Tax changes and key amounts for the 2020 tax year who's getting a stimulus check that's more. The base amount for the third stimulus payment is $1,400.

3rd stimulus check update Payments will start in March

They are worth up to $1,400 per qualifying taxpayer and each of their dependents.

Third stimulus check pay back. The amount you'll get decreases by 5% for every $100 you earn over the threshold. You will not need to pay the government back for your third stimulus check. There's a special procedure for anyone who received a third stimulus payment in the form of a debit card, wants to return the money to.

The income cutoff to receive a third stimulus check is $80,000 for an individual taxpayer, $120,000 for a head of household and $160,000 for a married couple that files jointly. The full amount of the third stimulus payment is $1,400 per person ($2,800 for married couples filing a joint tax return) and an additional $1,400 for each qualifying dependent. Millions of americans have been helped by a third round of stimulus check payments.

The checks are part of a $1.9 trillion economic. Recovery rebate for missed economic impact payments the irs is telling taxpayers that if you didn’t get the third stimulus check, you need to file for the payment using the recovery rebate credit. That means single filers who make $80,000 or more and couples who make $160,000 or more won't receive a stimulus check.

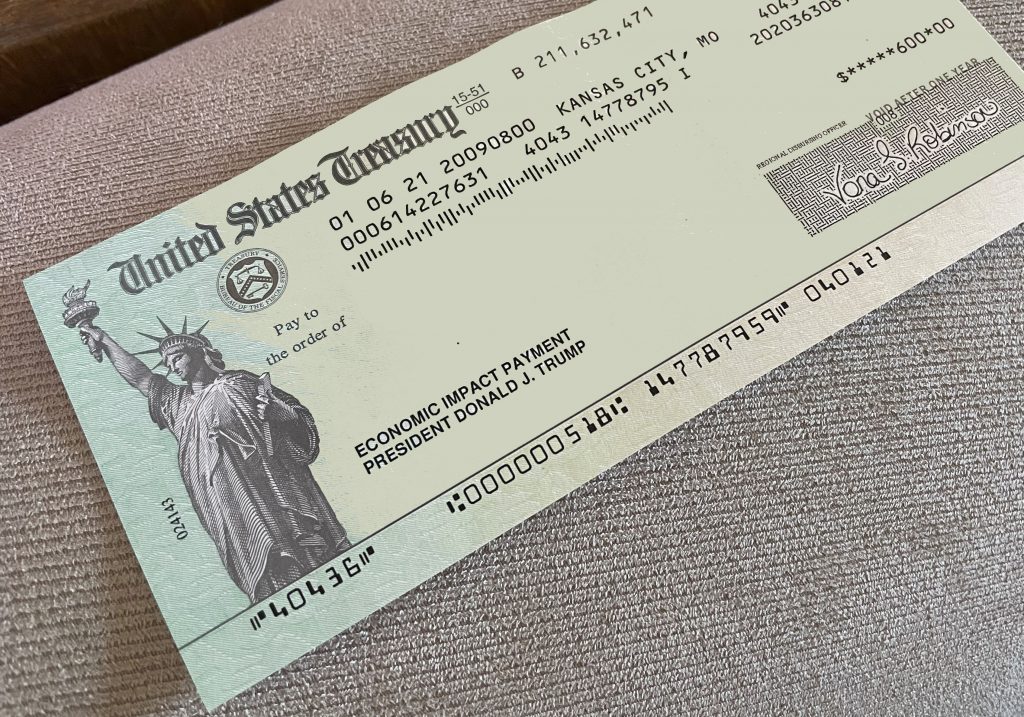

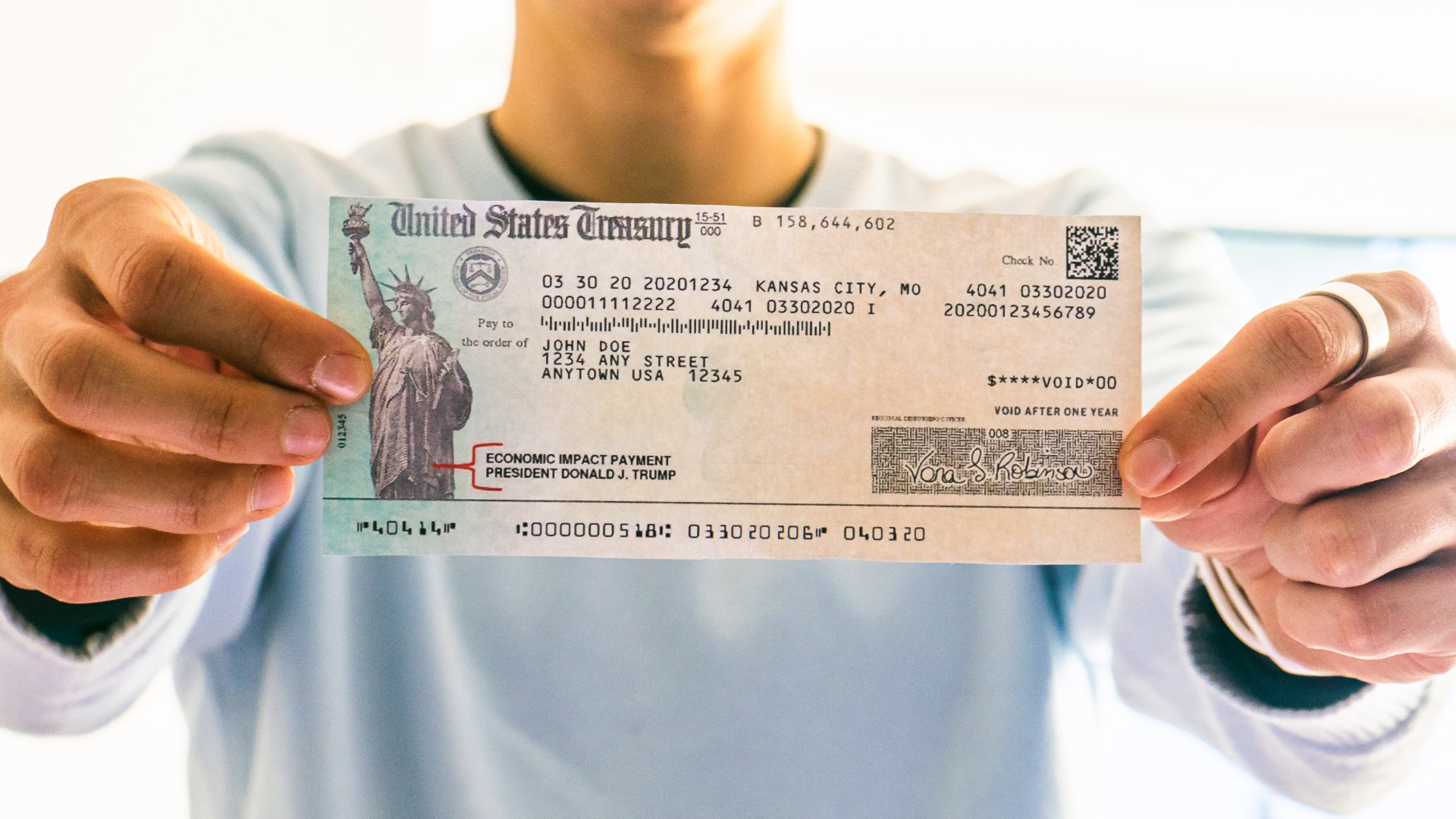

The 2021 stimulus checks were disbursed to eligible recipients starting in march of last year. The $1.9 trillion coronavirus relief plan includes a third round of $1,400 stimulus payments, topping off the $600 checks that were already approved by congress in december 2020 , and adding up to $2,000. A third round of stimulus checks is on its way to americans.

There is, however, one exception: Families also receive an additional $1,400 per eligible dependent. The final 2021 child tax credit payment gets sent directly to americans on december 15 credit:

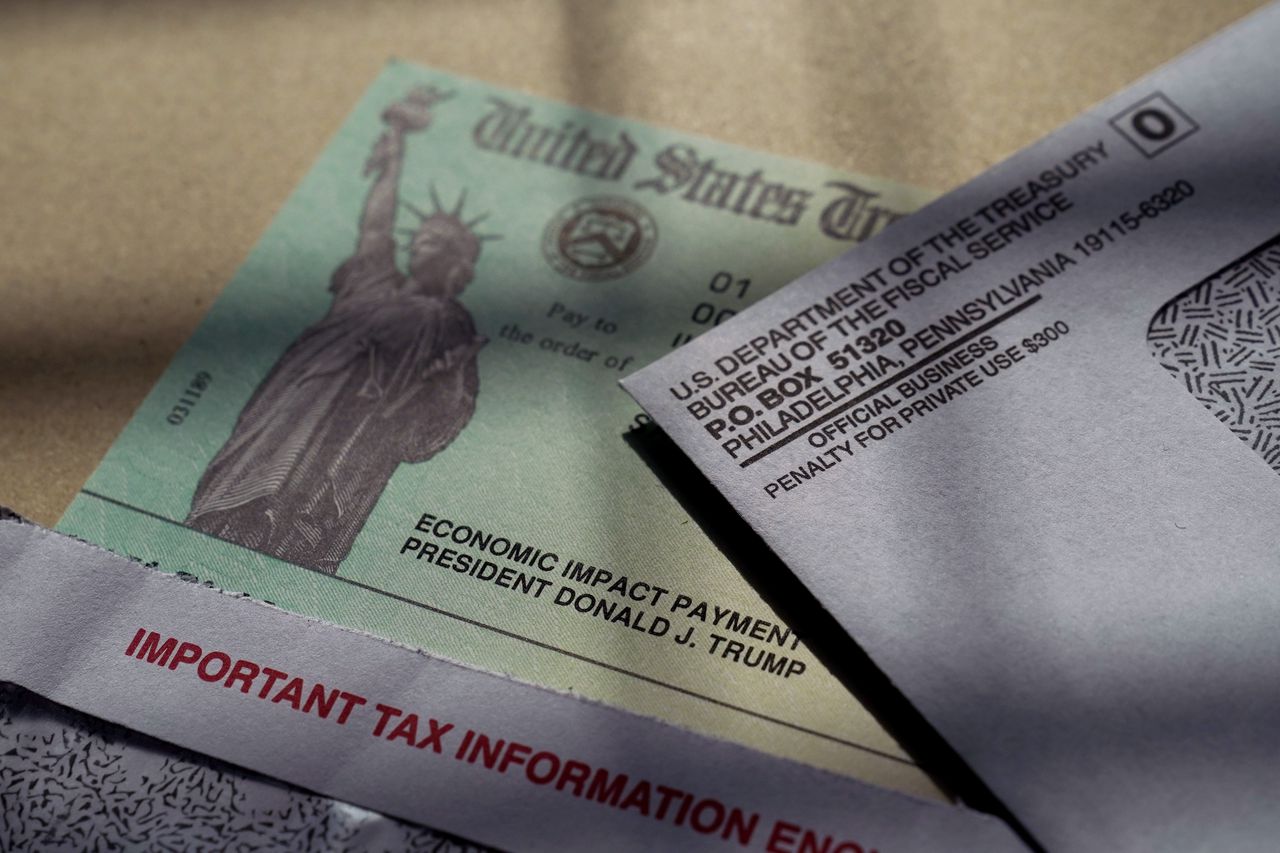

The third stimulus check, formally known as an economic impact payment, was a product of the american rescue plan, which was enacted in march 2021. You won't be required to repay any stimulus payment amount when filing your 2020 tax return, it says. Eligible recipients for the $1,400 direct payment include single filers earning up to $75,000, and joint filers.

Under the bill governing the second stimulus check, your funds could not be garnished to pay debts like child support, banks. These checks were sent based on your income during the year, and if you fell within the approved income then you were sent a check. If the deceased individual is a married member of the u.s.

Debt collectors can't take your third stimulus check. The income cutoff to receive a third stimulus check is $80,000 for an individual taxpayer, $120,000 for a head of household and $160,000 for a married couple that files jointly. The stimulus check will not impact benefits you receive like social security, nor will it push you into the next tax bracket.

Up to $1,400 per person and $2,800 per married couple. The third stimulus payment starts to phaseout for people with higher earnings. The check is the largest yet:

The third stimulus check’s maximum income limit is lower than the first and second stimulus check. Single filers who earned more than $80,000 ($160,000 if married filing jointly and $120,000 if head of household) in 2020 are ineligible for the third stimulus check. Know that the extra $1,400 per dependent is also not available for a parent who died before that date.

No, there is no provision in the law that would require individuals who qualify for a third economic impact payment or an additional payment based on their 2020 or 2019 information, to pay back all or part of the payment if, based on the information reported on their 2021 tax returns, they would have qualified for a lesser amount. These payments are also targeted more toward families who are more likely to be suffering financially, with payments phasing out once an individual’s or head of household’s adjusted gross income (agi) exceeds $80,000 to $160,000. How much does the third stimulus check pay?

Yes, your third check might be seized to pay certain debts. No, there is no provision in the law that would require individuals who qualify for a third economic impact payment or an additional payment based on their 2020 or 2019 information, to pay back all or part of the payment if, based on the information reported on their 2021 tax returns, they would have qualified for a lesser amount.

The Third Stimulus Check For SSI And SSDI Making The Cut

New York What information do you need to give the IRS

Third Stimulus Checks IRS Tax Return, Amount and More

Third stimulus check update Should I file my 2020 tax

Third stimulus check Get My Payment tool for Social

Third stimulus check update How to track 1,400 payment

Joe Biden stimulus package update Why you shouldn't

IRS Wednesday is official payment date for stimulus checks

Third stimulus check update Use our calculator to see if

Has anyone received their third stimulus check? Marca

Third stimulus check VA recipient payment date still

3rd stimulus check 2021 Here’s how to get your full

Stimulus Check The Timeline, Amount, And Potential Delays

Your Third Stimulus Check Could Be Much Bigger If You File

Stimulus checks 2021 Young investors use COVID aid to

Already got a third stimulus check? The IRS may now have