaway Deluxe

TurboTax Deluxe Federal + efile 2009 [Old

united states Is it worth it to buy TurboTax Premier