2022 Child Tax Credit Tax Return. The government began to send the. Under president joe biden's american rescue plan, the child tax credit (ctc) was expanded from $2,000 per child to $3,600 for each kid under age 6 and $3,000 for those between 6 to 17.

Child tax credit 2022 on tax return. People who are missing a stimulus payment or got less than the full amount may be eligible to claim the recovery rebate credit on their 2021 tax return. Even though the advance child tax credit payments ended back in december, there’s more money on the way from the expanded child tax credit for parents to get with their 2021 tax refunds.

That May Make Taxpayers Nervous About Delays In 2022, But Most Americans Should Get Their Refunds Within 21 Days Of Filing, According.

Families who utilized the six monthly advance payments can expect to receive $1,800 for each child age 5 and younger and $1,500 for each child between the ages of 6 and 17 on their 2021 tax return. It is possible that you. Under president joe biden's american rescue plan, the child tax credit (ctc) was expanded from $2,000 per child to $3,600 for each kid under age 6 and $3,000 for those between 6 to 17.

Written By Amanda Glover January 16, 2022 There Might Not Be Planned Advance Child Tax Credit Payments For 2022, But There’s Still More Money Coming.

Keep reading to see how the child tax credit payments will affect your taxes in 2022. Personal income fell 0.3% the month following the expiration of. Yes, the irs will send a letter to families that received child tax credit payments in january 2022.

Here's What To Know About Filing Taxes, Unemployment Claims And Child Tax Credit Payments.

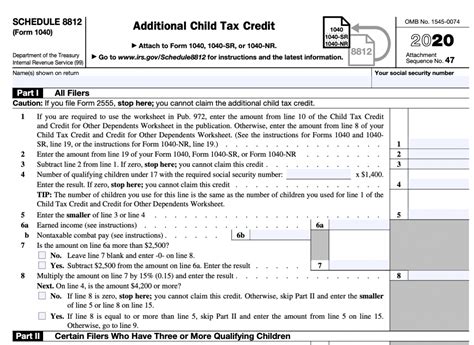

In early 2022 you will be required to file your tax returns for the previous year and you will get the chance to claim the remainder of the expanded child tax credit. Keep this for your records because you’ll need it when you file your return. Dependents who can’t be claimed for the child tax credit may still qualify you for the credit for other dependents.

Although The Child Tax Credit Is Not Available At The Moment, There Are Other Tax Provisions That May Affect Your 2020 Tax Return.

Child tax credit 2022 on tax return. Millions of american families received monthly advance child tax credit (ctc) payments between july and december of 2021. Democrats push for return of child tax credit.

In January 2022, The Irs Will Be Sending Letter 6419 To Recipients Of The Child Tax Credit.

Eztaxreturn is the fastest and easiest way to do your taxes. The 2021 child tax credit payments are expected to be from www.digitalmarketnews.com. This is called letter 6419, and will include the total amount of money you received in 2021.