What Is The Capital Gain Tax Rate For 2022. According to a house ways and means committee staffer, taxpayers who earn more than $400,000 (single), $425,000 (head of household), or $450,000 (married joint) will be subject to the highest federal tax rate beginning in 2022. Capital gains tax rules can be different for home sales.

In 2021, the capital gains tax rates are either 0%, 15% or 20% for most assets held for more than a year. According to a house ways and means committee staffer, taxpayers who earn more than $400,000 (single), $425,000 (head of household), or $450,000 (married joint) will be subject to the highest federal tax rate beginning in 2022. According to a house ways and means committee staffer, taxpayers who earn more than $400,000 (single), $425,000 (head of household), or $450,000 (married joint) will be subject to the highest federal tax rate beginning in 2022.

Gst Tax Rate Begins At 5 Per Cent, And The Tax Rate Begins At Seven Percent.

According to a house ways and means committee staffer, taxpayers who earn more than $400,000 (single), $425,000 (head of household), or $450,000 (married joint) will be subject to the highest federal tax rate beginning in 2022. Capital gains tax will be raised to 28.8 per cent by house. Capital gains are the profits from the sale of an asset — shares of stock, a piece of land, a business — and generally are considered taxable income.

The Irs Assesses Capital Gains Tax As A Means Of Raising Revenue For The Government.

So why does capital gains tax exist? What amount of taxes applied to these products is dependent on the tax rate, which began at 5 per cent and seven percent, respectively. How much these gains are taxed depends a lot on how long you held the asset before selling.

The Profit Generated From The Sale Of A Stock Is Usually Taxed At The Capital Gains Tax Rate.

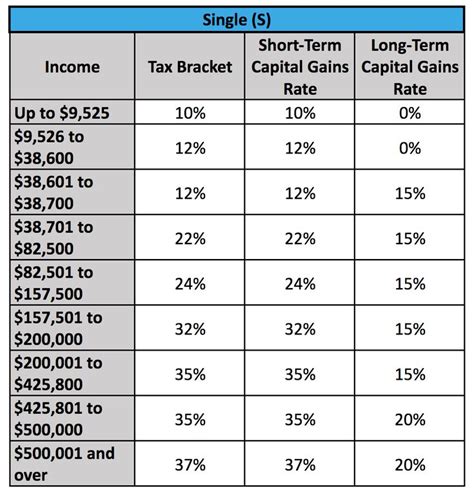

He us internal revenue service (irs) has released the capital gains tax thresholds for 2022 after adjusting the tax rates according to the inflation. In 2021, the capital gains tax rates are either 0%, 15% or 20% for most assets held for more than a year. Capital gains tax rate 2022 tax on capital gains would be increased to 28.8 per cent by house democrats.

Your Rate Will Depend On Your Total Taxable Income And Filing Status.

Capital gains tax rate 2022. Capital gains tax would be raised to 28.8 per cent by house democrats. In 2021, the capital gains tax rates are either 0%, 15% or 20% for most.

The Finance Minister Nirmala Sitharaman Announced The Capping Of The Surcharge On The Long Term Capital Gains Payable On Capital Assets, At 15 Percent.

Capital gains tax rate 2022 tax on capital gains would be increased to 28.8 percent,. According to a house ways and means committee staffer, taxpayers who earn more than $400,000 (single), $425,000 (head of household), or $450,000 (married joint) will be subject to the highest federal tax rate beginning in 2022. This is shown in the table below.