2022 Expanded Child Tax Credit. According to the tax policy center, the price of reverting to the old child tax credit for 2022 would be about $125.5 billion, whereas the more generous benefit of 2021, which doesn't exclude or limit families for earning too little income, would cost about $100 billion more. Columbia university's center on poverty and social policy estimates that the number of children in poverty grew by 3.7.

Though, romney’s proposal would bring some big changes to the tax. For 2021, the amount of the credit has been increased and the phas e out income limits have been expanded. The expanded child tax credit was regarded as a major success in 2021, even reportedly bringing some families out of poverty.

However, That Only Applies To The Monthly Payout Of The Expanded.

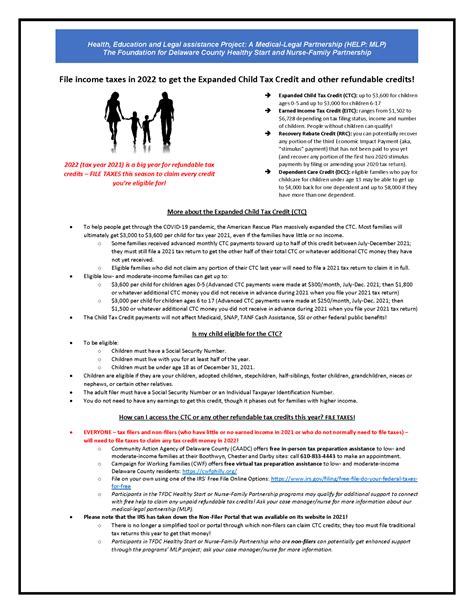

Congress will need to take action to expand the $3,600 child tax credit as a result, eligible american families received monthly payments of up to $300 per child from july to december. Families with children 5 and younger are eligible for credits of as much as $3,600 per child, with up to $300 received monthly in advance; This expanded tax credit kept.

Biden Pushed To Enact Bbb.

The hopes of millions of families have been dealt a blow if the vote is no, the child tax credit will revert back to its original amount. Child poverty rising after expanded tax credit expires, study says. However, the expanded child tax credit expired.

But Without Intervention From Congress, The Program Will Instead Revert Back To Its Original Form In 2022, Which Is Less Generous:

Sentiment on the expanded child tax credit’s expiration. As part of a pandemic relief bill, the revised credit also boosted the maximum amount of money each family could receive to as much as $3,600 per child, up from $2,000 per child before. Stefani reynolds for the new york times by ian prasad philbrick published jan.

His Camp Noted The American Rescue Plan Act Expanded The Child Tax Credit For One Year, From $2,000 Per Child To $3,000 Per Child Between The Ages Of 6 And 17, And $3,600 Per Child Under 6 Years Old.

But in december, congress left washington for winter recess without passing president joe biden's build back better agenda, which included an extension of the expanded child tax credit, or ctc. According to the tax policy center, the price of reverting to the old child tax credit for 2022 would be about $125.5 billion, whereas the more generous benefit of 2021, which doesn't exclude or limit families for earning too little income, would cost about $100 billion more. For 2021, the amount of the credit has been increased and the phas e out income limits have been expanded.

The Expansion Reached 61.2 Million Children Across More.

But now, the expanded child tax credit has expired since congress failed to pass the build back better spending bill before the end of 2021. The child tax credit isn't going away. The cutting of the child tax credit expansion could leave many families without enough food on the table jan 24, 2022 how the expanded child tax credit is helping families