Your third stimulus payment will be protected from outstanding tax debt and child support, but not from private debts, such as debt accrued due to a civil judgment, ranging from civil damages to. Since the start of the pandemic congress has approved close to $6 trillion in stimulus spending to help prop up the us economy and ensure that americans have enough money to pay for essentials.

3rd stimulus check update Payments will start in March

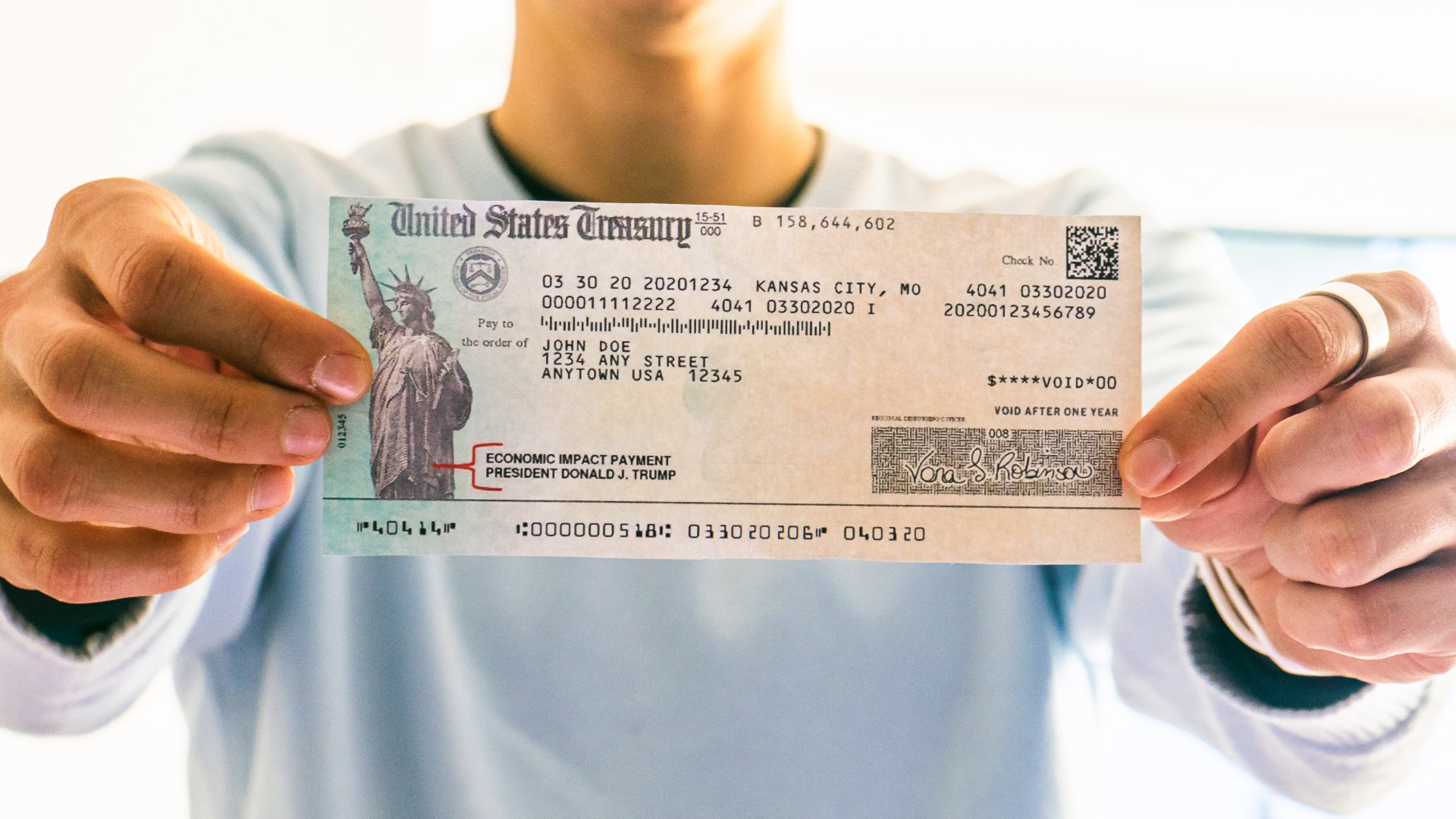

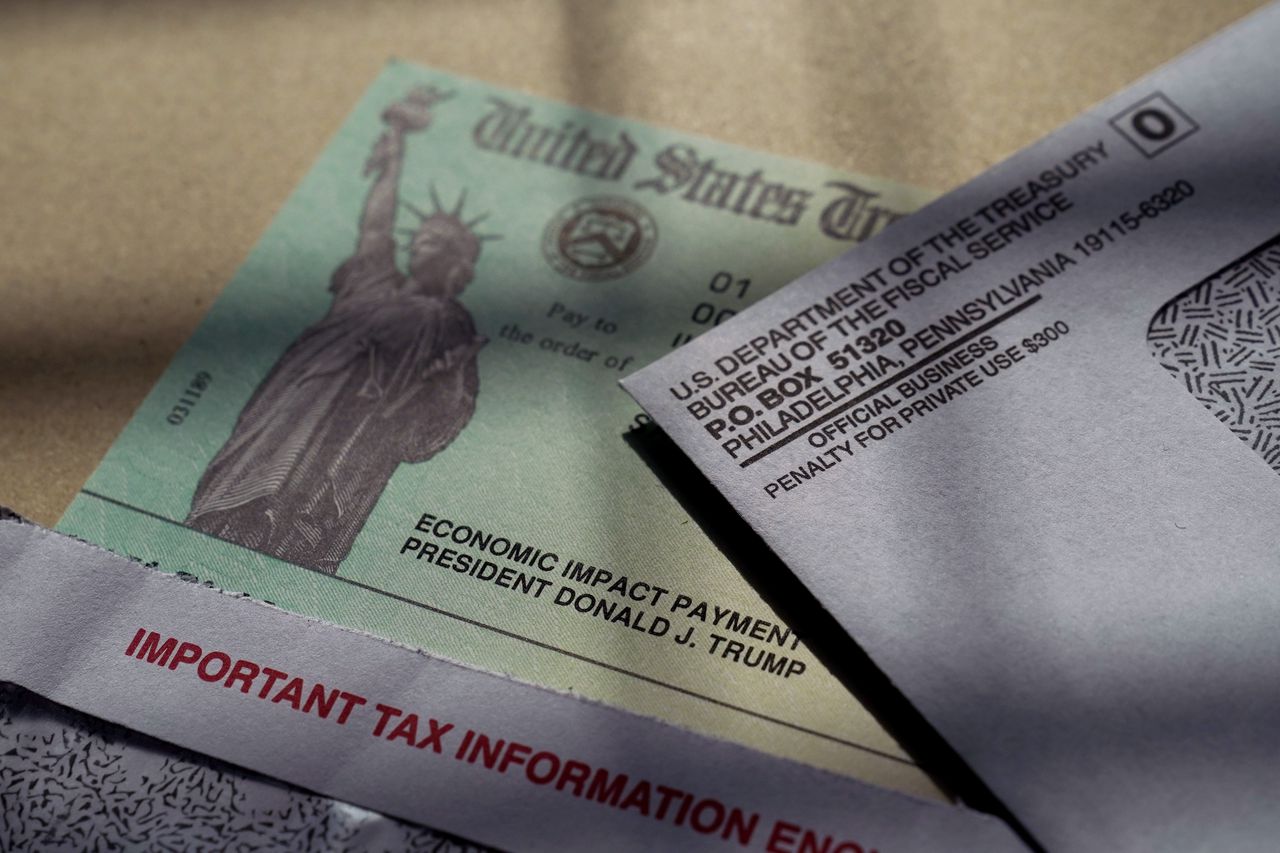

Labeled letter 6475, your third economic impact payment, the correspondence will include how much you received in stimulus money.

3rd stimulus check pay back. Although the irs cannot take your stimulus money for unpaid child support or student loans, they can withhold money issued as a recovery rebate credit, which cnet. Up to $1,400 per person and $2,800 per married couple. The payments are an advance of a temporary credit for 2021 (which you file taxes for in 2022).

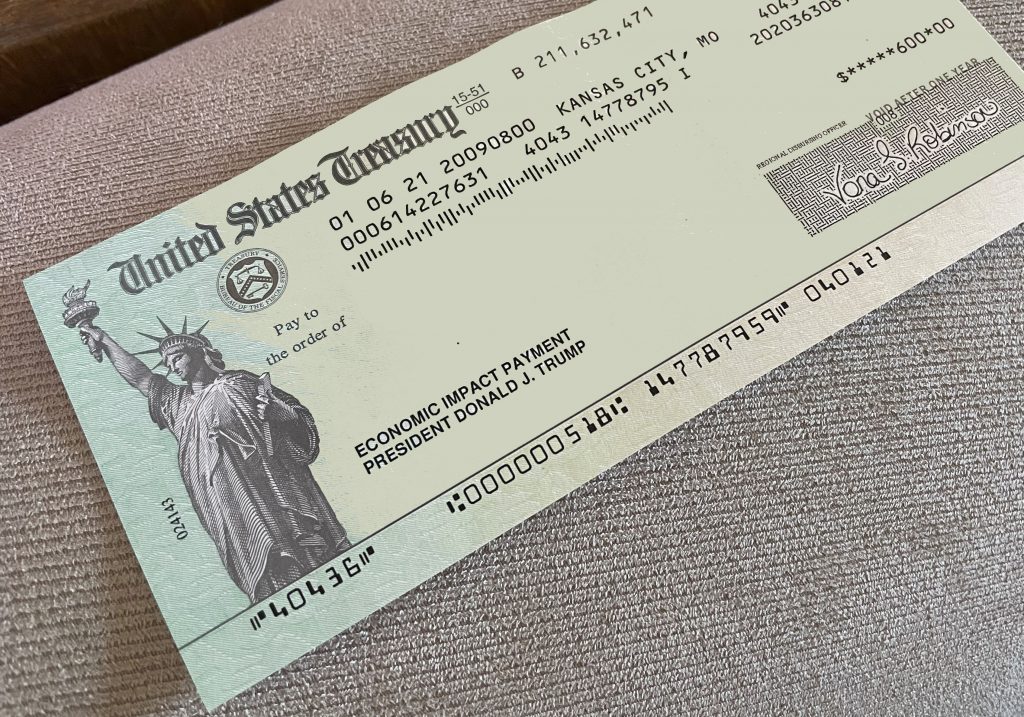

On march 11, 2021, president biden signed the american rescue plan act, which includes a third round of stimulus checks. You will not need to pay the government back for your third stimulus check. Eligible recipients for the $1,400 direct payment include single filers earning up to $75,000, and joint filers.

The payment is worth up to $1,400 for each eligible adult and each qualifying dependent in a household. Cleveland (wjw) — the third stimulus check was sent out to eligible american families starting back in march 2021 as part of the american rescue plan act. It will not reduce your refund or increase the.

The income cutoff to receive a third stimulus check is $80,000 for an individual taxpayer, $120,000 for a head of household and $160,000 for a married couple that files jointly. The checks are part of a $1.9 trillion economic. These checks were sent based on your income during the year, and if you fell within the approved income then you were sent a check.

No, the third economic impact payment is not includible in your gross income. President joe biden only just approved a third round of coronavirus stimulus checks in the american rescue plan, but there's already a lot of confusion around the $1,400 payments. Are we paying back the third stimulus check with our tax refund?

The third stimulus check, formally known as an economic impact payment, was a product of the american rescue plan, which was enacted in march 2021. This third stimulus payment cannot be seized or garnished for back child support, but it can be taken to satisfy private debts. How much does the third stimulus check pay?

The delay could be detrimental to millions who are hoping to purchase groceries, pay bills, or alleviate debts with the funds. Individuals who didn't qualify for the third economic impact payment, better known as the third stimulus check, or did not receive the full amount may be eligible for the recovery rebate credit. Partially because it's tax time, one of the biggest misconceptions is that the funds will get added to americans' tax refunds in the next few weeks.

The $1.9 trillion coronavirus relief plan includes a third round of $1,400 stimulus payments, topping off the $600 checks that were already approved by congress in december 2020 , and adding up to $2,000. A third round of stimulus checks is on its way to americans. No, there is no provision in the law that would require individuals who qualify for a third economic impact payment or an additional payment based on their 2020 or 2019 information, to pay back all or part of the payment if, based on the information reported on their 2021 tax returns, they would have qualified for a lesser amount.

Therefore, you will not include the third payment in your taxable income on your 2021 federal income tax return or pay income tax on the third payment. When can the government garnish my stimulus check? To that end, the law authorizing the third round of stimulus checks completely cut off payments for single people earning at least $80,000.

The full amount of the third stimulus payment is $1,400 per person ($2,800 for married couples filing a joint tax return) and an additional $1,400 for each qualifying dependent. The final 2021 child tax credit payment gets sent directly to americans on december 15 credit: The stimulus check will not impact benefits you receive like social security, nor will it push you into the next tax bracket.

The check is the largest yet: And while the internal revenue service. Millions of americans have been helped by a third round of stimulus check payments.

Individuals eligible for payments could receive up to $1,400 , and married couples filing a.

Third stimulus check Get My Payment tool for Social

Joe Biden stimulus package update Why you shouldn't

3rd stimulus check? IRS says watch out for payment, COVID

1,400 Stimulus Check When Could You Get Your Third

The Third Stimulus Check For SSI And SSDI Making The Cut

New York What information do you need to give the IRS

Third Stimulus Check When Payments Will Be Sent Money

IRS Wednesday is official payment date for stimulus checks

Third stimulus check when will Wells Fargo, Chase Bank

Stimulus check update Some Americans may have to GIVE

If you haven’t received your 3rd stimulus check yet, here

Already got a third stimulus check? The IRS may now have

Third Stimulus Checks IRS Tax Return, Amount and More

When is the third stimulus check coming? Use the IRS

How To Track My Third Stimulus Check Direct Deposit

Third stimulus check update Use our calculator to see if