What Are The 2022 Tax Brackets. The current tax year is from 6 april 2021 to 5 april 2022. However, the tax brackets have been adjusted to account for inflation.

There are seven tax rates in 2022: For tax year 2022, the top tax rate remains 37% for individual single taxpayers with incomes greater than $539,900 ($647,850 for married couples filing jointly). Then taxable rate within that threshold is:

There Are Seven Tax Rates In 2022:

You can see also tax rates for the year 202 1. In tax year 2020, for example, a single person with taxable income up to $9,875 paid 10 percent, while in 2022, that income bracket rose to $10,275. With regard to capital gains tax (cgt), the inclusion rate for trusts is 80% and the maximum effective rate is 36% (for the 2022 and 2022 tax years).

The Maximum Earned Income Tax.

Federal tax bracket rates for 2022 15% on the first $50,197 of taxable income, plus 20.5% on the next $50,195 of taxable income (on the portion of taxable income over 50,197 up to $100,392), plus 26% on the next $55,233 of taxable income (on the portion of taxable income over $100,392 up to. This guide is also available in welsh (cymraeg). Tax brackets for 2022 there are seven federal tax brackets for the 2022 tax year:

For Tax Year 2022, The Top Tax Rate Remains 37% For Individual Single Taxpayers With Incomes Greater Than $539,900 ($647,850 For Married Couples Filing Jointly).

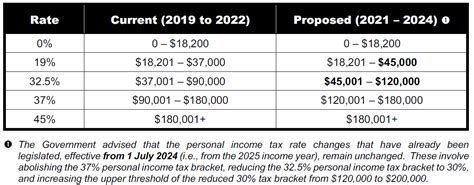

Retirement calculator marginal tax rate 6 rows 19c for each $1 over $18,200. The tax rates will not change.

Then Taxable Rate Within That Threshold Is:

The top tax rate for individuals is 37 percent for taxable income above $539,901 for tax year 2022. Taxable income ($) base amount of tax ($) plus marginal tax rate of the amount over not over over ($) single. 2022 tax brackets mark kantrowitz the kiddie tax thresholds are increased to $1,150 and $2,300.

0% Tax Rate If They Fall Below $83,350 Of Taxable Income If Married Filing Jointly, $55,800 If Head Of Household, Or $41,675 If Filing As Single Or Married Filing Separately.

2022 tax bracket and tax rates. These are the 2021 brackets. Here is a list of our partners and here's how we make money.