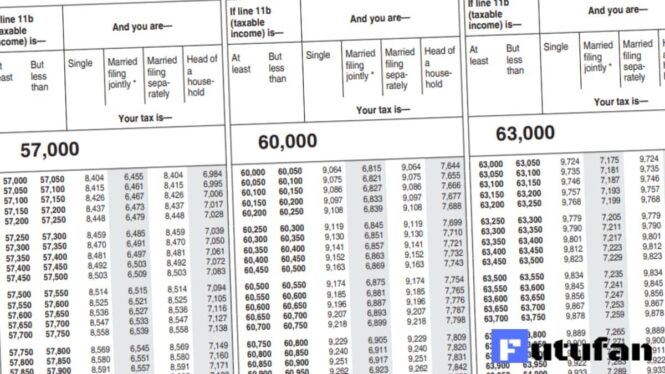

Tax Chart 2021 Irs. All these are relatively small increases from 2020. What are the 7 tax brackets?

More news for tax chart 2021 irs » Only the money you earn within a particular bracket is subject to the corresponding tax rate. By the quantity of money being kept, the workers are able to assert income tax return credit scores.

Ordering tax forms, instructions, and publications.

Ordering tax forms, instructions, and publications. The irs will process your order for forms and publications as soon as possible. Estimated tax is the method used to pay tax on income that isn’t subject to withholding (for example, earnings It contains several changes like the tax bracket changes and the tax rate each year, together with the option to employ a computational link.

It contains several changes like the tax bracket changes and the tax rate each year, together with the option to employ a computational link. Go to irs.gov/orderforms to order current forms, instructions, and publications; All these are relatively small increases from 2020. What is the highest tax rate?

What are the 7 tax brackets?

It contains several changes like the tax bracket changes and the tax rate each year, together with the option to employ a computational link. More news for tax chart 2021 irs » The tax rates for 2021 are: Don't resubmit requests you've already sent us.

It contains several changes like the tax bracket changes and the tax rate each year, together with the option to employ a computational link.

It’s important to remember that moving up into a higher tax bracket does not mean that all of your income will be taxed at the higher rate. What is the highest tax rate? By the quantity of money being kept, the workers are able to assert income tax return credit scores. Oct 27, 2020 · 2021 earned income tax credit the maximum earned income tax credit in 2021 for single and joint filers is $543, if the filer has no children (table 5).

It’s important to remember that moving up into a higher tax bracket does not mean that all of your income will be taxed at the higher rate.

Don't resubmit requests you've already sent us. It’s important to remember that moving up into a higher tax bracket does not mean that all of your income will be taxed at the higher rate. By the quantity of money being kept, the workers are able to assert income tax return credit scores. What is the lowest tax bracket?

It contains several changes like the tax bracket changes and the tax rate each year, together with the option to employ a computational link. It’s important to remember that moving up into a higher tax bracket does not mean that all of your income will be taxed at the higher rate. The irs will process your order for forms and publications as soon as possible. All these are relatively small increases from 2020.