On Wednesday, October 12, the USDA launched its newest Globe Agricultural Supply and also Need Price Quotes, or WASDE. The WASDE record gives an upgraded factor of recommendation for farming asset cost assumptions. This post reviews adjustments made by USDA to its 2022/23 corn and also soybean annual report and also one point to see moving forward: adjustments in South American manufacturing quotes. The dimension of the plant in Brazil and also various other South American nations will certainly play an essential function in figuring out export need and also cost degrees for United States corn and also soybeans. If estimates for a document Brazilian harvest are recognized, it will certainly remain to wet the influence of various other favorable information as was seen in the marketplace response to the WASDE record launch recently.

Present United States Supply and also Need Price Quotes

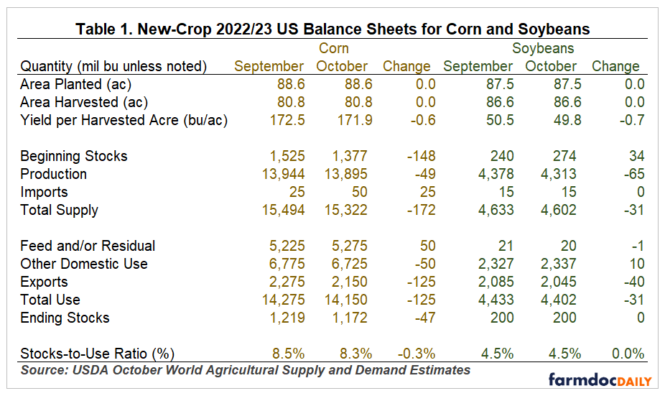

Reduced forecasted corn and also soybean returns were the major adjustment to United States corn and also soybean annual report in the October WASDE discovered in Table 1. USDA went down corn return 0.6 bushels per acre to 171.9. Soybean returns was reduced 0.7 bushels per acre to 49.8. These decreases adhere to bigger return decreases in the September WASDE record and also bring complete United States manufacturing for 2022 in well listed below both first assumptions and also in 2014’s plant. Present return estimates placed United States manufacturing down 8% for corn and also 3% for soybeans about the previous 2021 plant.

Reduced forecasted returns for corn and also soybeans brought about reductions in complete offered supply for the 2022/23 advertising year. While the return reduction was proportionally bigger for soybeans, complete corn supply was down much more as USDA likewise upgraded start supplies to show reduced approximated supplies since September 1 discovered in one of the most current Grain Supplies Record launched by the National Agricultural Data Solution on September 30.

The current WASDE annual report balance out a lot of the yield-driven annual report tightening up with decreases in operation. This varies from the previous September WASDE record which saw big reductions in anticipated United States finishing supplies. Corn and also soybean export projections lowered by 125 and also 40 million bushels specifically, constant with an enhancing United States buck and also various other headwinds in the international economic situation. With reduced exports taking in a lot of the decrease in anticipated supply, finishing supplies estimates were down somewhat for corn and also unmodified for soybeans. Finishing stocks-to-use for corn went down from 8.5% to 8.3% and also for soybean stayed at 4.5%. Both numbers signify really limited supply and also need problems in the USA.

The Transforming Factor in the International Plant Schedule

The October WASDE record accompanies a seasonal transition in corn and also soybean markets; the dimension of the 2022 United States plant is almost completely understood, and also focus transforms towards residential usage and also export need. The contrary happens in the Southern hemisphere; growing and also weather condition information from Brazil and also Argentina ends up being much more constant and also exports slow-moving. This transforming factor is particularly obvious in information on Chinese soybean received Number 1. The United States share of Chinese imports rises in the autumn and also hands over by April as Brazilian deliveries enhance. One significant exemption to this seasonal pattern was late 2018 when China considerably restricted United States soybean imports as component of the US-China profession battle.

Historic information (See likewise: farmdoc day-to-day July 18, 2022) recommend information concerning the dimension of the United States plant is restricted after October. Number 2 reveals the seasonal adjustments in USDA return updates with focus on the present advertising year. Adjustments in forecasted returns after the October record are normally little. Most of return information is included right into USDA projections throughout the expanding period, particularly in the August and also September records. While adjustments in forecasted return are feasible later on in the autumn, such a November shock shows up most likely when USDA has actually currently made big adjustments in return projections previously in the year and also total unpredictability is increased. The reasonably little adjustments in projection return seen this year show up to signify small modifications to the manufacturing side of the United States annual report moving forward.

As corn and also soybean manufacturing information subsides in the USA, it warms up in South America. The October WASDE saw USDA enhance its quotes for 2023 Brazilian soybean manufacturing to 152 million statistics bunches. (Note that 2023 South American manufacturing is gathered in the 2022/23 United States corn and also soybean advertising year.) This is 3 million statistics bunches more than the previous price quote and also relocates USDA closer to numbers launched previously this month by Conab, the Brazilian federal government food supply and also stats company. (See likewise: farmdoc day-to-day August 29, 2022) Approximated Brazil corn manufacturing stayed unmodified at 126 million statistics bunches.

Greater Brazilian manufacturing added to a boost in forecasted globe soybean finishing supplies for 2022/23 of 1.6 million statistics bunches. This very early positive outlook concerning Brazilian manufacturing, coming as Brazil is growing its very first period plant, might remain to wet the result of whatever favorable information stays concerning the smaller-than-expected 2022 United States soybean plant.

Just how much could the international annual report adjustment based upon upcoming manufacturing information from South America? To approximate the size of most likely manufacturing adjustments, Number 3 reveal the dimension of the complete adjustment in Brazilian corn and also soybean manufacturing in between the last and also first WASDE quotes. The typical outright adjustment is 9.4 million statistics bunches for corn and also 7.1 million statistics bunches for soybeans. recommending considerable adjustments to Brazilian manufacturing quotes exist in advance. The 3 statistics lot rise in Brazil soybean manufacturing observed in the October WASDE is little about regular adjustments in approximated plant dimension observed over the South American manufacturing period.

Historic information likewise recommend that adjustments to approximated South American manufacturing might play out over a longer duration than is regular for United States manufacturing adjustments in the WASDE. As a result of the size of the South American manufacturing duration (which includes numerous harvests) and also the timing of manufacturing about the United States corn and also soybean advertising year, Brazil manufacturing numbers in the WASDE are not normally worked out up until the actual end of the advertising year in August and also September.

Conversation

October normally notes a transforming factor current cycle appropriate to corn and also soybean costs. Emphasis changes far from United States manufacturing information and also towards growing progression, weather condition, and also return projections for South America. In the October WASDE record, USDA made little yet considerable adjustments to approximated Brazilian soybean manufacturing which have actually solidified the cost effects of less than prepared for United States soybean manufacturing. Soybean futures markets rallied almost 40 cents per bushel instantly adhering to the information of reduced soybean return approximates in the WASDE record, yet these greater costs were short-lived.

Looking in advance, estimates for South America manufacturing will certainly play an essential function in cost decision. Any kind of favorable information from the United States and also in other places will certainly need to emulate the leads of a huge rise in accessibility in very early 2023. The cost effects of present logistics obstacles for United States exports, especially those as a result of low tide on the Mississippi River, likewise relies on harvest end results in South America. If Brazil’s plant is still anticipated to be big when United States transport problems convenience, after that need for United States exports might damage. The transforming factor in the plant schedule might likewise signify a transforming factor for costs.

Referrals

Colussi, J., G. Schnitkey and also N. Paulson. “New Document Grain Manufacturing on Perspective for Brazil.” farmdoc day-to-day (12 ):130, Division of Agricultural and also Customer Business Economics, College of Illinois at Urbana-Champaign, August 29, 2022.

Janzen, J. “WASDE Wrap-up for July 2022: What Takes Place When USDA Updates Return Expectations?” farmdoc day-to-day (12 ):105, Division of Agricultural and also Customer Business Economics, College of Illinois at Urbana-Champaign, July 18, 2022.