Read about the third stimulus check, worth up to $1,400, here » if you received a stimulus check, you may be wondering whether it's truly free money. And for the tax credit, the lowest it can be is 0 (it cannot be negative).

IRS to send refunds to those who got unemployment payments

To be completely honest i forgot the last couple questions but i ultimately opted for a call back which i received 56 minutes from the time i called.

3rd stimulus check overpayment. In 2019, we claimed our college age son as a dependent. If you received overpayment,none of the stimulus checks are taxable and won't impact your income tax filed this year. $1400 stimulus payment update blog brand:

However, if the internal revenue service (irs) doesn't have your banking information, you could receive the money as a check. A change.org petition for $2,000 a month stimulus checks has hit 3 million signatures, according to cnbc. That’s according to national taxpayer advocate erin collins.

Now, for the 2020 tax year, our son is not a dependent. Irs used out 2019 returns. A second stimulus check for $600 was approved and sent out in december 2020.

2019 my parents claimed me as a dependent (2019) which means i did not receive the first two stimulus checks. Our, the parents, 2020 returns have not been filed yet. The advance refund (the check) and the tax credit (in the case of the third stimulus payment, it's a tax credit for the 2021 tax year).

There are two parts to the stimulus payment: Yes, your third check might be seized to pay certain debts. You both need to decide which check was sent in error.

What if you got stimulus money that you weren't eligible for with the $1,400 check? The income cutoff to receive a third stimulus check is $80,000 for an individual taxpayer, $120,000 for a head. We, the parents, today just received $4200 (3×1400) in stimulus money.

Under the bill governing the second stimulus check, your funds could not be garnished to pay debts like child support, banks. Here are answers to some common questions about this set of stimulus payments, which differ in some ways from the first two. For the advance refund, you received the correct amount;

Hope for more stimulus as biden to. This third stimulus check is an advanced tax credit on your 2021 taxes, and calculated based on your 2020 taxes. Under the american rescue plan act of 2021 signed in 3/11/2021, a family with household income of $150,000 or less will receive a stimulus of $1,400 per taxpayer and dependents including qualified dependents over 17 years old.

What happens if you got paid. The irs send dad $2800 as the third stimulus payment because it used 2019 as the basis of the stimulus. Section 9601 adds 26 usc 6428b which provides the third stimulus tax credit and advance refund.

Stephanie bonin, a denver restaurant owner and the petition’s organizer, wants $2,000 a. Many people received their stimulus money as a direct deposit into their bank accounts. The third stimulus payout of $1,400 for every qualified adult was part of.

Congress is slated to approve the third round of direct stimulus payments in less than a year, meaning that most americans can expect another cash i. Then son filed his 2020 tax return and son received $1400 as he filed independent of his father. He, son, filed 2020 taxes and received the 3rd stimulus, $1400.

$1,400 stimulus checks began to roll out last month credit: Track your money with ‘get my payment’ tool. Alternatively, there was no stimulus payment but he will be able to claim a recovery credit on his 2021 tax return.

Next, press 3 “for all other questions.” next, press 2 “for all other questions.” when the system asks you to enter your ssn or ein to access your account information, enter it. My daughter received the first two stimulus payments a couple of weeks ago as part of her tax refund/filing process, and yesterday received the third payment for $1,400.00. In a blog post, collins states “the irs has agreed to use.

We have not filed yet for this year, but my daughter did (her first year filing and no longer our dependent). Stimulus payment update stimulus payment $1400 stimulus. I am aware that the 3rd was to be included with my parents lump some but when i asked them for my share they said “they didn’t get it” and only got $2800.

Third stimulus check prepaid debit cards coming; IRS has

Monthly Child Stimulus Check 2022 Start Date E Jurnal

Stimulus Check calculator Is your payment total correct

Stimulus Check Reduce Tax Return ISTIMULUS

Stimulus Check 2022 Limits E Jurnal

Third stimulus summary Wednesday 5th March 2021

Child tax credit for 3,600 Everything to know about

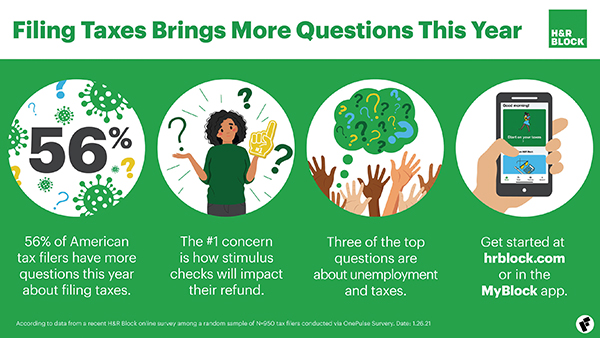

Experts Share Advice on Confusing Tax Situations Created

Stimulus update IRS issues more refunds for overpaid

Third stimulus check updates summary 14 February 2021

Do You Get A Stimulus Check If You Owe Back Child Support

Stimulus Check 2022 Limits E Jurnal

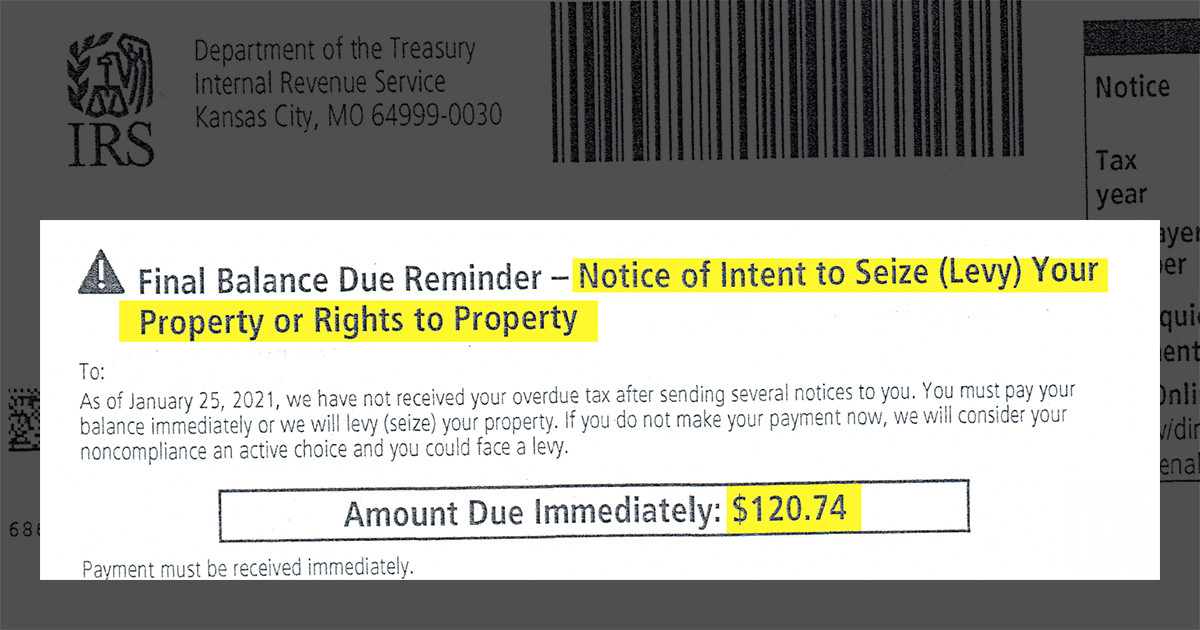

Do you have to return your stimulus money to the IRS

Stimulus Check Irs Letter 2021 90 Million In Wisconsin

Stimulus Check 2022 Limits E Jurnal

Irs Debit Card Payment EIP stimulus debit cards Is IRS

Mail Stimulus Check Envelope 2021 Why Your Second