2022 Child Tax Credit Irs. Families will have the chance to recover missed child tax credit payments from 2021 when they file taxes this year. Yes, the irs will send a letter to families that received child tax credit payments in january 2022.

Get the rest of your money with this irs letter. Child tax credit, third stimulus payment, new $600 irs rule. Families will have the chance to recover missed child tax credit payments from 2021 when they file taxes this year.

(Updated January 11, 2022) A1.

As you file your 2021 taxes in 2022, i share the top things to keep in mind, especially if you got child tax credits or the third stimulus payment! Families who are eligible for ctc portal can get advance payments of 2021 taxes before they file taxes in 2022. You could receive your money as early as february 19, but in a lot of cases it will not be until march 1

While The Monthly Advance Payments Ended In December, The 2022 Tax Season Will Deliver The Rest Of The Child Tax.

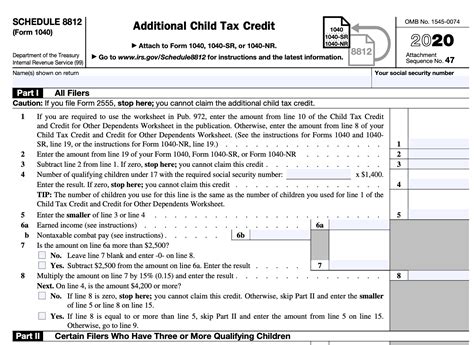

Advance child tax credit payments are early payments from the irs of 50 percent of the estimated amount of the child tax credit that you may properly claim on your 2021 tax return during the 2022 tax filing season. Between december 2021 and this january, the irs sent families that received child tax credit payments a letter with the total amount of money they got in 2021. For example, many families saw.

The Irs Is Sending Out A Letter To Ctc Recipients With The Exact Amount Each Family Received Through The Expanded Child Tax Credit.

For this example, the maximum child tax credit owed for those two children would be $6,600 for a married couple filing a joint return or a single parent making $80,000 or less. Recipients of the third round of the economic impact payments will begin receiving information. Make sure you hold on to this notice, as you may need the information when you file your 2021 tax return in 2022.

2022 Irs Tax Filing Tips:

What are advance child tax credit payments? Along those lines, the irs is sending letters this month to taxpayers who received the third federal stimulus check in 2021, as well as the advanced child tax credit payments. Yes, the irs will send a letter to families that received child tax credit payments in january 2022.

This Is Called Letter 6419, And Will Include The Total Amount Of Money You Received In 2021.

It's possible you could be looking. Irs sending information letters to recipients of advance child tax credit payments and third economic impact payments. The irs was delayed in sending out some payments.