2022 Tax Brackets Build Back Better. The tax rates haven't changed since 2018. Couples filing jointly, under our current system, will face a 37 percent tax on.

The tax rates haven't changed since 2018. About this event the tax landscape has experienced constant and rapid change since 2017, and additional tax changes are on the table, most recently in the form of the build back better act (bbba). The foreign tax credit changes will apply to tax years beginning after dec.

· Child Tax Credit Refundability Is Extended Beyond 2022 · Increase Earnings And Phaseout Amounts For The Earned Income Credit · Salt Deduction Cap Raised From $10,000 To $80,000 Through 2031

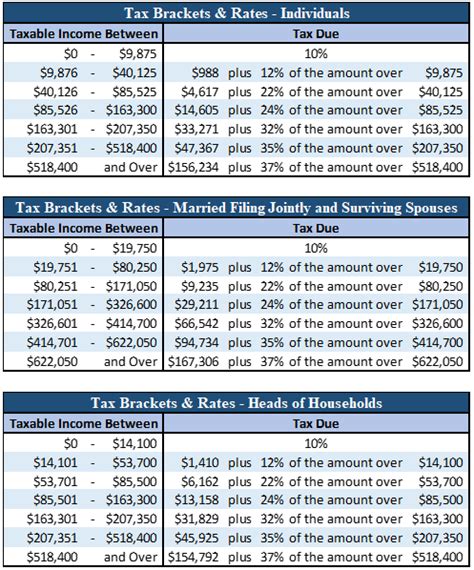

Those in the top 1. An apolitical webinar discussing the build back better act and what changes, if any, it will bring in the 2022 tax season. For 2022, they're still set at 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Democrats Are Currently Discussing A Tax Surcharge On Millionaires To Fund The Build Back Better Act,.

Note that, under the current version of president biden's build back better plan that's being considered by congress, the surtax would be. About this event the tax landscape has experienced constant and rapid change since 2017, and additional tax changes are on the table, most recently in the form of the build back better act (bbba). As a result, taxes will rise regardless of what happens with biden's build back better initiative.

However, The Tax Brackets Are Adjusted (Or Indexed) Each Year To Account For Inflation.

The estate and gift tax exemption (which will likely eclipse $12 million per person in 2022, after the application of the inflation adjustment). For the 2021 taxes taxpayers will file in 2022, the state and local income tax deduction has seen a significant improvement. By common dreams — february 5, 2022.

Here's The Financial Assistance That Could Make The Cut In Biden's Smaller Build Back Better Published Mon, Jan 24 2022 3:30 Pm Est Updated Mon, Jan 24 2022 3:32 Pm Est Lorie Konish @Loriekonish

The $1.75 trillion proposal currently before the house of representatives would end up raising the average top tax rate on personal income in the us to a. And those in the top 0.1% — those making $4 million or more — would. Without congressional action on the build back better act, in 2022, the child tax credit would revert back to $2,000 per qualifying child, subject to.

The Bill Was Known As The 2017 Tax Cut And Jobs Act.

In a new analysis, the tax policy center estimates that the major tax changes in the latest version of president biden’s build back better plan would cut taxes on average for nearly all income groups in 2022. This year, the highest earners will need to earn more than $539,900 (more than $647,850 for couples) before falling. President joe biden’s build back better program gives americans an opportunity to reduce their 2022 tax bills, but the biggest breaks will only last for a year.