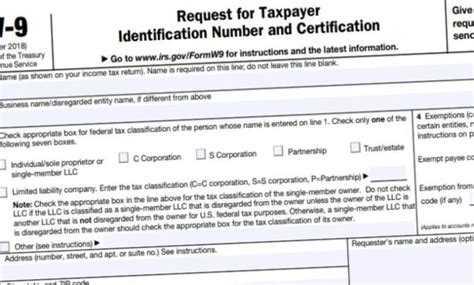

W9 Form 2022 Vs 1099. The irs utilizes this information to help identify and determine taxpayers whether they have properly reported all income. Form w9 is completed by independent contractors or other relevant u.s.

May be filled out and filed by employers and. Provides employer correct information for tax and payment documentation. What is a w9 vs 1099?

What Is The Difference Between Irs Form W9 Vs 1099?

The irs utilizes this information to help identify and determine taxpayers whether they have properly reported all income. Instructions and help about w9 form 2022. Provides irs tax information about contractor earnings.

A Form 1099 That’s Totally Blank.

The irs uses this details to help determine taxpayers and identify whether they have actually properly reported all earnings. Also read new york 2022 w9 form. What is a w9 vs 1099?

Citizen, Or An Foreign Resident.

A 1099 form, on the other hand, is utilized to report how much money was made by a contractor at the conclusion of the year. Provides employer correct information for tax and payment documentation. Keep in mind that new york 2022 w9 form is just relevant to company in the united states.

You May Send The Form To Someone In Case You Are Freelance.

How to deal with form 1099. May be filled out and filed by employers and. Form w9 is completed by independent contractors or other relevant u.s.

Typically, When A Contractor Gets A Form 1099 From A Client, Some Of Those Blue Boxes Are Going To Be Filled In—With The Contractor’s Name, Address,.

Also read backup withholding 2022. The irs utilizes this details to assist determine taxpayers and determine whether they have actually properly reported all earnings. Here’s a sight to behold: