2022 Tax Bracket. 2022 tax bracket and tax rates. However, the tax brackets have been adjusted to account for inflation.

15% on the first $49,020 of taxable income, and. This means that these brackets applied to all income earned in 2021, and the tax return that uses these tax rates was due in april 2022. All net unearned income over a threshold amount of $2,300 for 2022 is taxed using the brackets and rates of the child’s parents 2022 tax rate schedule standard deductions & personal exemption filing status standard deduction personal exemption phaseouts begin at agi of:

Find Previous Tax Year Or Back Tax Brackets And Income Tax Rate Tables.

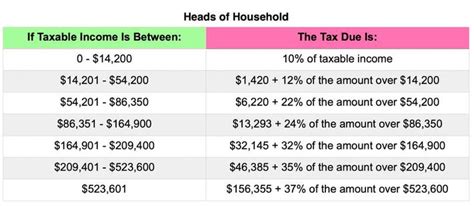

And then you’d pay 22% on the rest, because some of your $50,000 of taxable income falls into the 22% tax bracket. Married individuals filling joint returns; Federal income tax brackets 2022.

Then Taxable Rate Within That Threshold Is:

In tax year 2020, for example, a single person with taxable income up to $9,875 paid 10 percent, while in 2022, that income bracket rose to. 2022 tax brackets are here. Download the free 2022 tax bracket pdf.

The Refundable Portion Of The Child Tax Credit Has Increased To $1,500.

The personal exemption for tax year 2022 remains at 0, as it was for 2021, this elimination of the personal exemption was a provision in the tax cuts and jobs act. In this bracket creep scenario, individuals may not actually experience increased purchasing power or have greater disposable income, even after receiving an increase in wages and salaries. 2022 tax bracket and tax rates.

For Example, The 10 Percent Tax Bracket Applies To Income Up To $9,950 For Single Filers In 2021 Tax Brackets, Whereas It Was $9,700 For 2020.

For tax year 2022, the top tax rate remains 37% for individual single taxpayers with incomes greater than $539,900 ($647,850 for married couples filing jointly). As we mentioned earlier, this doesn’t mean that she is going to pay 22% of $60,000 annual salary to the federal government. 2022 federal income tax rates:

You Can See Also Tax Rates For The Year 202 1.

2017 2016 2015 primary r15 714 r14 958 r14 220: 10%, 12%, 22%, 24%, 32%, 35% and 37%. 20.5% on the portion of taxable income over $49,020 up to $98,040 and.