What Is The Extended Due Date Of Corporate Tax Returns. The due date for filing of return of income has been further extended to march 15, 2022 vide circular no. A special rule to defer the due date change for c corporations with fiscal years that end on june 30th defers this change until december 31, 2025.

Today is the deadline to file c corporation tax returns. For c corporations operating under a calendar year, the 2020 taxable year extended due date is november 15, 2021. If there is a payment required with the return, the payment is due by the original due date of the tax return to avoid any additional late payment penalties and interest.

C Corporations Using The Calendar Year As Their Fiscal Year Must File Their Income Tax Return, Form 1120, By March 15.

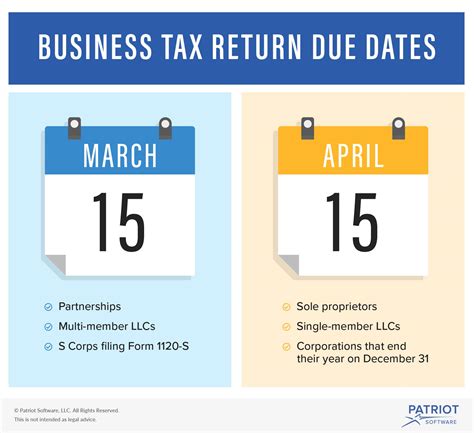

S corporation (calendar year) form 1120s For corporations, the due date is april 18, 2022. For tax years ending june 30, the due date is on or before the 1st day of the 4th month following the close of the tax year;

C Corporation Tax Returns Due.

Returns is the 15th day of the fourth month following the conclusion of the fiscal year. A special rule to defer the due date change for c corporations with fiscal years that end on june 30th defers this change until december 31, 2025. Corporate tax returns are due, and taxes are payable on the 15th day of the fourth month after the end of the company's fiscal or financial year.

April 18 Is Also The Deadline To File For An Extension To File Your Individual Tax Return.

Employee benefit plan tax returns are due the last day of the seventh month after the plan year ends. The extended deadline is oct. Pte returns are due on or before the 15th day of the 3rd month following the close of the taxable year.

If The Corporation Runs On A Fiscal Year Rather Than A Calendar Year, The Deadline For C Corp.

Today is the deadline to file c corporation tax returns. You must still send a return if you make a loss or have no corporation tax to pay. April 18 is also the deadline to file for an extension to file your corporate tax return.

If A C Corporation Does Not File Its Return By The Extended Due Date, Then The Extension Does Not Apply, And Any Applicable Late Filing Penalties Will Be Calculated From The Original Due Date.

The extended deadline is oct. The deadline has been extended to oct. Corporation income tax returns (irs form 1120):