2022 Tax Brackets Virginia. Virginia's 2022 income tax ranges from 2% to 5.75%. This is the lowest tax bracket 2021 in canada that is applicable to the taxable earnings of an individual or a company.

The tax bracket applicable to corporations is the 15 percent tax bracket. But not your tax of excess over— over— is— over— $ 3,000 $ 5,000 $ 60 + 3 % $ 3,000 $ 5,000 $ 17,000 $ 120 + 5 % $ 5,000 $17,000 $ 720 + 5.75 % $17,000 tax table the tax table can be used if your virginia taxable income is listed in the table. Under provisions of north carolina’s biennial budget bill signed by governor roy cooper (d) on november 18, 2021, the state’s flat income tax rate was reduced to 4.99 percent on january 1, 2022.

Under Provisions Of North Carolina’s Biennial Budget Bill Signed By Governor Roy Cooper (D) On November 18, 2021, The State’s Flat Income Tax Rate Was Reduced To 4.99 Percent On January 1, 2022.

Calculate your state income tax step by step 6. Tax brackets and rates for the 2022 tax year, as well as for 2020 and previous years, are elsewhere on this page. Since the top tax bracket begins at just $17,000 in taxable income per year, most virginia taxpayers will.

(B) Virginia Income Tax Can Reasonably Be Expected To Be $150 Or Less For The 2022 Taxable Year.

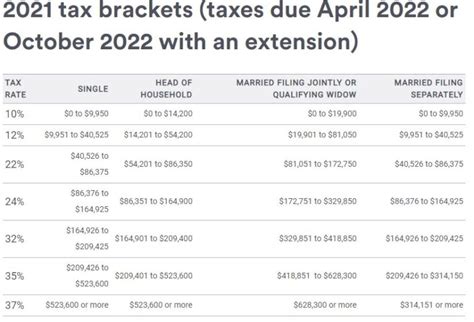

Virginia state income tax rates are 2%, 3%, 5% and 5.75%. There are seven federal income tax rates in 2022: For tax year 2022, the top tax rate remains 37% for individual single taxpayers with incomes greater than $539,900 ($647,850 for married couples filing jointly).

The State Income Tax System In Virginia Has 4 Different Tax.

Taxable income between $89,075 to $170,050. Taxation on corporate income is a tax that corporations pay. Income tax tables and other tax information is sourced from the virginia department of taxation.

The Virginia Salary Calculator Is A Good Calculator For Calculating Your Total Salary Deductions Each Year, This Includes Federal Income Tax Rates And Thresholds In…

The internal revenue service (irs) has announced the new federal income tax brackets, exemptions and deduction limits for 2021. Any income over $17,001 would be taxes at the highest rate of 5.75%. Virginia state income tax brackets and income tax rates depend on taxable income and residency status.

Unlike The Federal Income Tax, Virginia's State Income Tax Does Not Provide Couples Filing Jointly With Expanded Income Tax Brackets.

But not your tax of excess over— over— is— over— $ 3,000 $ 5,000 $ 60 + 3 % $ 3,000 $ 5,000 $ 17,000 $ 120 + 5 % $ 5,000 $17,000 $ 720 + 5.75 % $17,000 tax table the tax table can be used if your virginia taxable income is listed in the table. The personal exemption for tax year 2022 remains at 0, as it was for 2021, this elimination of the personal exemption was a provision in the tax cuts and jobs act. You can try it free for 30 days, with.