2022 Tax Brackets Increase. Estate tax exemption limits and gift tax limits rise. Individual top marginal income tax rate increase a proposed increase in the top ordinary income tax rate from 37% to 39.6% would be effective starting with the 2022 tax year.

$51,667 plus 45c for each $1 over $180,000. For single taxpayers and married individuals filing separately, the standard deduction rises to $12,950 for 2022, up $400, and for heads of households, the standard deduction will be $19,400 for tax year 2022, up $600. Tax brackets increase for all filing statuses.

Estate Tax Exemption Limits And Gift Tax Limits Rise.

This change would accelerate the return to a top income tax bracket of 39.6% rather than waiting until tax years following 2025. For married couples filing jointly, it goes up. 2022 increase $63 $89 the ei tax has gone up in recent years, increasing employee and employer tax bills of $858 and $1,202 in 2018, respectively, to $953 and $1,334 in 2022.

19C For Each $1 Over $18,200.

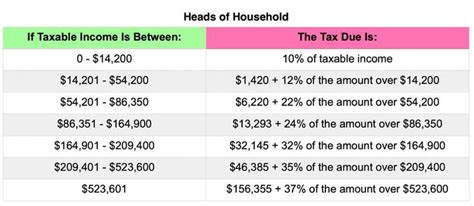

There are seven federal income tax rates in 2022: 2022 federal income tax brackets and rates in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). Tax rates not changed, but brackets increase.

The Standard Deduction Claimed By Most Taxpayers Is Increasing By $400, From $12,550 To $12,950.

The tax rates haven't changed since 2018. Marginal tax rates for 2022 will not change but the level of taxable income that applies to. The standard deduction is also increasing in 2022.

Individual Top Marginal Income Tax Rate Increase A Proposed Increase In The Top Ordinary Income Tax Rate From 37% To 39.6% Would Be Effective Starting With The 2022 Tax Year.

The federal government’s carbon tax is set to increase from That means if you make the same. The federal estate tax exemption for decedents dying in 2022 will increase to $12.06 million per person or $24.12 million for a married couple.

The Tax Rates Will Not Change.

However, the tax brackets have been adjusted to account for inflation. For 2022, they're still set at 10%, 12%, 22%, 24%, 32%, 35% and 37%. $29,467 plus 37c for each $1 over $120,000.