What Is The Current Provisional Tax Period. This tax payment will take all taxable income for the period march to august of the relevant tax year into account. If you use the standard or estimation option, you'll usually pay provisional tax in three instalments, in august, january and may.

The 2021 tax year refers to the period 1 march 2020 to 28 february 2022. Provisional itc as per rule 36 (4) of the cgst rules, 2017 will be allowed a maximum up to 5% of the invoices furnished by the vendors in their gstr 1/ through iff facility. The provisional tax payment for the second period must be made not later than the last day of the year of assessment in question, i.e., if the year of assessment ends on 28 or 29 february, the second period for which provisional tax becomes due will be the period ending on 28 or 29 february.

O The First Provisional Tax Payment Due From 1 April 2020 To 30 September

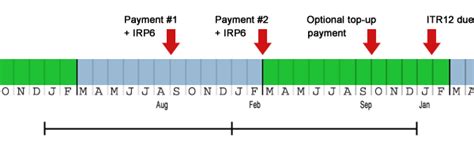

Management should recognise the benefit of the tax loss as an asset in the period in which the tax loss occurs, because the asset is reliably measurable and recovery is probable. Provisional tax payments are based on the estimated taxable income for the year. For years of assessment starting march, this will be 31 august, if it is a business day, or the last business day before that date.

Companies Are Allowed To Have A Tax Year Ending On The Same Date As The Last Day Of Their Financial Year.

Provisional tax payable (see table for relevant months). An entity may incur a tax loss for the current period that can be carried back to set against the profits of an earlier accounting period. The 2021 tax year refers to the period 1 march 2020 to 28 february 2022.

For Those With A 31 March Yearend, This Will Be Due On 7 February Or 7 April The Following Year.

Provisional payments due for the 2022 tax year: This means any current provisional taxpayers with provisional tax payments of less than $5,000 will have until 7 february following the year they file to pay their tax bill. The first provisional tax return must be submitted within the first 6 months of the year and the second provisional tax return at the end of the year of assessment.

The Balance Of The Final Tax For The Preceding Year Of Assessment And 75 Percent Of The Provisional Tax For The Current Year Of Assessment Are Paid In January, With The Remaining 25 Percent Of The Provisional Tax Being Paid Shortly After The End Of The Year Of Assessment, In April.

Tax payments are generally made in january and april; The first provisional tax payment must be made within six months of the start of the year of assessment, which for individual taxpayers are 31 august. This is intended to lower compliance costs for smaller taxpayers and allow them to retain cash for longer.

Provisional Itc As Per Rule 36 (4) Of The Cgst Rules, 2017 Will Be Allowed A Maximum Up To 5% Of The Invoices Furnished By The Vendors In Their Gstr 1/ Through Iff Facility.

If you have paid more provisional tax than you actually owe, you will receive a refund from ird. • 2016 yoa was issued 11 days before the date on which the provisional tax estimate was submitted. The first provisional tax payment must be made within six months of the start of the year of assessment for 31 august or six months after the approved financial year end date.