What Is The Deadline For Income Tax 2022 Malaysia. Malaysia residents income tax tables in 2022: Some types of assistance include life insurance, medical expenses for parents, individual education fees, the purchase of a laptop.

Gone are the days of queuing up in the wee hours of the morning at the tax office to complete your filing. In 2022, monday, april 18, rather than april 15, is the irs filing deadline by which individual income tax returns must be postmarked. This is expected to take place starting from 1 january 2022.

It Is Best To Keep All Relevant Documents For More Than 7 Years.

So, you must pay any amount owed to uncle sam by estimating your tax liability. This will save you time and. What is the deadline for income tax 2020 malaysia 22 jan, 2022 posting komentar deadline for malaysia income tax submission in 2021 for 2020 calendar year l co

This Is Expected To Take Place Starting From 1 January 2022.

April 30 for electronic filing i.e. A person — be it a company, an individual, trust, and so on — who has derived income from outside malaysia and who brings (remits) the income (whether wholly or in part) back to malaysia, whether in the same year or in a later year, will, effective from jan 1, 2022, be obliged to report the amount thus remitted as their income for the relevant year of assessment. Generally, an individual becomes a tax resident for the tax year if the aggregate number of days they stay in malaysia during the basis year is 182 days or more.

The Deadline Was Pushed From April 15 Because Of Emancipation Day, Which Is A Holiday In Washington, D.c.

2) a deadline extension to july 15, 2022, from. March 31 for manual submission; When is the deadline and who should submit the form?

Tax Filers Can Submit Their Returns Starting Jan.

Gone are the days of queuing up in the wee hours of the morning at the tax office to complete your filing. Income tax imposed on income from foreign sources the government has proposed to begin taxing malaysian residents who are earning income from foreign sources and receiving them in malaysia. You can now pay your taxes and get your tax returns online (or through other methods).

Malaysia Residents Income Tax Tables In 2022:

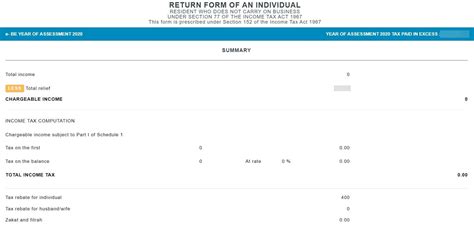

For the be form (resident individuals who do not carry on business), the deadline for filing income tax in malaysia is 30 april 2021. The personal income tax rate in malaysia is progressive and ranges from 0% to 30% depending on your income. Income tax rates and thresholds (annual) tax rate taxable income threshold;