It’s obvious that 2022 has actually been a tough time within the marketplace. Geopolitical concerns, persistent COVID-19 unpredictabilities, as well as a hawkish pivot from the Federal Book have actually all been thorns on the market’s side year-to-date.

Nonetheless, think it or otherwise, there have actually been a lot of supplies in 2022 breaking the general bearish pattern.

3 of the leading S&P 500 entertainers in 2022– Occidental Oil OXY, Cardinal Wellness CAH, as well as Hess Corp. HES– have actually all supplied considerable gains to financiers.

The graph listed below highlights the year-to-date efficiency of all 3 supplies.

Picture Resource: Zacks Financial Investment Research Study

As we can see, all 3 supplies have actually taken place an outstanding run in 2022. Allow’s take a better consider every one.

Occidental Oil

Occidental Oil is an incorporated oil as well as gas firm with substantial expedition as well as manufacturing direct exposure.

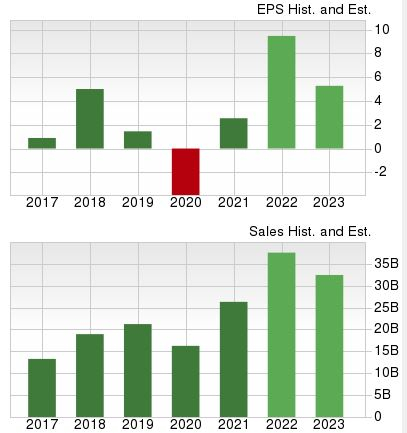

Like numerous supplies in the Zacks Oils as well as Power industry, OXY’s development trajectory is difficult to overlook; the firm’s incomes are anticipated to rise almost 280% year-over-year in its existing (FY22) combined with earnings development of 42%.

Still, the development is predicted to cool down in FY23, with quotes requiring a 23% year-over-year decrease in incomes as well as a 9.6% pullback in earnings. This is received the graph below.

Picture Resource: Zacks Financial Investment Research Study

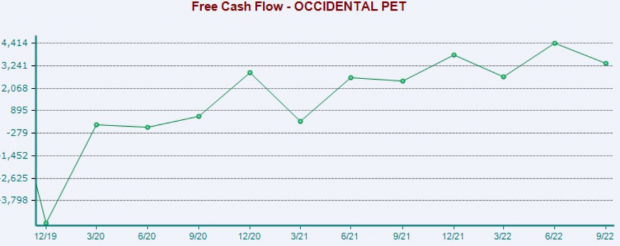

Even more, the firm produces strong money; OXY reported cost-free capital of $3.6 billion in its most recent quarter, sufficient for a substantial 36% Y/Y rise.

Picture Resource: Zacks Financial Investment Research Study

Cardinal Wellness Inc.

Cardinal Health and wellness is an across the country medication supplier as well as carrier of solutions to drug stores, doctor, as well as producers.

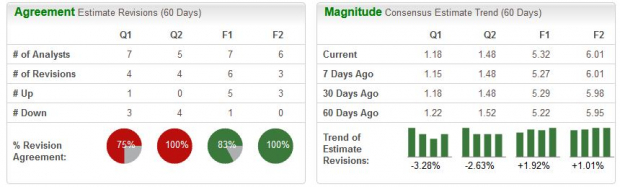

Experts have actually elevated their incomes expectation for CAH’s existing as well as following since late, aiding land the supply right into a Zacks Ranking # 2 (Buy).

Picture Resource: Zacks Financial Investment Research Study

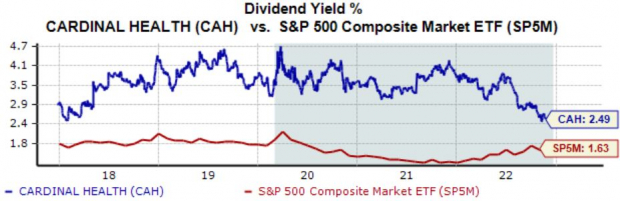

Undoubtedly a significant favorable, Cardinal Health and wellness comes from the elite Returns Aristocrat team; Returns Aristocrats are identified as firms with at the very least 25 successive yearly reward boosts.

CAH’s yearly reward presently produces about 2.5%, over its Zacks Medical industry by a reasonable margin.

Picture Resource: Zacks Financial Investment Research Study

Hess Corp.

Hess is a worldwide incorporated power firm participating in the expedition, manufacturing, growth, transport, acquisition, as well as sale of petroleum as well as gas fluids.

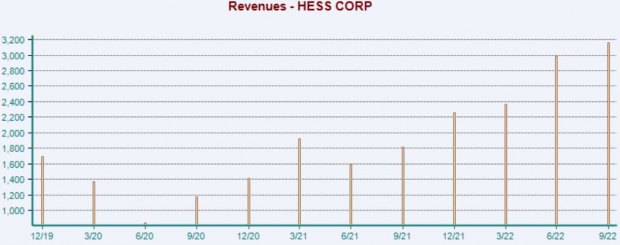

Hess has actually gotten on a solid incomes touch, going beyond incomes as well as earnings quotes in 4 successive quarters. Simply in its most recent launch, the firm directly defeated incomes assumptions as well as published earnings 7.4% over assumptions.

Picture Resource: Zacks Financial Investment Research Study

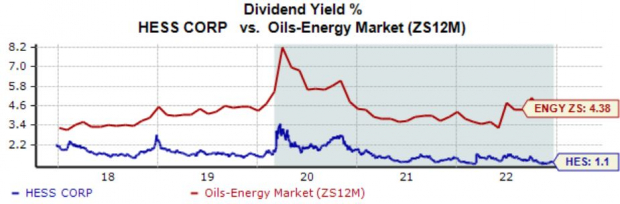

HES does pay a reward, presently generating a moderate 1.1%, listed below its Zacks Oils as well as Power industry standard by a reasonable margin. Still, the firm’s 6.4% five-year annualized reward development price aids get the slack.

Picture Resource: Zacks Financial Investment Research Study

Profits

Capitalists are greater than familiar with just how rough the marketplace has actually remained in 2022, with numerous supplies living at a loss year-to-date.

Still, all 3 supplies above– Occidental Oil OXY, Cardinal Wellness CAH, as well as Hess Corp. HES– have actually all gotten rid of the marketplace’s troubles, ending up being leading S&P 500 entertainers in 2022.

Zacks Names “Solitary Best Select to Dual”

From countless supplies, 5 Zacks professionals each have actually selected their favored to increase +100% or even more in months to find. From those 5, Supervisor of Research study Sheraz Mian hand-picks one to have one of the most eruptive benefit of all.

It’s an obscure chemical firm that’s up 65% over in 2015, yet still economical. With unrelenting need, skyrocketing 2022 incomes quotes, as well as $1.5 billion for redeeming shares, retail financiers might enter any time.

This firm might measure up to or exceed various other current Zacks’ Supplies Ready To Dual like Boston Beer Firm which soared +143.0% in little bit greater than 9 months as well as NVIDIA which grew +175.9% in one year.

Free: See Our Top Supply And Also 4 Joggers Up

Desired the most up to date referrals from Zacks Financial investment Research Study? Today, you can download and install 7 Finest Supplies for the Following one month. Click to obtain this cost-free record

Hess Company (HES): Free Supply Evaluation Record

Occidental Oil Company (OXY): Free Supply Evaluation Record

Cardinal Wellness, Inc. (CAH): Free Supply Evaluation Record

To review this write-up on Zacks.com go here.

Zacks Financial Investment Research Study

The sights as well as viewpoints revealed here are the sights as well as viewpoints of the writer as well as do not always mirror those of Nasdaq, Inc.