2022 Tax Brackets Philippines. Philippines residents income tax tables in 2022: The results will be displayed below it.

The philippines income tax calculator uses income tax rates from the following tax years (2022 is simply the default year for this tax calculator), please note these income tax tables only include taxable elements, allowances and thresholds used in the philippines annual income tax calculator, if you identify an error in the tax tables, or a tax. Philippines residents income tax tables in 2021: Philippines income tax rates in 2021.

Tax Rates For Income Subject To Final Tax.

Under train, a taxable income of php 250,000 will be subject to the rate of 20% to 35% for the year 2018, and 15% to 35% starting on 2023. With the new tax reform, the exemptions enumerated in the current tax rules will be removed. 2022/01/13 · for local and foreign taxpayers living in the philippines, here’s the bir tax table showing the tax rates on passive income.

₱50,000 Worth Of Personal Exemption ₱25,000 Worth Per Qualified Dependent Child ₱2,400 Per Year Or ₱200 Per Month Worth Of Premium Payments On Health And/Or Hospitalization;

Reflected in the above table are tax rate changes from the 2018 budget for the 2 years from 1 july 2022 to 30 june 2024, which include an expansion of the 19% rate initially to $41,000, and lifting the 32.5% band ceiling to $120,000. Philippines residents income tax tables in 2021: Personal income tax rate in philippines averaged 32.53 percent from 2004 until 2020, reaching an all time high of 35 percent in 2018 and a record low of 32 percent in 2005.

Paying P152,500 Income Tax On P1 Million Annual Salary, This Taxpayer Is Paying An Effective Income Tax Rate Of 15.25%, Lower Than The 19% Effective Income Tax Rate During The Implementation Of Train In 2018 To 2022.

The philippines income tax calculator uses income tax rates from the following tax years (2022 is simply the default year for this tax calculator), please note these income tax tables only include taxable elements, allowances and thresholds used in the philippines annual income tax calculator, if you identify an error in the tax tables, or a tax. The personal income tax rate in philippines stands at 35 percent. New graduated tax rates at 0%, 20%, 25%, 30%, 32%, and 35% will be in effect from 1 january 2018 until 31 december 2022.

Philippines Income Tax Rates In 2021.

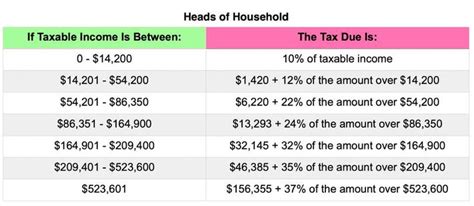

The results will be displayed below it. California has nine tax brackets: Tax rate for single filers for married individuals filing joint returns for heads of households;

1%, 2%, 4%, 6%, 8%, 9.3%, 10.3%, 11.3% And 12.3%.

2021 tax brackets and rates for single filers, married couples filing jointly, and heads of households; Here are the rates and brackets for the 2021 tax year, which you'll file. There were further amendments in 2019.